China is a massive force in the global economy. According to Bloomberg,

China is the world’s largest producer of steel. It accounted for 49.18 percent of worldwide crude steel production in May, according to the World Steel Association. Japan, the second-largest producer, accounted for 7.06 percent, the data showed.

And the USA? We are the third largest producer of raw steel, behind Japan, producing less than 15% of what China makes each year.

What does China do with all this steel? It produces a giant, modern nation with an enormous urban infrastructure. I recently bought this excellent book (a few years old, but it was $3.99 / used plus shipping) called “Shanghai: The Architecture of China’s Great Urban Center“. Shanghai has an immense number of skyscrapers – so many that there are debates about the exact count – but the list per Wikipedia shows that Shanghai held the title of world’s tallest skyscraper until beaten by Dubai and there are an immense number of very tall structures in the city, all built in the last 20-25 or so years.

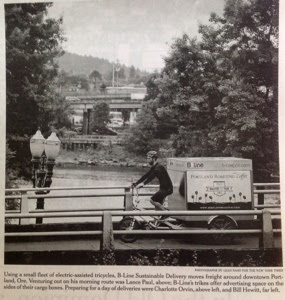

This article in today’s NY Times about a bicycle service that is thriving in Portland, Oregon due to its lower carbon footprint shows the “dream” view of capitalism held by those in the left in the USA.

However, while the bucolic bicyclist delivery driver making his rounds to fair-trade coffee shops seems like a worthy economic topic, it is in fact the opposite of efficiency when compared to the real-world efforts in China which dwarf our physical economy components. The US can compete in services and in software but we are getting blown away in the physical world which China’s steel production and immense cities sprouting from the ground show clearly.

The small-scale craft economies have an absolute place in the world, but there also is room for world-class efficiency which only can come from large-scale investments in steel, construction, and advanced building techniques, which also include time-to-market. The US is losing our ability to compete in these spheres while the Chinese continue to innovate – the evidence of which is all too visible for anyone traveling through their new cities when compared to their US counterparts.

Cross posted at LITGM

This is because we are at point in the IP & Services Economy, while China is out to play catchup by bootstrapping into an old style industrial economy. It has to do that in order to have any chance in the IPSE.

In the USA, there is little money to be directly made in manufacture. The only way the USA can/will do this is to go large. Just as the Ag economy, which, only 150 years ago employed 90% of all Americans, yet now employs 2-4%, so, too, will the manufacturing sector soon employ only 2-5% of the American population.

Apple iPhone: Designed in U.S., Assembled in China

Money Quote:

Turn over your iPhone and you’ll see that it’s “assembled in China.” But that doesn’t mean that most of the profits or revenue go there. In fact, only about $6.54 (a little more than than 1%) of the full $600 retail price of an iPhone goes to China and more than 60% goes directly to Apple and other American companies and then indirectly to American workers (see chart above)…

See also:

iPod Teardown: Who Really Makes It?

America is uniquely capable at this time to be, and to continue indefinitely as, the preemminent leader in the IPSE. The simple fact is that US/UK IP sells all over the world. It is popular all around the world, and there are no contenders for all-around attention and appreciation. Yes, there is Bollywood, which sells mainly to India’s non-too-shabby home market — but it fails to appeal worldwide. China’s Hong Kong “action cinema” is also effective internally, but, while its techniques are often used in US/UK films, its movies don’t sell outside China except to a limited, narrow segment of fans.

The US/UK’s IP, by contrast, is sold and pirated worldwide — why? I’d argue it’s because the USA is uniquely a melting pot of world cultures — we are a mongrel society, and we already HAVE elements of almost every other world culture of any prominence already in our societal “DNA”. As a result, if it sells here, it sells almost ANYWHERE.

And the predominance of English as a second language is hardly damaging to that, too.

China also has HUGE pollution problems, and a lot of that building is … “questionable” — there are, as I understand it, places in the cities like Shanghai where shoddy construction — crappy concrete mixtures and/or quick pours of improperly cured and “expandable” concrete slabs have led to massive cracks and particularly unsafe buildings.

