I was doing some work in my basement when I came across the following, tucked away out of sight behind a girder.

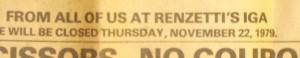

It is an old grocery flyer from a nearby store. How old is it?

Okay, so it lists the prices from 1979. But how do those prices stack up against the cost of similar items that can be found on the shelves today?

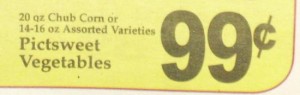

This handy inflation calculator is pretty nifty. Prices are based on the Consumer Price Index, which is a comparison of a basket of common household items from place to place, and from year to year.

But though I have found it to be extremely useful for figuring out the buying power of wages in different decades, the CPI has some critics. They claim that it isn’t accurate because technology causes the relative cost of various items to rise and fall. And it seems that food prices have been falling relative to buying power.

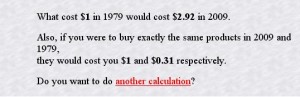

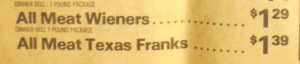

How can we check this? Well, the first step is to see how inflation has effected prices in the last 31 years. According to the inflation calculator, $1 USD in 1979 would buy the same amount as $2.92 USD today.

Okay, so according to the CPI prices today are about three times what they were back in 1979. But has the price for food risen that high?

It just so happens that a flyer for the very same store appeared on my front porch yesterday, although one that had been recently printed. Let us compare the price of chopped ham. The first image will always be from the 1979 flyer, and the second will be taken from the 2010 handbill.

![]()

Pretty close in price! If the CPI was accurate, then the price per pound for chopped ham should have risen to about $4.65 USD.

Okay, what about hot dogs?

Still way off. If a one pound package of tube steak cost $1.29 back then, it would have to cost $3.77 today in order to conform to the CPI reported increase. Instead it goes for $2.

Milk is a household staple that seems to be popular in every decade.

Again, according to the CPI a $1.39 gallon of milk back then should cost about $4.06 today. Instead it sells for $2.50 a gallon. But a straight comparison doesn’t tell the whole story.

The words “LIMIT: 2 CTNS” above the 1979 price listing would seem to indicate that this was an exceptional deal. The grocery store manager didn’t want a run on the item as people stocked up on milk, leaving bare shelves and angry customers who didn’t get a chance to take part in such a value. The present day price might be worth noting in the flyer to get people to visit the store, but there doesn’t seem to be any danger of milk selling out any time soon.

So we have compared items from the dairy and meat aisles. What about vegetables?

Hmmm. The size of the packages by weight don’t exactly match up, except for corn. But, even so, it is obvious that the price of food has not been increasing along with inflation. In fact, it would seem that the percentage of an average American budget devoted to food has fallen by about one half in the last 31 years. If someone had to use 20% of their pay to buy food back in 1979, then they should have to shell out 10% of their hard earned nowadays to get the same number of items, and of the same quality.

Unless, of course, chopped ham makes up a large portion of some persons diet. If so, then the percentage of their income devoted to food should have fallen from 20% to about 7%. Chopped ham seems to be the hot tip for meaty value.

There is more to the story than simply more effecient farming methods. Big box stores like Walmart provide everything the consumer might need for the home, and high volume sales means that there is a reduction in price. The IGA store mentioned above is family owned, and it is much, much smaller than anything Walmart puts up. The prices in the IGA are not only higher, but they also have lower quality goods in the form of off-brand merchandise. The only reason they survive is due to the fact that the store is situated in a rather crappy neighborhood, one which is off the well traveled bus routes. There are enough people living nearby who do not have access to a car so taking a trip to stock up on less costly groceries is not a viable option.

While mildly interesting, this direct comparison in food prices has caused another question to spring to mind. If food has not kept pace with the average price increase due to inflation, then some other items in the CPI basket must have jumped far ahead in comparative cost to offset the lag.

What do I have to spend a greater percentage of my paycheck on today, compared to 1979? Housing? Clothing? Automobiles?

(Cross posted at Hell in a Handbasket.)

Here’s a graph from Professor Mark Perry’s blog Carpe Diem that adds to your point:

http://mjperry.blogspot.com/2010/06/wealth-of-nations.html

Every time I see something like this I think of the Poverty Level calculation that keeps rising exponentially while the basis of it drops at least arithmetically. In my state, we are now offering free child health care to kids from a family of 4 whose parents make $56,000 based on 2 1/2 times the poverty level. Seems to be a priority setting problem to me rather than a poverty problem but then I’ve always been on the paying rather than the receiving end of government largess.

