I spent the past six months reading about Calvin Coolidge. I was interested in why the 1920s were a period of great prosperity and why the severe recession/ depression of 1920-1921 was so short. At its peak, there was 25% unemployment. Gross domestic product dropped by 6.9% in one report.

The recession of 192021 was characterized by extreme deflation — the largest one-year percentage decline in around 140 years of data.[2] The Department of Commerce estimates 18% deflation, Balke and Gordon estimate 13% deflation, and Romer estimates 14.8% deflation. The drop in wholesale prices was even more severe, falling by 36.8%, the most severe drop since the American Revolutionary War. This is worse than any year during the Great Depression (adding all the years of the Great Depression together, however, yields more severe deflation). The deflation of 192021 was extreme in absolute terms, and also unusually extreme given the relatively small decline in gross domestic product.[2]

The Harding-Coolidge administration took office in March 1921 and the recession was over in months. Why ? Governments were smaller then and had less influence on the economy. The Wilson Administration has been widely described as the equivalent of a fascist regime with its war time controls and economic meddling. Again from the Wikipedia article:

Interpretations of the end

Austrian School economists and historians argue that the 1921 recession was a necessary market correction, required to engineer the massive realignments required of private business and industry following the end of the War. Libertarian Austrian School historian Thomas Woods argues that President Harding’s laissez-faire economic policies during the 1920-21 recession, combined with a coordinated aggressive policy of rapid government downsizing, had a direct influence (mostly through intentional non-influence) on the rapid and widespread private-sector recovery.[12] Woods argued that, as there existed massive distortions in private markets due to government economic influence related to World War I, an equally massive “correction” to the distortions needed to occur as quickly as possible to realign investment and consumption with the new peace-time economic environment.

Daniel Kuehn’s recent research demonstrates that Woods gets many of the facts of the 1920-21 recession wrong.[13] The most substantial downsizing of government was attributable to the Wilson administration, and occurred well before the onset of the 1920-21 recession. The Harding administration raised taxes in 1921 by expanding the tax base considerably at the same time that it lowered rates. Kuehn also points out that Woods underemphasizes the role the monetary stimulus played in reviving the depressed economy. Since the 1920-21 recession was not characterized by any aggregate demand deficiency, fiscal stimulus was entirely unwarranted.

[edit]

I would tend to doubt the “recent research” that tries to include Keynes’ theories in the explanation. The issue of Fascism is more interesting. The National Recovery Administration was probably the most openly fascist bureaucratic organization that the US government ever instituted. It was eventually overturned by the Supreme Court, prompting Roosevelt’s “court packing” scheme. (A very sympathetic version by PBS).

What then, led to the Depression and what is leading to the present frightening echo of 1933? Here is a very worrisome chart.

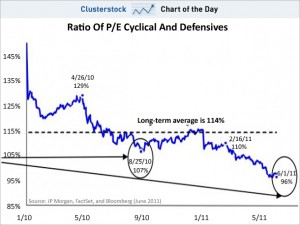

Here is a chart showing the price/earnings ratios of cyclical stocks vs “defensive stocks.” What it shows is that cyclical stocks, that can be expected to respond to economic conditions, are very, very cheap. That looks like most people do not expect recovery any time soon. Why ?

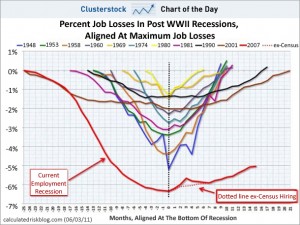

This is a very frightening chart. It has been so for months as no prior recession has shown this deep a fall in employment and this slow a recovery. Now, if you look at the end of the red line, you see that employment is not recovering at all. The line is flat.

Calvin Coolidge has been criticized in history for his pro-business sentiments expressed in words. He is alleged to have said, “The business of America is business.” In fact, that is not an accurate quote but the sentiment he expressed was similar. He was also quoted as saying something like “A man who builds a factory, builds a temple and those who work there, worship there.” He has been widely criticized for those statements, as if praising business was immoral.

What we have now is a president who makes statements like, “So if somebody wants to build a coal-powered plant, they can; it’s just that it will bankrupt them because they’re going to be charged a huge sum for all that greenhouse gas that’s being emitted.”

We have a president who tells would-be entrepreneurs that “I do think at a certain point you’ve made enough money.”

Does anyone still wonder why the economy under a president who seems hostile to business is failing while the economy under a president who supported it and wasn’t ashamed to say so, boomed?

