A lot of people arguing against my thesis that the government-sponsored enterprises (GSEs) lie at the heart of the residential mortgage problem ask the obvious question: If the GSEs cause problems, why are we only seeing a problem now? Why didn’t we see problems a long time ago?

Try this analogy on for size: It has been snowing on the mountain for years, yet we’ve never had an avalanche. It must be caused by something else. Carl’s yodeling must have angered the mountain spirits.

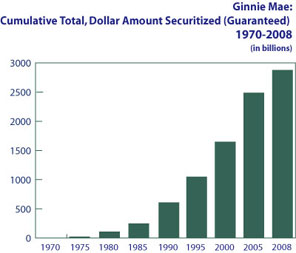

Look at this graph from Ginnie Mae itself of the buildup of the value of mortgages guaranteed by Ginnie Mae. (Ginnie Mae is a behind-the-scenes GSE that is explicitly backed by the full faith and credit of the U.S. government.)

See the avalanche building?

I can’t find the graph of the similar growth of Freddie Mac, Fanny Mae and the Federal Home Lone Banks (Flubs) but they were linked to the growth of Ginnie Mac as Ginnie Mac secured most of the mortgages the GSEs bought up. Obviously, given their huge size, they too started out small and grew gargantuan over a period of decades until their combined debt exceeded that of the federal government.

Had the GSEs failed anytime prior to the mid-’90s they wouldn’t have caused much damage, due to their small size relative to the entire market. Institutions could legally hold their debt instruments, securities and stock as legal collateral just as they could have legally held T-bills. Yet in the first two decades of their existence, few private institutions held enough GSE debt to cause major problems if the GSEs tanked.

By 2000, however, the gradual accumulation of GSE debt in private hands began to reach dangerous levels. By 2008, it was very serious. Worse, the market viewed that debt as being as safe as T-bills. This induced private entities to take greater risk with private investments. Most notably, it induced credit-default-swap issuers to use GSE securities and bonds as major parts of one side of the swap in a lot of swaps.

So, when the GSEs tanked in 2008, they took a lot private parties down with them. People didn’t have to play fast and loose with novel finances, they just had to trust the integrity of the GSEs. Institutions like arch-leftist Maxine Waters’ pet bank became insolvent merely because they had bought GSE stock to use as collateral. Many banks sold mortgages to the GSE and then bought GSE securities back as a means of insuring against a local real estate bust.

Even if we had imposed the regulation that Democrats now claim they wanted back circa 2000, the growing size of the GSEs would have eventually led to problems. How long could the economy have tolerated treating a debt backed by residential real estate as presenting the same risk as T-bills? If the debt of the GSEs had grown twice as large a the federal debt, even a relatively minor nationwide real-estate bust would have had cataclysmic consequences. All the institutions that bought GSE debt to use as collateral would turn insolvent overnight. This would cut off lending, which would have driven the real estate market down more, creating a positive feedback loop. We would be seeing the same problem we see today but on a larger scale.

When we started distorting the market, we began to build an avalanche of lies about the risk of residential mortgage lending. Like villagers in the Alps living under a growing snow mass on the mountains above, we were going to have an avalanche at some point.

[Update: I would also add that the GSE issued debt based on 15-30-year residential mortgages. Such debt instruments have to hang around for a long time before their benefits and risk become apparent. By the late ’90s, GSEs had been around for 20 years, so people began to trust them at greater and greater levels. Worse, they made the whole MBS concept seem safe so more and more private entities started issuing them.]

hey shannon:

securitization of loans was not around in the 70’s and 80’s so I’m not sure the labels on that graph are correct(?)

also here’s alan white:

“The fact is that subprime lending caused the crisis, and subprime loans were, by definition, loans that Fannie and Freddie (the GSEs) would NOT purchase. Let’s say that again. A subprime loan was a loan that was not eligible for purchase by the GSEs, also known as a “nonconforming” loan. A mortgage was ineligible for GSE purchase for one of two reasons: either the amount exceeded the GSE ceiling of about $350,000, or the underwriting was too lax to meet GSE standards. Subprime loans were sold to investors through so-called private label securitizations, which means a securitization that was NOT sponsored by Fannie or Freddie. So, for example, Aurora Loan Services, an unregulated nondepository lender, made no-doc loans interest-only loans and sold them to investors through a Lehman Brothers securitization. The subprime lending and securitization machine was pumping out toxic mortgages for years before Freddie, and to a lesser extent Fannie, started purchasing the subprime securities to boost their profits. At worse, the GSEs, along with every bank, insurance company and institutional investor in the world, acted as enablers for the subprime lending boom to continue, and were victims, not catalysts of the crisis.”

The GSE’s only started to purchase the subprimes under political pressure from lenders e.g. Countrywide is the most obvious example (they actually threatened Fannie, saying they would route their business to the newly enabled banks) – and this happened in 2005. Much of the bad subprime debt had already built up at that point – with NO involvement from the GSE’s at all.

So while the GSEs made things worse, I can’t understand the claim that they were somehow *responsible*. They may have guaranteed a lot of loans but they guaranteed *good* loans that met their underwriting standards, not subprime loans that caused the crisis. Yes, they exacerbated the problem when they caved and lowered their standards, but how can you accuse them of causing the crisis when they mostly refused to touch the stuff while the market for it was exploding?

SeanF,

The mission of the GSEs was to induce the issuing of loans that the free-market judge to risky. They did this by buying up the riskiest loans. Otherwise, they had no point in existing. So common sense dictates that the GSEs main business lay in buying up loans from the bottom of the pile. Otherwise, they could not have accomplished their design goals.

(I would note that due to the decades long effect of the GSEs, the definition of subprime shifted quite a bit from the early seventies to the present. Many prime loans made in 2000 would have been considered subprime in 1980. This was another distortion. Lenders grew progressively used to taking bigger and bigger risk because they could resell the mortgages. Again, this was an intention of the design.)

More importantly, your assertion that the GSE got involved in the subprime market late in the game is simply not true. From the Washington Post

The article details how this process accelerated although out the net 14 years to 2008. Trying to blame relatively small actors such a CountryWide for the GSEs going off the rails misses the point. The GSE were supposed to be charted to serve the public interest, not personal profit. If the evil mortgage brokers threatened to take their risky business elsewhere then so what? The GSE should have said, “Well, go ahead, profit isn’t the point of government. We’ll keep investing conservatively. Besides, your just a pissant compared to us. Go see who’s stupid enough to buy your trash mortgages when we won’t touch them.”

That they continued to increase their subprime borrowing doesn’t make them hapless victims of the free-market, it makes them greedy bastards who chose to play fast and loose with taxpayers money for their own profit. The best thing you can say about the GSEs was that they were exactly as bad as the worst of the free-market

I can’t understand the claim that they were somehow *responsible*

Well, if you could stop acting like the global financial system sprang fully formed form Bush’s forehead in 2001 and start looking at the evolution of the entire system over the past 40 years, you would see that my argument is rather simple. The political imposition of the GSEs on the markets slowly but progressively drove the markets away from their natural states. Over 40 years lenders made progressively riskier and riskier loans and the very accepted definition of “risky” change. Over 40 years, financial institutions of all kinds bought GSE instruments in greater and greater numbers to use for collateral. Over 40 years, the GSE grew form tiny institutions to colossuses that own half the market and whose actions dictated the market. Over 40 years, they acquired so much debt that the failure of the GSE alone could destroy the financial system.

If we had never had the GSE the residential market would look more like the essentially free-market commercial market. No GSEs buy up commercial real estate loans and issue securities backed by them. A few private entities do issue commercial MSB but, even though commercial mortgages are safer than residential, MSBs play a much smaller role in the commercial market. Why don’t people flock to commercial MSBs? Oh, right, half of them don’t have government guarantees. Why didn’t investors throw money at commercial real estate? Oh right, to risky.