I think the CPI is nonsense over time frames of more than a few years because the things people can buy are constantly changing.

In 1979, people did not pay much for information and information services. They had a single landline phone billed at a flat rate plus specific long distance charges. Some people had cable but most used free broadcast. Maybe you spent $100 (2010 dollars) on information services and technology.

Today, our family has high speed internet, internet based TV, plus three unlimited data plans for three cell phones. There is nothing circa 1979. We pay over $250 a month for all our information services.

That is not even considering the computer hardware and cell phones that were literally science fiction in 1979.

Even things that would seem constant like food is constantly changing. Our family eats a lot better than we did when I was kid. Back then, only the snoots made coffee from beans. Everyone else drank Folger’s. Ditto for European cheeses and wines. Asian food was almost entirely unavailable outside of the big city Chinatowns. My pantry is crammed with spices, seasonings and foods most Americans didn’t even know existed in 1979.

So, you can’t compare what we paid in 1979 with today because it’s apples and oranges. Well, Apple IIs versus iPhones at any rate.

I just took a look at the BEA’s PCE price indices (which avoid your index base year problem and has broader coverage than the CPI) by product…

http://www.bea.gov/national/nipaweb/TableView.asp?SelectedTable=69&ViewSeries=NO&Java=no&Request3Place=N&3Place=N&FromView=YES&Freq=Year&FirstYear=1979&LastYear=2009&3Place=N&Update=Update&JavaBox=no#Mid

…it looks like durable goods, especially fun stuff, and clothing have gotten cheaper in real terms since 1979, and services much more expensive. The price indices for housing (i.e. rent) and health care have risen particularly quickly. Services have gone from 54% to 68% of consumption in that period. Housing, health care, and education are where much of the extra spending (both price and quantity) has gone, and their price has gone up. This isn’t a new trend; it’s known by economists as the ‘Baumol Effect’. It’s a bit unintuitive because it’s a general equilibrium phenomenon, but it basically says that in real terms, an increase in productivity in one sector (like manufacturing) can lead to a rise in demand, and therefore the price, of goods in the other sector (like health care). This has been happening at least since the second world war.

And the real price of food? The BEA says that that the 2009 price is 2.3x the 1979 price. With the big increase in incomes and a small increase in the amount actually eaten, food has fallen from 14% to 8% of consumption, or 20% to 13% if you include eating out (which includes a service component). So your back of the envelope calculations do get you into the right ballpark.

“Back then, only the snoots made coffee from beans. Everyone else drank Folger’s. Ditto for European cheeses and wines. Asian food was almost entirely unavailable outside of the big city Chinatowns. My pantry is crammed with spices, seasonings and foods most Americans didn’t even know existed in 1979. “

Do you remember the “wine and cheese” shops that started to appear in strip malls in the 1970’s? They specialized in exotic luxury food items, almost all imported, and many saw them as an example of conspicuous consumption for the Yuppie set. It was in one of those shops that I first came to the realization that there were more varieties of vinegar than white or cider.

Of course, those same luxury items are hardly considered luxuries anymore. As you pointed out, they are common as anything. I find stuff on the shelves at Walmart today that couldn’t be found anywhere back then.

An aside on Snoots and coffee: When I was a kid (40’s and 50’s) my parents ground their own beans at the Great Atlantic and Pacific Tea Company store (A&P) but I think it must have been cheaper that way because they also bought “oleo-margarine” in big bags with an enclosed die packet that you had to break and mix in by hand (or it looked like half melted lard). Not snoots by a stretch.

So, like, Apartment Therapy and Etsy and all of those recipe blogs (they blow away the political blogs for regular readership) are a part of the roiling, changing, improving market economy we have in the West.

Beauty matters and I am always surprised that so few people see the beauty in modern American life. I mean, I’m as grumpy and horrible as they come, but surf the mommy or lifestyle blogs. Little bits of home-made created beauty, you know?

What’s that Guy Fieri show? Diners, Dives and Drive-Ins or something like that. It’s all about our changing eating habits, I think, because even the dives are very interesting. Someone makes Spanish tapas with a Florida flair in the strip mall. Americans are more “sophisticated” than they get credit for. We’ll try anything. Not so with some other cultures that are in love with their own cuisine, but look down on that of others.