Some have blamed Coolidge for the 1929 crash but it is pretty clear that the problem was similar to the problem of the real estate bubble in 2005. The Federal Reserve kept interest rates too low for too long. In 1928, Coolidge did not feel he had the right to intervene with the Fed and Benjamin Strong, who was the president of the New York Fed, died that year. In 2005, Alan Greenspan still believed that a real estate bubble was preferable to a correction from the 1990s internet bubble. George Bush may have had more ability to intervene but all the safety mechanisms, which had not existed in 1929, still failed.

We are on the path to another Depression. One small indication. I do reviews of workers compensation claims. One would expect that, early in a severe recession, claims would go up as workers anticipate layoffs and try to file claims. There was a bit of that but it is over. Employment in California is down so far that the State Compensation Insurance Fund is laying off doctors and closing offices. Claims are way down because employment is falling rapidly. Workers may be afraid to file claims now.

Paul Ryan seems to be our best hope right now. We don’t need another Progressive Herbert Hoover.

“Paul Ryan seems to be our best hope right now.”

that choice isn’t available at present. you don’t have any interest in pawlenty, cain, santorum or bachmann?

David Goldman is one of my favorite analysts. He also uses the nom d’Internet of ‘Spengler”.

“If It’s Wednesday, It Must Be Belgium” By David Goldman on June 1st, 2011:

Let’s go through the checklist:

1) There’s huge permanent unemployment;

2) There are no jobs for young people, who end up living with their parents;

3) The banks work under the thumb of the government;

4) Big corporations dominate the economy;

5) Entrepreneurs are few and far between.

Damn! We must be in Belgium. But it’s not Belgium, of course; is the United Socialist States of America.

I’ve been boring the CNBC audience since the end of 2009 with a gloomy outlook on employment, insisting that without startups, the American economy will have destruction (slimming down to increase productivity) without creation ( the new industries that make the jobs). … this is NOT, NOT, NOT a business cycle. It’s a transition from a vibrant if error-prone capitalist economy to a sclerotic but stable socialist economy.

That is why there won’t be a double dip recession. There’s no risk to liquidate, no excess labor to fire, no inventories to sell off (except of course in the housing market), no problem financing the enormous government deficit. Remember the bond Armageddon that was supposed to befall us in 2011? Just before 9 a.m. [Wednesday], the 10-year note was trading at just 3.01%. That’s because there’s nothing else for bond investors to buy: few corporates, almost no mortgages, no asset-backed securities of other kinds, almost no municipal bonds.

Bank regulation has played a huge role in crushing animal spirits. The regulators always fight the last war, machine-gunning the corpses on the ground to make sure they’re really most sincerely dead. …

Venture capital commitments in the first quarter of 2011 were 26% below the first quarter of 2008. In 2000, before the Internet bubble popped, VC raised $100 billion; the present annual rate is $23 billion. So much for animal spirits.

Independent business sentiment (as polled by the National Federation of Independent Business) remains miserable, barely off the 2008 bottom, and falling again during the past two months.

* * *

Other small business surveys give the identical picture.

No start-ups, no employment growth.

What does the US need?

A repeal of Obamacare and slashing of regulations that choke off business start-ups.

Elimination of capital gains tax and dividends tax, period.

Cuts in the corporate tax rate.

In other words, we need a capitalist restoration to overturn the socialist revolution of the past few years.

A word about the cause effect relationship between the 1929 Crash and the Great Depression. Many writers (mostly hack apologists for the Democrat party and its socialist policies) have relied on the temporal order of events as a demonstration of a cause and effect relationship. The Crash caused the Great Depression, they say, demonstrating the necessity of FDR’s wise regulation of the evil capitalists.

The more correct way of viewing the Crash is that the stock markets did what they were supposed to which is to price the risk of future developments. If you were an owner of equities in 1929, and an oracle told you that the US was about tho be taken over by socialists who would default on the Governments obligations by making gold ownership illegal, that Japan was going to invade China as the first act in a new and more Global War, that Germany would be taken over by a mad man socialist dictator, who would be the new Napoleon, what would you do? Me, I would have sold everything and buried the gold dollars in the basement.

Forget the Democrat narrative, the market was right. It was the socialists who were wrong.

In short, all the experts who claim to know everything about everything don’t know what they’re doing.

I don’t think Ryan is our only hope but he seems best equipped to make the economic arguments that are necessary. Pawlenty may be OK. Daniels was my previous choice and he has bowed out, probably for family reasons that won’t change.

