From xkcd

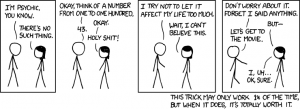

Economics is not a predictive science, i.e., economists do not make better predictions than mere chance. Yet most economists build their careers based on selling the idea that they can predict the consequences of different economic decisions under real-world conditions. Just like the character in the cartoon, economists build their reputations by advertising the few times they got lucky and guessed right, while convincing people to ignore their many, many failed predictions.

As one wag said of Paul Krugman,”He has successfully predicted 9 of the last one recessions.”

He’s far from alone in that.

The only economists whose works stand the test of time are those who explain why economics isn’t a predictive science and that we shouldn’t make decisions based on the belief that it is a predictive science. This is why Adam Smith is still studied 230 years later while all his contemporaries who argued that they did have predictive powers have been forgotten or discredited.

Does that mean that no prizes ought to be given out for outstanding contributions to the field? How can contemporary economists be expected to be recognized in the short term if only the long haul is acceptable? What of Keynes?

All science is probabilistically predictive.

Sometimes, when you don’t look carefully enough, you can pretend it is lawfully predictive.

Economics is no different here, though of course every field of science is at its own stage of tool development.

Fred Lapidies,

Does that mean that no prizes ought to be given out for outstanding contributions to the field?

No, it just means we shouldn’t make decisions based on such ideas. Every science goes through an evolutionary process in which it starts out with raw observation, then repeatable, measurable observations, then taxonomy, then hypothesizing, then falsification of hypothesis and finally the creation a predictive model. Only the last stage can be used to make decisions.

Economics is basically in the raw observation stage. We can’t even make repeatable measurable observations of the economy. We don’t know exactly what economic factors we’re measuring or how precisely and accurately we are measuring them. Economic measures such as unemployment, GDP etc don’t even use the same definitions from year to year or region to region. No predictive science uses such slipshod definitions or such imprecise measurements.

At best economics provides rough rules of thumb. For example, we know that increasing taxes on an good or activity reduces the consumption of that good. However, we can’t predict how much revenue any particular instance of such a tax will produce or how much it will reduce the consumption or activity. The luxury tax past back in ’93 is a good example of this. The tax ended up producing negative revenue, something none of the economist who supported the tax predicted.

Another example is the Laffer curve much beloved by free-market/low tax advocates. The Laffer curve is obviously true in broad concept. If you tax at 0% you get zero revenue. If you tax at 100%, you get zero revenue. Somewhere in between lays an optimum tax rate that collects the most revenue. However, no body has the least idea what that optimum tax rate is at any given point of time. Instead, people who oppose taxes always say the current tax rate is to high and people who approve of taxation always say it is to low. Ditto for Keynesian stimulus. Maybe true in some rough sense but nobody knows exactly how much of a stimulus is needed at any given time or what the tradeoffs are.

The only thing we can define concretely is the boundaries of our our own ignorance. We can say what we don’t understand and what we can’t predict.

Tdax,

Economics is no different here, though of course every field of science is at its own stage of tool development.

Agreed, see my response to Fred.

The problem is that we treat economics like physics instead of as an immature science of largely academic interest.

I think economics is so important to use that we can’t psychologically tolerate the idea that we can’t predict the behavior of the economy or the consequences of economic decisions. If you look back at the history of economic thought going back centuries, you see that each generation firmly believed they understand and can predict economic consequences. Each generation believes the previous generation were naive but that the current generation now understands what’s going on.

I would draw a parallel to pre-scientific medicine. The models it was based on where in retrospect nonsense. IT was actively dangerous in most of its treatments. Most people were better off never seeing a doctor. Yet people returned to doctors if they could afford them and suffered under horrific and pointless treatments. They did so because undergoing a treatment, any treatment, provided a psychological boost in comparison to doing nothing. (The same effect drives people to use “alternative” treatments today.)

The only practical economic theories are the ones that explain why we don’t actually have the ability to predict or manipulate the economy. These are theories about the limits of our knowledge instead of attempt to predict specific economic outcomes.

Economics is basically in the raw observation stage.

This is a good point. Behavioral economics is the hip new thing in economics, which implies that experimental manipulation is at about the stage that psychology was, say, 120 years ago.

Correlational methods are very good, but establishing a chain of causation from human behavior to GDP is a long way off, I would think.

A trick that works much more often than the 1-100 guess, is to have two explanations ready for every event. Then you can be right most of the time.

Winston Churchill said: “If you put two economists in a room, you get two opinions, unless one of them is Lord Keynes, in which case you get three opinions.”

(

More on Keynes)

Obama has shown that this works great in politics, too.

A lucrative variation of guessing gives stock brokers a good income.

How To Predict the Future Without Knowing Anything

It is easy to convince 30% of prospects that you can predict the direction of stock prices.

Andrew_M_Garland,

How To Predict the Future Without Knowing Anything

I think I just found my new business model. ;-)

How To Predict the Future Without Knowing Anything

Hey, that’s me on blogs…..because if you can’t blow smoke in a blog comments section, then what is the point of it all?