If your model is correct we should have seen run away lending in the unregulated commercial markets every decade or so. Instead, we see a much less violative market than the residential market which has a great deal of political interference. My argument was that we should never had tried to trick the market in the first place. Had we not done so, then nothing else we did would have mattered.

I understand that you have problems with my argument because from the leftist simply don’t think of economics in terms of the flow of information and incentives to take or not take action. For leftist, economics in moral theater. Bad things happens because bad people made them happen. You continually argue that we failed because good people lost a political struggle with the bad people.

My arguments are grounded in the systems approach which assumes that everyone is selfish and will act foolishly unless prevented from doing so by immediate feedback. The GSE severed that feedback and the consequences unfolded naturally as a result.

“The fact is that subprime lending caused the crisis…

This kind of statement is never right. As long as the risks are known there is no problem investing in “subprime” loans or any other kind of asset. Problems occur when risks are hidden and incentives distorted. In this case, government involvement in the residential-loan market, via the CRA and GSEs, hid risks and subsidized inappropriate risk-taking by market participants. Now that the system has blown up it is important to understand that it was precisely the involvement of government that made the problem into something more than a short-lived market disruption.

shannon,

i have problems with your argument because (1) your facts are wrong and (2) the argument is not credible.

First, the facts.

>>The mission of the GSEs was to induce the issuing of loans that the free-market judge to risky. They did this by buying up the riskiest loans. Otherwise, they had no point in existing. So common sense dictates that the GSEs main business lay in buying up loans from the bottom of the pile.

This is wrong. Just plain wrong. As your own Washingtonpost.com article clearly states.

“For Wall Street, high profits could be made from securities backed by subprime loans. Fannie and Freddie targeted the least-risky loans.”

>>More importantly, your assertion that the GSE got involved in the subprime market late in the game is simply not true.

Your article states that the the GSE’s buying accelerated 10-fold between 2000 and 2004. And then Bush raised the targets even further from 50 to 56% in 2005. how is that not late? and how is not that Bush forcing the GSE’s to make the same bad decision that private investors were making, *against* their better judgment – repeatedly?

“In 2000, as HUD revisited its affordable-housing goals, the housing market had shifted. With escalating home prices, subprime loans were more popular. Consumer advocates warned that lenders were trapping borrowers with low “teaser” interest rates and ignoring borrowers’ qualifications. HUD restricted Freddie and Fannie, saying it would not credit them for loans they purchased that had abusively high costs or that were granted without regard to the borrower’s ability to repay. Freddie and Fannie adopted policies not to buy some high-cost loans. ”

“But by 2004, when HUD next revised the goals, Freddie and Fannie’s purchases of subprime-backed securities had risen tenfold. Foreclosure rates also were rising. That year, President Bush’s HUD ratcheted up the main affordable-housing goal over the next four years, from 50 percent to 56 percent. John C. Weicher, then an assistant HUD secretary, said the institutions lagged behind even the private market and “must do more.” For Wall Street, high profits could be made from securities backed by subprime loans. Fannie and Freddie targeted the least-risky loans. Still, their purchases provided more cash for a larger subprime market. That was a huge, huge mistake,” said Patricia McCoy, who teaches securities law at the University of Connecticut. “Thatjust pumped more capital into a very unregulated market that has turned out to be a disaster.”

Next, the argument itself.

You’re saying that GSE’s altered everyone’s definition of risk – although they were not buying risky securities while the mountain of debt was being built during the late 1990s and early years of this century – and that somehow led to the crisis.

But that doesn’t compute. Even if the GSE’s had not changed the policies and bought a single sub-prime mortgage we would still have had this disaster. The market was already there. The newly deregulated banks and Wall St was making billions off these loans. The banks and investors were still there.