– Madhu

Heh, wifey and I just watched “The Big Sleep”, 1946, Bogey and Bacall. In a scene where detective Marlowe, deep in thought, figures out an “angle” in the case, the waitress snaps on an electric bulb light over his head (classic imagry!) the sign on the wall reads “sausage and 2 eggs, $.35”.

It’s a bit unintuitive because it’s a general equilibrium phenomenon, but it basically says that in real terms, an increase in productivity in one sector (like manufacturing) can lead to a rise in demand, and therefore the price, of goods in the other sector (like health care).

This is one of the reasons why prices for things like theater tickets and labor-intensive services go up.

I graduated from college in 1979 so this is a very interesting comparison for me.

=====

Grammar nerd correction:

“how inflation has effected prices”

should be

“how inflation has affected prices”

although I could be wrong since college WAS a long time ago.

It’s actually rather impressive how much cheaper most durable goods are on a relative basis vs 1979. My personal favorite is cars – my first new car purchase was a 1984 Dodge Daytona – 2 dr, hatchback for a little under 10k. 2 years ago we bought a 2009 VW Beetle, which is also a 2dr hatchback for just over 18k. The CPI-U doubled over the same period, so the inflation adjusted price was down slighty. But…

My Daytona was stripped (no A/C, no power windows or anything of that sort, I didn’t actually get a radio in it (bought it later)).

The VW has A/C, power everything, leather seats, ABS, airbags, full stereo/CD player/mp3 hookups, a much more powerful engine, and on top of all of that is a lot better made and more reliable. Not that Chrysler even had everything like this even as options in 1984, but the A/C and safety features alone would have added 5k, and my guess is it would have taken close to double the original sticker to even get close.

It’s this kind of thing that makes me crazy when I read the “government is lying about inflation” nuts – if you actually remember what you paid for stuff 25 years ago and the quality of what you bought at the price it is fairly obvious that the inflation numbers are at least reasonable (I tend to think they’re overstated because they understate substitution/quality improvements). The truth is, competition drives continuous improvement in costs of goods sold – 1-2% per year really adds up over time. Only in the areas where productivity gains are hard to come by or where resources are truly constraining do you see real price increases.

The dollar is unquestionably being devalued. A dollar in 1800 is worth $0.08 today. But what is the market basket of goods the average worker can buy for an hour’s worth of labor versus what an hour’s worth of labor bought then? We moved from a culture that valued savings and investment to one that valued borrowing and consumption in 1913. We may have played that opportunity out and now will have to revert to save and invest. It was a fun century. I wonder if the Islamic Puritans are unintentionally sowing the seeds of the next wave of freedom.

But Democrats keep telling us the middle class is falling behind!

You’re disrupting the narrative. Time to get on Journolist 2.0.

I think Shannon has huge point there.

While gasoline is probably about 3 times as much (assuming your flyer was before the 1979 gas shock that moved prices up to $1/gallon), it’d be interesting to compare electric and gas bills from that era. It’s not even clear what the proper measure would be; some appliances are more efficient, and others didn’t even exist. Many of the improved or new items suck electricity all the time, but provide a service that didn’t exist then, either.

Automobiles? Leaving gas aside, it seems the right comparison would be average annual maintenance of a well-maintained vehicle, and I suspect that since that’s labor-intensive, it’s gone up as well. And with dozens of new features, mandatory and not, I wouldn’t be surprised if the price of a mid-sized sedan or a station wagon is more than 3x higher.

Formal education has skyrocketed, both from labor and subsidies.

Let’s see, your house or rent is probably the leading area in which you experience this inflation. Houses back in ’79 cost under $100K normally. Thanks to the gov’t for subsidizing the increase in housing prices.

Cars probably also experience the inflationary effect. Although, a 1979 honda or buick is worth 1/10 of what a 2009 honda or buick is actually worth (AC, CD player, better mileage, room, crash worthiness, etc.) so I wouldn’t call that inflation as the underlying object is worth more (sort of how plasma TV’s are more expensive today than 1979 20″ tubes but plasmas didn’t exist, so what is the real increase?)as inflation is the devaluation of the currency not the rise in value of a good). Similarly, medical advances drive the costs of care because people in 1979 didn’t live as long.

But, an interesting find. It also reminds me of the Ehrlich bet that prices of industrial goods (borax and aluminum, I guess) would skyrocket over a 10 year span. He lost that bet as the prices went down.