The most notable I’m aware of is this (pictures only, unless you read Chinese):

Thirteen Story building falls over in Shanghai

This has smaller pix, some useful diagrams, and, most critically, *English* descriptions:

Hoax-slayer confirms.

That event is a centerpiece in this story:

The Cracks in China’s Shiny Buildings

Money quote:

All of this is at odds with the image overseas of China winning the “infrastructure race,” as the headline of an Aug. 24 online story from Foreign Policy put it. China’s structural woes stem in part from the government’s focus on quantity of growth over quality.

In general –

the fact that China has a vastly larger infrastructure capability than the US is a fact, shown not only in use of steel but in myriad other metrics.

The US and Germany and Europe (I had a recent post on this) have also had many, many failures in our recent infrastructure efforts that we should consider before we point at the Chinese. Since the Chinese are doing many more projects than we are, the known failures need to be matched against the much larger scale of their efforts.

The US and Europe simply are not competitive on infrastructure in terms of cost or innovation compared to the Chinese. Every day they refine techniques and scale and blow us away in terms of time to market. The fact that they do this every day on a large scale while our manufacturing whithers away only makes the gap larger.

It is interesting that the US is in a different stage of our “development”. The answer is that the US either does not have the will or the capability to truly advance our infrastructure – the Chinese would simply rebuild Detroit and other cities as a way to spur demand while we make payments to individuals instead.

Go to Hong Kong or Shanghai then look at our infrastructure and ask how long it would have taken us to build it – and the first answer is “an infinity” because getting building permits and working through lawyers etc… would make it impossible in the first place – but even with that we don’t have the industry or staff or capabilities to pull it off anyways.

}}} The fact that they do this every day on a large scale while our manufacturing withers away only makes the gap larger.

This has at its heart the complete presupposition that we should somehow be making an effort to prevent that.

In actual fact, the USA’s manufacturing economy — if it were a nation unto itself, is tied with Germany’s ENTIRE economy as the third largest in the world.

THAT’s REVENUES, which in most ways is what counts. Most of the stuff that went away to China in the early 00s is now coming back, the process called “reshoring”, as China’s formerly attractive low wages rises to the point where it does justify bringing it back home — to newly built fully robotic factories which have far fewer people than the old ones.

THIS is the typical factory of the future.

Also remember the 3D printing revolution which is going to shift that entire dynamic in directions we cannot yet begin to imagine with any reliability.

And WHO is going to be at the forefront of that cottage industry?

Ahhh, right. Americans. Because they’re playing with these things and applying American ingenuity and free-thinking, free-wheeling, independent minds and a comparatively free market economy to the task, something no other nation on Earth can come close to.

}}} even with that we don’t have the industry or staff or capabilities to pull it off anyways.

Dude, America certainly has issues with lawyers and regulations that need to be tackled, no argument. But the real fact is, if push came to shove, all that stuff would get tossed out the window anyway. We put up with it because we CAN.

As far as having the industry or the staff to pull it off, “LMAO” — America does what it does when it needs it, not a bit sooner. Go back and look at the USA’s military production in 1940, then look what it was by even 1943 or 1944. If we can succeed in taking back the education of our kids from the current establishment that is out to turn out good little sheep and not US Citizens, then we could duplicate everything China has achieved in two decades in less than five years. If we wanted to, which I seriously doubt would EVER take place.

As someone who has written about energy policy many, many times over the last few years at this site can attest, US regulations make it impossible to build a modern nuclear plant, and other regulatory factors make it impossible to build an adequate transmission network.

Even the current administration thought it could make progress in these areas back in 2008 when I openly mocked them for their lack of understanding of the barriers in this area. Of course they failed.

We lack the fiscal, legal, and physical infrastructure in terms of laws, capacity, and human capital to rebuild even what we have much les grow our electrical energy capacity. Thanks to natural gas, done by areas in a favorable regulatory framework (note the late group of laws banning “fracking”), we are going to be able to get by, but this is a regulatory accident in an area that the government failed to capture.

The battle isn’t the US. It is the world. The world where Chinese farmers and firms are spreading out to build capabilities for the long term.

