Today, the trial begins to determine if Detroit can enter chapter 9 bankruptcy. I have been trying to read a lot about what this means for the muni bond markets. As of right now, not much. But in the future, possibly a lot.

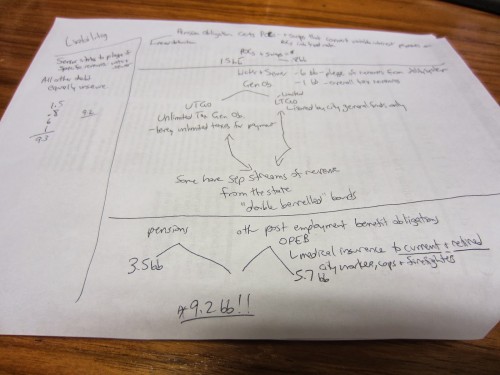

Here is a great piece on the subject and one that I will refer to through this post. It is written by the Chicago Fed, and explains what is going on, and how the Emergency Manager, Kevyn Orr, is going about trying to right the ship. The document is short, but somewhat dense. I had to read it three times and making some notes helped me understand it better.

After making this diagram, I joked to myself that this is probably a better flow chart understanding of the City of Detroit’s debt than any sort of financial documents the city of Detroit had prior to the EM taking over. But I digress.

After the issue of letting Detroit go Chapter 9 is resolved (I guess I don’t really see any other option) there are several interesting issues that may affect the muni bond market moving forward.

The debt looks like this, in simplified form:

Water and sewer debt – $6bb

General Obligation debt (limited tax backed and unlimited tax backed) – $1bb

Pension Obligation Certificates and associated swaps – $2.3bb

Pensions – $3.5bb

Other Post Employment Benefit Obligations – $5.7bb

First, Orr has decided that the only things that he will be treating as secured debt will be the water and sewer system bonds (backed by a pledge of revenues from the utility system) and the “double barreled” UTGO (unlimited tax general obligation) and LTGO (limited tax general obligation) bonds. Double barreled means that these certain bonds have separate income streams derived from the State of Michigan. This is significant because no General Obligation bond in the muni universe in any Chapter 9 filing has ever been impaired (with the exception of the disastrous Jefferson County, Alabama filing in 2011). Basically, Orr is offering ten cents on the dollar to EVERYONE that is not secured. This includes pensions, OPEB (other post employment benefit) plans, pension obligation certificates, swaps, and all the rest. In the middle of this, the fact that Orr treated the UTGO debt (which can be funded by unlimited property tax levies) just like all of the other debt is a first. This will also be settled in court, and will affect the perception of a lot of other cities’ GO debt as relates to the backing by property tax levies.

The next Big Deal to the muni bond universe is that there is a conflict between state and federal law as to if Orr can pound down the pensions and OPEBs. Law in the State of Michigan says he can’t but federal law has no issue with it. There is no law on record that addresses this and I am sure it will be a bitter battle to the end. If there is some sort of sweeping Tenth Amendment ruling that says that you can’t touch the pensions, this will affect the debt of a LOT of large cities that have similar state laws in place, such as Chicago, LA and others that have giant unfunded pension obligations. But to me, winning this in court is one thing for the pensions, actually getting the money out of the city of Detroit, that has none, is quite another. I am sure that they would at that time try to get preferred secure status over the utility bonds, but I don’t think that will really happen.

So far, the markets have just shrugged their shoulders at this whole affair, with the small exception of punishing the bonds slightly from places in the State of Michigan. I am sure that as this disaster winds its way through the courts, that this may change. Being an investor in the muni market, I will be keeping a close eye on how this plays out, as well as the soon to be crisis in Puerto Rico.

Cross posted at LITGM.

Regarding pensions and OPEBS, as the State of Michigan says they can’t be crammed down, I would expect the pensioners to look to the State of Michigan if they lose in BK court, which seems likely and desirable to them. Better Lansing’s deep pockets than Detroit’s holy ones. Then Michigan will have the hot potato.

Mrs. Davis – that will be a battle royale in the courts as to if the pensions and OPEBS can get crammed down or not. It will affect a LOT of municipalities ability to borrow at reasonable rates of they don’t take some sort of haircut.

Mrs. Davis: It think Detroit’s pockets are not sacred, but that they do have holes in them, i.e. they are holey not holy:-)

Dan, no doubt. It will also have a significant impact on the productivity of government. When I raised the possibility of his pension being at risk to a lawyer employed by my state he became absolutely rabid in his protestations that it was a sacred obligation to him by the state and its citizens, etc. Those folks think they live in a world without personal risk. Being confronted with reality will be a jarring experience.