So, what is actually happening? Why do food prices seem constant? Maybe food should be cheaper as farm technology has advanced? Don’t we subsidize farmers to not grow to artificially raise prices? Maybe food should now be 1/3 as expensive as they currently are? A gallon of milk should be $.50?

Our food prices have stayed low partly because we import so many fruits and vegetables from Mexico and Chili. This puts competitive pressure on domestic producers, who then use illegal aliens to harvest crops grown in the USA. So, we do get our relatively inexpensive produce because of illegal aliens who are more than willing to work in the USA for the same wages they would be paid in Mexico.

But don’t worry, the USDA is working hard to ensure that our produce prices will grow a lot – new regulations, under the guise of ‘food safety’ will greatly increase producer costs, without really affecting food safety. The feds will tell growers what varieties they will be allowed to grow, what fertilizers, what pesticides they will be allowed to use – and in doing so, will put out of business small growers (like myself) who sell at local farmers’ markets – because small growers simply cannot afford the cost of the regulations – paying for inspections, etc., just to make a few hundred bucks in the summer months.

Oh, and don’t even talk to me about eggs! At ALDIs, you can buy a dozen grade B or even Grade A eggs for $1 a dozen – these eggs come from humongous producers – even non-peta types like myself cringe at their practices.

I sell a dozen non-graded eggs from truly free-ranging chickens(if graded they would be Jumbo, AAA eggs) for $3.50 a dozen – a loss – because what I make during market season does not begin to pay for the feed my chickens need to make it through the winter, and there is no market for them in the winter unless someone wants to drive to my farm to purchase them. I’m too small for any federal subsidies, and would not accept subsidies anyway – but to break even on my eggs, I would have to charge $4 a dozen- to make a profit, more than that.

And, to make matters worse, I can’t put the term “organic” on my eggs (even though I use organic practices) because I cannot afford to pay the Feds the thousands of dollars it takes over 3 years time to be “certified” organic.

Ugh. There is so much more to this than meets the eyes of the city people!

Notice also the change in quality of the fliers themselves; in 1979, one color printed on (probably) something like newsprint; the new one, full-color printing on coated paper (which would have been far too expensive for advertising circulars 30 years ago).

When I was a kid my grandfather liked to drink his coffee from a saucer. I guess it cooled off quicker that way. It must have been much more common back then, because in the “Grapes of Wrath” movie notice on the wall of the diner where the kids go and are given candy, there is a price sign offering a “cup of coffee” for 10¢ and a “saucer of coffee” for 5¢.

Chopped ham????

I had to stop right there–in what part of the country is chopped ham a food product?

Housing mostly.

It’s nearly impossible to compare prices directly. In my own experience, though, I’ve seen standard inflation in deli meats. 20 years ago I worked in an in-store deli, and I still remember the prices of the various hams, cheese, bologna, etc. that we sold. The prices that I pay nowadays at the deli for similar products is around double those prices.

As someone pointed out above, many things are incomparable. For instance – cars. There’s just no way to compare. Cars nowadays have far more features and, more importantly, last far far longer than the cars of 20 or 30 years ago. Looking at cars from my youth – late 70’s models – the engine was shot at a little more than 100K miles. It had to be rebuilt. The rest of the car probably made that not worthwhile. You had probably torn the drooping headliner out by then.

And electronics? No comparison.

How about clothing? Oddly, I remember just having to buy Nike shoes for around $50 in high school. I rarely pay more than $10 for a pair on cheap tennis shoes at Costco now, and the quality is at least the same.

Housing is way more expensive, but, again, hard to compare. My house is 4x the size of the one I grew up in, maybe more, and cost more than 10x as much. But the pipes don’t freeze every winter, well, I could go on for awhile there.

Anyway, I’m rambling. But the point is that it’s just difficult to look at an item from 30 years ago and now and do a reasonable comparison in all but a few (deli meat) areas.

“…I think it must have been cheaper that way because they also bought ‘oleo-margarine’ in big bags with an enclosed die packet that you had to break and mix in by hand…”That wasn’t about price. Yellow margarine, whether naturally yellow or dyed by the manufacturer, was banned by federal law (and by state law in every state with a dairy lobby) until the 50s.

oh, and of course, schools. Education is a big mega-inflation beater. If you want your kids to go to private school that’s one thing but colleges, again thanks to government subsidies, have increased tuition many times more than the rate of inflation would suggest.

Easy money leads to price increases because the cost borne by the consumer is not understood. That’s why there are so many law school grads from third to fifth tier law schools out there, struggling under six figure student loan debts. They’ll be lucky to work at the mall, let alone a real law firm.