The 1929 crash did not necessarily lead to the Depression and the events of the 30s were not necessarily predictable. It’s my opinion that Hoover began the slide with progressive policies that differed little from what Roosevelt did. I am certainly no economist but my interest in Coolidge was partly an exercise in wondering what would have been the outcome if he had been president at the time of the crash.

Reading this nice piece reminded me to put The Forgotten Man on my reading list – by Amity Shales.

Left out of the piece but just as illuminating is the Obama’s war on Boeing – trying to prevent them from using their new $1 Billion factory in S Carolina because it isn’t unionized.

This factory would build the new 787 Dreamliner.

I do feel that we are sliding into the abyss.

Remember too that Coolidge was known as “Silent Cal”

From Wikipedia:

“Coolidge restored public confidence in the White House after the scandals of his predecessor’s administration, and left office with considerable popularity.[2] As a Coolidge biographer put it, “He embodied the spirit and hopes of the middle class, could interpret their longings and express their opinions. That he did represent the genius of the average is the most convincing proof of his strength.”[3] Some later criticized Coolidge as part of a general criticism of laissez-faire government.[4] His reputation underwent a renaissance during the Ronald Reagan Administration,[5] but the ultimate assessment of his presidency is still divided between those who approve of his reduction of the size of government programs and those who believe the federal government should be more involved in regulating and controlling the economy.[6]”

Since those who dislike him don’t believe in laissez-faire government and want it enlarged (!?) it would seem that based on the evidence of things they are discredited today.

#3 is ridiculous. If you believe that then you have no chance. The opposite is true. They have you.

My sympathies.

oh, well, thanks for clearing that up. care to actually, oh , i don’t know, actually provide some evidence for your position?

#3 is ridiculous. If you believe that then you have no chance. The opposite is true. They have you.

Reading The Big Short is an interesting exercise. It suggests that the investment banks were bundling and selling mortgage backed securities that they did not understand. Nicole Gelinas’ book “After the Fall gives another part of the story. Those investment banks were gambling with other people’s money. The only investment bank that did not get into trouble was Brown Brothers Harriman because they remained a partnership in which the partners’ money was at stake.

Those same investment banks, Goldman Sachs in particular, were first in line for government bailouts when the music stopped and a lot of people found there were not enough chairs to go around. Those same people have used crony capitalism to rescue their firms and are still supporting the administration in return for the guarantee they need to avoid bankruptcy and keep the music playing.

Banks, in the sense of banks that actually do banking business, are under the thumb of the Dodd Frank legislation, written by the men who had more to do with the financial crisis than anyone else on earth. The rating companies like Moodys were part of the financial gambling casino but are still untouched by the fiasco.

Mussolini would understand what we have now as a financial system.

“the events of the 30s were not necessarily predictable.”

John Maynard Keynes, who attended the Versailles Conference as a delegate of the British Treasury wrote “The Economic Consequences of the Peace” and published it himself in 1919. The book was a best seller. In it he argued that the Versailles Treaty would cause the impoverishment of Germany and an even larger war:

“If we aim deliberately at the impoverishment of Central Europe, vengeance, I dare predict, will not limp. Nothing can then delay for very long that final war between the forces of Reaction and the despairing convulsions of Revolution, before which the horrors of the late German war will fade into nothing.”

Also, it should be noted that in the spring of 1929, the house of representatives had passed the tariff bill that became known as Smoot-Hawley, and had sent it to the Senate. Markets, by aggregating the unarticulated observations of all participants create forecasts of the future. In the fall of 1929, the looming storm spooked enough people.

Could Coolidge have done much to prevent the ensuing catastrophe? First we should note that the origin of the collapse was in Europe and was caused by the war reparations. Coolidge tried to address the the problem with the Dawes plan, but that fix did not hold. Second, two fundamental commitments of the Republican party were the gold standard, and high tariffs. Could Coolidge have vetoed the Smoot Hawley tariff? Hoover couldn’t, and I don’t think ideology controlled his action. Sometimes a President can’t buck his base. Finally, the biggest problem was the way the Fed operated the gold standard. Could Coolidge have done better there? I doubt it. As you noted, he was not able to replace Benjamin Strong adequately. An institutional problem, the extreme localism of the US banking system should also be noted under this heading. Any attempt to change the system was doomed by the political power of the bankers in their communities. FDIC was a patch, and FDR knew it. It would be 70 years before the country could accept nationwide banking.