The idea that our current broken governance team will get together and “fix” this is not supported by evidence. Come to Illinois and watch it not work from the ground floor…

See also the China-Israel rail project and similar projects around the world.

The adverserial regulatory structure we currently have is unsustainable and is now on the verge of collapsing. It has been used by the Luddite Left for the last 30 years to stop any large industrial/energy project or at least delay and make it prohibitively expensive.

IMHO, the besy energy policy the federal government can pursue is to NOT have one. Simply dismantle the oversized regulatory apparatus (EPA/OSHA/IRS/ad naseum) and get out of the way.

There are a lot of positive factors for manufacturing in the US at this moment, including the benefits of cheap natural gas via fracking and the increasing recognition among managements (and even consultants & academics) that too often the labor-cost-based cases that were made for offshoring failed to properly consider the inventory and other cycle-time-related costs of long transportation links.

Also, I think the cultural hostility (see my post Faux Manufacturing Nostalgia) is to some extent dissipating, and indeed we are even seeing a certain amount of glamorization of making things.

For a stateside view of the Chinese demand for steel and infrastructure, and how it relates to North American demand, one only need to look at Eureka Nevada., home of Mount Hope, one of the world’s largest Molybdenum deposits. Molybdenum or “moly” is an element critical for high-grade less corrosive steel used in high rises, bridges and piping for nuclear energy plants. Mount Hope is 80% owned by Lakewood, Colorado based General Moly (NYSE:GMO).

It’s a developmental stage mine, just now being built, that once completed is expected to yield 40 million pounds of moly annually that currently sells for $11lb in the spot market.

Now here’s the rub, it is going to take about $800m in financing to complete the construction of this mine. An earlier $665m term loan with China Development Bank fell through. With only $57m cash on its books General Moly management is scrambling to find financing.

Publicly, management is not even pretending to look for non-Chinese customers to purchase the moly to be mined or non-Chinese banks to finance the Mount Hope mine’s construction.

“”¦.as we move forward to secure another Chinese strategic partner capable of advancing the full financing of the Mt. Hope Project and reinvigorating advanced stage loan negotiations with China Development Bank,” said [CEO Bruce] Hansen

http://tinyurl.com/menu797

The fact that these mining jobs would be located in the United States appears of little interest to American bankers and policy makers. Both of whom apparently feel we have no need for the moly here in the States. Perhaps we do not. But why? Are our manufacturing and energy industries so superbly built out and maintained already?

General Molly stock quote http://finance.yahoo.com/q?s=GMO

**Note, although I may sound like a disgruntled stockholder I am not. GMO was on my watch list since December. As the financing collapsed, predictably, so too did the company’s market value from $365m to its current $166m. Thank heavens I didn’t place a bid.

Japan’s investments in infrastructure during the boom years in the 80s were similarly intimidating to China’s investments today. The collapse of the Japan Inc. was foreseeable in principle but nobody really knew the timing because the details were hidden. The same process is going on in China right now. Hidden details, hidden losses, ridiculous decisions being made that extend the cycle but do not provide true value, the Chinese economy is incredibly fragile. It is also headed straight for a demographic wall.

Now the part that is so frustrating for analysts is that literally nobody knows what is going on, not even the people running China today. There are multiple books being kept for every business of consequence in China. Which are providing net real value and which are political patronage machines and which are exercises in socializing risk and privatizing profit are simply not known.

TM Lutas wrote: “Now the part that is so frustrating for analysts is that literally nobody knows what is going on, not even the people running China today.” – that says it.

“Democratic oversight is something that a lot of people devote about an hour a week to do. Can you get the job done in that little time? With Citizen Intelligence, you will.” – from your Citizen Intelligence” site. Interesting. citizenintelligence.org

Yes, the bike deliverer in this case is laughable, but how much of the Chinese infrastructure build is as well? It seems like they excel at building both where the need is as well as where it doesn’t make sense. How many Potemkin villages (for lack of a better term, but one that describes it fairly well) are the Chinese building? Their centrally planned build blueprint misses as many (or more) of its hits from my limited dealing with some of our Chinese subsidiaries.