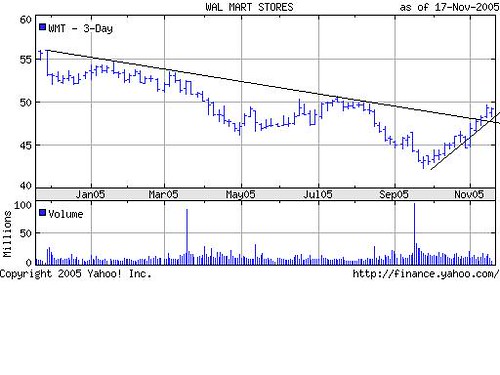

options trade that I have on. I’m holding a large chunk of the March 2006 $47.50 calls, and a smaller amount of March 2006 $50 calls. I picked up the $47.50 calls at an average basis of $3.20 per contract. I picked up the $50 calls for $1.90 this past Friday. Here’s my thinking:

options trade that I have on. I’m holding a large chunk of the March 2006 $47.50 calls, and a smaller amount of March 2006 $50 calls. I picked up the $47.50 calls at an average basis of $3.20 per contract. I picked up the $50 calls for $1.90 this past Friday. Here’s my thinking:

Walmart stock’s volatility is extremely low. Being a Dow component helps. As a result, the option price is pretty cheap compared to even large cap tech stocks. The $47.50 calls cost me $3.20. It’s in the money by $2. So what I’m really paying for is $1.20 for the right to WMT’s upside from now until March 17, 2006. To put it in other words, if WMT is at $50.70 on or before March 17, 2006, I break even. Anything on top of that, and I’m making money.

Why do I like the $47.50’s? The $50 calls are not in the money. So I’m really paying $1.90 for the privilege to WMT’s upside from now until March. But the initial outlay is lower per contract. With the $45 calls, I would be paying 90 cents for that privilege, but the intial outlay is much higher since it’s further in the money.

For me, it’s like buying a $3 tech stock with the upside potential of Nasdaq, backed by the steadiness of a Dow component.

Buyer beware: options are extremely risky. Do not construe any of the above as investment advice.

Update: It seems Warren Buffet thinks Walmart is a value here as well.

WASHINGTON (Reuters) – Berkshire Hathaway Inc. (NYSE:BRK-A – News; NYSE:BRK-B – News), a company run by billionaire investor Warren Buffett, on Monday revealed previously undisclosed holdings of shares in Anheuser-Busch Cos. (NYSE:BUD – News) and Wal-Mart Stores Inc. (NYSE:WMT – News).

According to amended U.S. regulatory documents, Berkshire Hathaway disclosed that it held 44.7 million shares of Anheuser-Busch stock valued at about $1.9 billion and 19.9 million shares of Wal-Mart stock valued at about $874 million as of September 30.

It’s nice to have validation from the most influential value investor. Even better is that he has a legion of investors who follow his lead.

Update 2: Wal-Mart’s Black Friday numbers are better than expected, and they forecast November same-store sales growth to be 4.3%. This number is without new stores and former Wal-Marts converted to Wal-Mart Supercenters. It’s looking like a merry Christmas indeed.

Also, with the 47.50s, you are better positioned to sell stock against the calls if there is a quick run-up in the share price. That would leave you synthetically long the puts.

Thanks Buddy. Not enough money to do that = )

I should have added that one reason I like options vs stock is that it takes a huge amount of capital to do anything meaningful with a stock like WMT. I’m long 60 of the $47.50’s and 10 of the $50’s, so total it costs me around $21k to get the benefit of being long 7000 WMT shares. To do the same by purely going long would cost around $347k. No way I can get my hands on that kind of capital. Options provide a tremendous amount of leverage. I’m a little “gee-whiz”-ish because I haven’t really traded options until recently. Hope I don’t get my head handed to me on a platter eh?

You have a sensible approach and expectations.

My understanding is that this year, this fall, until recently, the retail sector was tired. As oil cost increases, the dollar strengthened, and hurricanes sapped growth expectations going forward dimmed. But as short-term issues cleared, and with ongoing Fed rate hikes making the US more attractive to foreign investment, pessimism about growth rates reversed. Thus, added to the seasonal nature of retailing, WMT share price reversed course.

As per Dow intentions, Wal-Mart is something of a retail sector proxy. Where risk enters into the calculus is how expectations for 2006 shape up as portfolio managers re-adjust. In the past, there was a January effect, plumping market prices in the early new year. But recently it’s become more of a December “effect.”

Therefore, the strategic investment issue is whether to sell for gains sooner (ie, this year), or hold out for early next? Given the uncertainties about next summer bound to emerge sooner than later, my bias would be for the former answer. And given how In-Cog-Nito has laddered his (or her) options, an easy course to execute.

Thanks TJ. Good observations. If WMT gets to 55, one plan of mine is to lock in gains by swapping out the 47.50’s to 55’s, contingent of course on how things look then. A few other things I’m hoping for:

1. WMT takes market share from Target and Bestbuy. WMT’s plans targeting BBY’s electronic warranties are quite exciting, as are its plans to enter higher margin electronics like LCD TV’s. Target warned on its guidance. WMT affirmed its guidance. This tells me they are beating TGT.