The old timers at my law school recall that a semester hour at Harvard used to be like $20 or some nonsense.

Shannon has it. Too many variables, not the least of which is the computer revolution and its effect across the board.

To get around this, you have to price-compare things whose technology has not changed appreciably, and whose cost-factors have been similarly stable. What products would qualify for this? Men’s suits?

The trick with inflation is that it’s not about prices, it’s about the devaluation of the currency. Prices are a symptom, not the essence or cause of inflation, and as with actual diseases, symptoms can be masked without affecting the underlying condition.

Assuming a stable currency, the technological innovations that have occurred over the last thirty years would mean that prices overall would have dropped significantly. In such a context, apparent price stability would serve to camouflage inflation in the eyes of those who think it’s about prices; the lowering of real costs, masked by inflation, results in what looks like stable prices even as the money supply increases. This creates an apparent “wealth effect” for government, who was able to enlarge the money supply without *apparent* inflation to skim off a bigger slice of the wealth being created, without being obvious about it.

So, just because you can buy some widget for $40 today what was $30 in 1979, it doesn’t necessarily mean low inflation; the reduced costs of making that widget made possible by 2010 technology, had it existed in 1979, might have resulted in a price of $5.50 back then.

It will be interesting to see what happens when the effects of innovation level off for a time, as I believe has been happening since the millenium, at least in terms of the effects of the computer/electronics revolution. I base this on the following indicators:

My field (computer effects) has been dominated by huge technological leaps and bounds for the last twenty years, but the last big tech leap that had my jaw on the floor was the “Birth of Sandman” shot in Spiderman 3. The effects business is now transitioning into an industry more like the older ones; well-established practices with few disrupting innovations, instead of the other way around. (There’s even talk of unionizing the field like the rest of Hollywood. Gah.) The technology now exists to realize pretty much any challenge that a director comes up with, without having to engineer another big breakthrough. Now that photorealism is within the reach of any FX house, they are now competing in terms of things that the viewer doesn’t see: beating competitor’s costs, and fixing the ever-more-egregious errors of all the old unionized professions (we have been fixing bad makeup for years; about the only thing we can’t do now is fix bad acting).

The average age of any given computer is rising, as computers are now fast enough to do nearly anything that people need; the only markets still demanding ever larger storage and speed, are the server market, game machines and raw number crunchers, and they represent a small slice of the overall market. So computers, at least, are not as likely to shake things up again like they did in the ’80’s.

Add in the macro factors that will suck capital away from private innovation — increased regulation, taxes and government spending — and you can see why inflation is my long-term bet, even if they weren’t expanding the money supply hand over fist.

The real outlier in terms of inflation is higher education. The cost of a college education has far surpassed, for example, the cost of medical care, especially when one considers that medical care today includes technologies and procedures not even imagined in the 1970’s. I defy anyone to prove that similar advances have occurred in education to justify the cost of higher education.

Why food prices are low:

The chief function of governemt, is to see that the population is housed and fed. Otherwise, the houses of the government employees get burned, and their kids get eaten by hungry, vengeful mobs.

Therefore, expect food prices to be low. :)

Insert various strategys for acheiving that goal here.

It’s kind of amazing to realize that if we eliminated government farm subsidies and price supports, food would be NOMINALLY less expensive today than in 1979.

This seems like one of those, “who are you going to believe, me or your lying eyes” kind of B.S. statistics. If you have been shopping for the last 5 years, it is pretty darn obvious that your food bill has dramatically inflated.

I find it interesting that they used the year 1979. Afterall, that is the year that the cost of housing shot through the roof, and interest rates started their climb upwards to 18+ percent. And how do food subsidies paid to farmers factor into this?

The problem with this type of feel good cheap baloney is that it changes nothing, including perception. So the dollar didn’t buy as much stuff in 1779 as is did in 1979. The bottom line is my dollar buys a whole lot less than it did five years ago. And that’s what inflation is really all about. Today I have less chance of a salary increase and my dollar doesn’t buy as much in food and gas than it did five years ago. I can buy a nicer house, yes, but only if 1) I don’t have to sell mine at a loss; 2) I have a job to pay for it; 3) I didn’t lose my downpayment in the market and 4); I don’t mind the fact that I can buy cheap because my neighbor lost his job, can’t find a new one and is being foreclosed upon and thus completely screwed by the price I am paying him.

“I find it interesting that they used the year 1979.”