Glad you got a chuckle, Robert. It was holy intended.

What happens if the case is decided in favor of the pension beneficiaries ? If Detroit has no money, then what ? There is a history in California of cities disincorporating .

In 2011, the state enacted Assembly Bill (AB) 506, which provides for a mediation process among localities and their stakeholders prior to bankruptcy.

Rather than preventing default and bankruptcy, AB 506 may have accelerated their occurrence. While state intervention is not factored into ratings unless the program is invoked and proven effective, Fitch believes credit deterioration can be forestalled for an entity in a state with an effective intervention program.

That law, in fact, was passed by the Democrat dominated legislature at the urging of their public union allies to try to impede BK. What has resulted, and may grow, is the dissolution of cities.

Seventeen cities have disincorporated in California’s history, including the cities of Long Beach, Pismo Beach, and Stanton, each of which later reincorporated. However, since the creation of LAFCOs [local agency formation commissions] in 1963, only two cities have disincorporated – Cabazon in 1972 and Hornitos in 1973. Of these, only Cabazon’s disincorporation went through the process prescribed by the Act; Hornitos was disincorporated by [legislative] statute.

Here is a paper on disincorporation. (pdf)

This may get very ugly.

“Case in Detroit Highlights Costs of ‘Extra’ Pension Payments” By MARY WILLIAMS WALSH

http://dealbook.nytimes.com/2013/10/22/case-in-detroit-highlights-costs-of-a-common-pension-practice/

[Detroit]’s pension system made extra payments for decades to thousands of people … The pension board thought it found the money for the extra payments by skimming off “the excess” when returns on investments exceeded the plan’s target ”” 7.9 percent in Detroit. But the pension fund also had years when its investments fell short of the target. And with millions of dollars being paid out each year in the extras, the fund missed out on all the investment income that money would have brought in. So the extra payments fundamentally undercut the health of the pension plan.

* * *

Earlier this month, a state labor judge ruled that Detroit illegally interfered with its pension system two years ago, when it stopped the extra payments in a last-ditch effort to save money and avoid bankruptcy. … “The city’s conduct was unlawful and constitutes a refusal to bargain in good faith,” wrote Doyle O’Connor, a state administrative law judge. Unions are likely to cite his finding in bankruptcy court this week to bolster their arguments that Detroit should not even be in federal bankruptcy court. Bankruptcy law requires that Detroit show that it bargained in good faith with its creditors, to no avail, before seeking relief in federal bankruptcy court.

Judge O’Connor said he was not ruling on the wisdom of the add-ons, only on whether the City Council could unilaterally stop them. He ordered that the add-ons for 2011 and 2012 be paid retroactively. But, given Detroit’s bankruptcy, he likened his order to a ticket refund for passengers on the deck of the Titanic.

* * *

Cities and states around the country are watching Detroit’s case closely. Many of them are struggling with pension plans that are overwhelming their finances, and a surprising number also make the extra payments. Detroit’s pension trustees distributed the extra payments not only to retirees and active workers, but also effectively gave some to the city in the form of reduced annual pension contributions.

* * *

But a study in 2011 by an outside actuary showed that the extra payouts were actually costing Detroit billions of dollars, although it was hard to see because the city’s disclosures were sketchy. Actuaries model pension costs over the long term, and when trustees find “excess” money year by year and spend it, they defeat the fundamental premise of the plan ”” that investment gains, not local taxpayers, will pay most of the cost.

* * *

In San Diego, officials also decided that the “excess earnings” of the pension fund allowed the city to reduce its required annual contributions. In fact, that worsened the damage because after making all the extra payments, the pension fund needed more money from the city, not less.

The San Diego pension fund seemed to doing fine for a while, but under the surface it grew shakier and shakier, and finally broke down after the technology stock crash in 2001. The resulting scandal led to a shake-up of the city government, indictments, civil lawsuits and a federal charge of securities fraud ”” the first against an American city for pension malfeasance.

* * *

Mike: Discorporation has a long tradition in California:

“Absolutely Free” by Frank Zappa

The first word in this song is discorporate.

It means: to leave your body

Discorporate & come with me

Shifting; drifting

Cloudless; starless

Velvet valleys & a sapphire sea:

Unbind your mind

There is no time

To lick your stamps

And paste them in

Discorporate

And we will begin