My bottom line is that the “progressives” operating through the Democrat party did enormous damage. I do not think that any one man could have prevented it. The Republicans of the 1920s had many basic policy commitments that lead to the depression. They were justly removed from power. The Democrats were hijacked by the progressives and did a great deal of harm in the name of fixing the Depression, but I am not sure that anyone could have stopped it. I am sure that it could have been worse, and we should be thankful for small favors.

Nice post, MK.

– Madhu

I don’t disagree about the crash and whether Coolidge could have influenced that event. There is some evidence that he was worried about the stock market boom in 1928, before he left office. My point was whether the Depression was avoidable. Could the economy have recovered in 1932 ?

Bush could have reigned in Alan Greenspan and should have but the SEC sat there in 2005 and 2006 and watched the bubble expand. My concern now is that we are headed into another depression because of Obama’s policies and those of the left which now control the Democratic Party.

I don’t think Coolidge would have prevented the 1929 crash because he was worried about the stock market bubble but felt he did not have the power to intervene. What would have happened after the crash was my subject. Hoover did all the wrong things although you are correct that Coolidge was not opposed to tariffs.

Here is an interesting comment about the second graph in this post.

UPDATE: A reader comments:

I’ve seen the graph many times and I believe you are unintentionally supporting President Obama’s claim that he “inherited” a Great Recession. The graph is misleading because it is “Aligned At Maximum Job Losses.”

The original version of this graph, from the same source, used to have all recessions start at the far left of the graph. If you were to view that version, you would see that the current recession was quite average for the first year or so as the red line would be clumped in the middle of all the other lines. After a year, job losses stacked up and the red line dropped precipitously.

Depending on your partisanship, one could view the plunge aligning with either Obama’s election or the aftermath of the collapse of Lehman Brothers. I was president of a small division owned by a DOW Jones 30 company when Obama was elected and the next day we began major restructuring plans so I see it as the former.

I don’t recall seeing this chart in another format but it has been around for some time except for the small horizontal extension at the right suggesting that employment has stopped recovering.

The Republican Treasury secretary had a big role too.

That was Andrew Mellon. He believed that markets do what needs to be done during recessions. His advice ror downturns was “Liquidate, liquidate, liquidate.”

Look at what we’re NOT doing with our housing – we’re using freshly printed money to prop up housing prices and using big tax credits to induce marginal buyers.

Post 1929 crash, Milton Friedman argued that the Federal Reserve did the wrong thing – they radically deflated the money supply. That’s why all the banks crashed.

Today, Benancke is avoiding that trap but doing just the opposite with his “quantitative easings.”

BTW, Keynes’ “Consequences of the Peace” has an insightful opinion of Woodrow Wilson, that tells a lot about the domestic aftermath of his Administration:

“His thought and his temperament wore essentially theological not intellectual, with all the strength and the weakness of that manner of thought, feeling, and expression.”

OK, bomb throwing time. There is sentiment both currently and then that uncertainty played a substantial role. OK – the bomb. The Fed did it. Not their policies but its creation. The banking and financial sectors were suddenly handed a new rule book.

All of the accumulated wisdom and practices were thrown a haymaker. Extreme confusion and doubt.

Excuse me while I find my flak jacket.

The Fed certainly played a big role, partly because they were dealing with the German reparations issue and the consequences of the gold standard. Strong seems to have been able to deal with it in spite of his tuberculosis but when he died in October 1928, the Fed was leaderless. I think the similarities between 1929 and 2007 are striking.

MK: “Reading The Big Short is an interesting exercise. It suggests that the investment banks were bundling and selling mortgage backed securities that they did not understand what they were selling.”

Certainly many (most, all?) of the buyers (apparently) didn’t understand what they were buying.

So much for the experts.

Oh my. Let me throw you a clue:

http://www.zerohedge.com/

The 1920/21 period was still under influence of the exceptional demobilization of a wartime economy. Soldiers were returning into civilian life, civilian consumer products had to be re-introduced.

It’s an odd example and not very indicative for other cases.

It’s an odd example and not very indicative for other cases.

The degree of mobilization was far less than World War II yet the same thing did not happen in 1946. Wilson’s fascist policies had more to do with the 20/21 depression than demobilization. Even though the 1946 Congress was Democrat majority, it was far more conservative than the 2008 Congress under Reid and Pelosi. In 1922, Republicans were in the majority.