What makes you think there was a choice involved, Becky? Like I said in the beginning of my post, this is a flyer I found in my basement, left by a previous tenant long decades ago. There wasn’t a stack for me to pick through until I found the desired year. This was the only one.

“The bottom line is my dollar buys a whole lot less than it did five years ago.”

I’m having trouble understanding what you mean by that. After all, the entire point of the essay is that food costs have not kept pace with inflation overall. It takes less time at work to feed someone than it did back in 1979.

I remember a passage in Mark Twain’s “A Connecticut Yankee in King Arthur’s Court”, where the title character struggles to convey the concept of relative value to some country bumpkins. They think that they would be better off if inflation caused their wages to rise, while the time traveler attempts to explain that it doesn’t matter if they take more coins home if the prices for goods means they can afford less.

http://books.google.com/books?id=2CDoNxruJ9wC&printsec=frontcover&dq=connecticut+yankee+in+king+arthur%27s+court&source=bl&ots=X5dic9qsBU&sig=MMqxNLAXGTLHcpcDFkFES95wED8&hl=en&ei=IjxmTJytLYOdlge93ZmwDA&sa=X&oi=book_result&ct=result&resnum=3&ved=0CCgQ6AEwAg#v=onepage&q&f=false

Click on the link and start reading at page 340 if you want to see how Becky makes me feel right now.

You are resorting to calling me a “country bumpkin” and imply that I can’t understand the concept of relative value becaues I’m not convinced that the relative price of milk, pork and a bag of vegetables between this year and one other means that food has not kept pace with the average price increase due to inflation?

I will grant your point that you just happened to have a flyer around for 1979. But perhaps you missed mine. You should have picked more than one year and more than just milk and pork (food subsidies greatly impact the price) and packaged vegetables (labor/imports costs)before you start calling me a bumpkin.

In 1993, a lap dance at the local strip club was $20.

It hasn’t changed in 17 years.

Just sayin’.

Around 1900 food made up 30% of the family budget. Today it is under 10%.

Two things cause this. Families make more money and food prices are declining in absolute terms.

Why do you think poor people are fat in America?

Chris Rock on too much food. Profanity alert.

While I agree that increases in productivity have in general offset, the inflationary effects, in food, I want to point out that it all depends on what you use as a matric. In 1990 in NYC I used to be able to buy a bag of gold fish crackers, a 1L bottle of diet coke and a pack of cigarettes for $5. Today the same purchase would cost $15. Granted a lot of that is tax, but taxs are a real part of cost for the consumer and should be calculated in inflation stats.

“In 1993, a lap dance at the local strip club was $20. It hasn’t changed in 17 years.”

The girls dancing in my lap seem to have gotten uglier in the last 20 years, though.

“Families make more money” heh. Not to mention that 1979 was before the two income family became a norm.

A Dutch friend of mine really liked his “Buy me another beer, you are still ugly” T-shirt some 10 years ago.

I wonder how the numbers changed since then.

Before you could really do a relative value comparison, you need to have a consistent unit of measurement.

Like gold: http://goldprice.org/gold-price-history.html#36_year_gold_price

Or chipped ham or frozen corn. Any other ‘official statistic’ of inflation is irrelevant as far as the average consumer is concerned.

Look at it another way. For the working stiff, an hour of minimum wage work is still enough to get you a couple gallons of gas, so you can get home and back to work the next day, and a pack of smokes to get you through the night. An hour’s work still buys the same things, or maybe a bit more.

If you compare most things we buy today, the relative cost is about the same, or maybe a little less than it used to be. But there is also a lot more available to buy. Then, you have the non-tangible value of the individual craftsmanship put into an item, though. My grandfather could build a house himself. Today, construction crews hire ‘nail drivers’. Things that lend themselves to mass production have not jumped in price. Things that require individual ability have.

Xiao,

You seem unaware that in the USA, the food price policy, in a bit of Marxist overreach, is to stabilize food prices to remain high. So that farmers can make money.

PJ Orourke wrote about this.

It’s like the government mandating that cars cost what they did, in constant dollars, in 1908 or computers remain as expensive as they did in 1985.

“In 1993, a lap dance at the local strip club was $20. It hasn’t changed in 17 years.”

“The girls dancing in my lap seem to have gotten uglier in the last 20 years, though.”

While working east of the Docklands area in London some ten years ago, I visited, entirely innocently of course, a pub where the ‘oldest exotic dancers’ were performing, if that was the appropriate term for their tired gyrations.