2. Thanksgiving effect. The market tends to go up during Thanksgiving. Desks are empty, and the markets are thin. People tend to try and gun things up during this week because they can. The effect should be less pronounced with WMT, but it couldn’t hurt.

3. New money in December and January. Year end bonuses and 401k contributions account for part of the Jan/Dec effects. This money tends to go to index funds. Index lifts tend to benefit the big liquid names like WMT.

4. WMT is down for the year. $55 would be roughly breakeven. Don’t underestimate fund managers who want their positions at or above breakeven.

5. I think WMT shares are unreasonably depressed from bad press and the WMT bashers.

WMT is in good shape vs. TGT, in sales at least and even with the desire of some bashers to see TGT become dominant, simply because it’s located virtually everywhere. In the upstate NY town I just moved to, it’s Wal-Mart or nothing for many products. Where’s Target? Couldn’t tell you.

So, with any luck, when Black Friday shopping commences, that flood effect takes hold and helps out the stock. And also, maybe people will realize that 99% of the Wal-Mart bashers were never going to shop there anyways, so their disdain means little.

Thanks James. Funny thing about the pro-WMT and anti-WMT movies that are out now. The anti-WMT movie took $1.8 million to make. The pro-WMT movie took $85k to make. Ironic eh? It says to me that the anti-WMT folks had to look harder with more effort to dig up dirt. The pro-WMT folks didn’t have to look far to find good things to say. The anti-WMT movie, from what I gather, is in the same vein as Michael Moore’s movies. They highlighted one hardware store who allegedly went out of business due to WMT. Problem is that the store went out of business before the WMT store opened. But why let the truth get in the way of a good rant.

Long-term,I do wonder how long Walmart can keep up the expanding. It gains much of its market advantage from its highly computerized inventory system and I think that advantage will diminish as competitors keep upgrading themselves in emulation of Walmart.

Believe it or not, they plan to open around 500-600 stores worldwide in the next year. They have about 5500 stores now worldwide, so about 10% growth. Pretty impressive for a company that big.

The New England region is still largely untapped, as they’ve only broken through there in recent years. That region may not be growing in many ways at all, but it’ll probably get a lot more Wal-Marts.

Interesting continued discussion, everyone! Merry Christmas for investors, too.

In the early 80s, I lived in Minneapolis and my oldest friend cut his teeth in his field by photo editing Target (actually Dayton Hudson Corp, the parent firm then where my woman-friend worked) mail order catalogs. Even then it’s distinctive fashion-forward discount store brand identity was forming.

Of course, the rise of Wal-Mart changed the US retailing landscape forever; my favorite benchmark is the fall of Sears. Earlier this year I was dating a thirtyish woman (with a leftish political orientation). In the 90s came the French hyper-market vogue, resulting in “Super” centers and such. But in this woman’s mind, either you were a Target shopper or a Wal-Mart shopper, whereas in my misspent youth, (and reflecting local dominance) you were either tres Tar-get [French inflection, puh-lease] shopper (cf, “Career Opportunities,” 1991) or a loser! Funny how things – or do I mean people? – never change.

In addition to its celebrated inventory reporting, Wal-Mart has patented the folksy-friendly store where you can find everything (and on my road trips throughout the trans-Mississippi West, I do). Yet, I admit, the sheer color and style coordinated visual experience of shopping at Target, as they refine and re-invent their formula, continues to amaze and astound me! Lately, I’ve noticed even Wal-Mart barrowing their style coordination themes, eg in housewears. As a man, naturally, I’m no American who ‘lives to shop’ – I merely shop to live, like most intellectual types, but unlike the latter I truly enjoy the human significance of shopping and watch the parade go by.

Shannon, however, raises the continual and suspenseful bottom-line mystery for pro-capitalist corporate watchers: WHERE CAN ALL OF Wal-Mart’s FUTURE GROWTH BE COMMING FROM? I recall that Wal-Mart honchos are placing big bets on…(drum roll, please!) China. Retailing in China – as in ‘carrying coals to New Castle (England)?’

Oh, the irony. When the chief menace of the out-sourcing boogey-man goes home to roost, where? Over THERE?! Yes, Incognito and Warren, WMT is this season’s low risk value play. But how much is this the reason?

Here’s a few more capitalist conversation starters: which retailer is the equivalent of MacDonald’s – or isn’t there any doubt? And concerning globalization and the world conflict: will Tom Friedman’s MacDonald’s maxim – that no nation with a MacDonald’s will attack another nation with one – soon be upgraded to…Wal-Mart? And will anti-globalists who made McDonald’s the object of their ire in the late 90s (and so famously in France) respond in kind? “Let’s go trash Wal-Mart!” Anyone watching the oracles of the anti-GloBos, like Hardt and Negri, on this?

May we all remain attack free and enjoy a safe holiday season!

Hi TJ,

It’s looking like a Merry Christmas indeed in the market. Nice day for WMT today, hope it continues.

Smokin’ action in WMT options last 2 days. It takes your breath away when you get it right. It takes your breath away also when you get it wrong, but obviously for the opposite effect. Hope people have had prosperous trading sessions this trading month. Thanksgiving is great; ie when all the turkeys in the market fly. Happy Turkey Day! haha