The fact that most people see this may be the reason why noone, other than libertarians, is blaming the GSE’s as causing the crisis. They made it worse by lining up like the rooked investors to buy the bad assets. But they didn’t initiate the risky loans. they didn’t cause the assets to be mispriced in the first place. they didn’t sell CDOs like AIG. they didn’t deregulate the banks so the banks could legally do what they did. they didn’t preempt state laws that tried to regulate predatory lenders.

Let me put it like this. If we were arguing about creationism, it’s possible that God created the fossil record and that carbon dating is somehow all wrong. It’s possible. It’s a judgment.

It’s just not likely. And when a biblical literalist believes in that when no one else does, one has to ask – how much of that judgment is coming from the biblical literalism?

When government imposes a price ceiling on a good or service, the market isn’t disrupted until the price hits the ceiling, and then all hell breaks loose. Similarly, securing mortgages with Fannie and Freddie wasn’t really that big a deal as long as the banks themselves continued vetting all would-be borrowers under industry standard criteria. But this wasn’t producing the results that fair housing advocates were after, so in 1996 the CRA was reformed, and the government started pushing banks to lower standards. This is where the bubble started. In graphs comparing housing prices to the consumer price index you can even see how after tracking the CPI for several decades, but in 1996 housing prices break away, eclipsing inflation. It wasn’t long before mortgage lenders realized they were in a “heads we win, tails the government loses” situation.

Peter,

From http://en.wikipedia.org/wiki/Community_Reinvestment_Act#Relation_to_2008_financial_crisis (with footnotes)

The only people who find the CRA responsible are Austrian school economists and Ron Paul. They cite no studies.

For the rest of us here is some data:

— A federal reserve study has found that institutions fully regulated by CRA made “perhaps one in four” sub-prime loans, and that “the worst and most widespread abuses occurred in the institutions with the least federal oversight”.

— According to Janet L. Yellen, President of the Federal Reserve Bank of San Francisco, independent mortgage companies made risky “high-priced loans” at more than twice the rate of the banks and thrifts; most CRA loans were responsibly made, and were not the higher-priced loans that have contributed to the current crisis.

— A 2008 study by Traiger & Hinckley LLP, a law firm that counsels financial institutions on CRA compliance, found that CRA regulated institutions were less likely to make subprime loans, and when they did the interest rates were lower. CRA banks were also half as likely to resell the loans.

— San Francisco Federal Reserve Bank Governor Randall Kroszner has stated that the claim that “the law pushed banking institutions to undertake high-risk mortgage lending” was contrary to their experience, and that no empirical evidence had been presented to support the claim.[56] In a Bank for International Settlements (BIS) working paper, economist Luci Ellis concluded that “there is no evidence that the Community Reinvestment Act was responsible for encouraging the subprime lending boom and subsequent housing bust,” relying partly on evidence that the housing bust has been a largely exurban event

Who’s more likely to correct? The ones with opinions? Or the ones with data?

SeanF,

I see part of your problem. You think that “risky loans” means subprime. It doesn’t. Subprime loans are just a subset of risky loans. The “subprime” in subprime loans refers solely to the credit score of the person seeking the loan. There are a lot of other factors that make loans risky. For example, if I have a perfect “prime” credit rating but I want to buy a house in an area with seriously declining property values, say Detriot, then that is a high risk loan. I might pay the loan off but the declining values make the consequence of a default much worse. Hence the loan becomes more risky. Banks with small capitalization were less willing to make loan that were large relative to the banks size.The GSEs were designed to induce more lending by removing ALL the risk of lending, not just those associated with borrows with poor credit scores. Make a loan and the GSE would buy it.

If you don’t accept this idea, you need to explain what the purpose of the GSE was. Why did we bother creating these monstrous organizations?

Your article states that the the GSE’s buying accelerated 10-fold between 2000 and 2004. And then Bush raised the targets even further from 50 to 56% in 2005. how is that not late?

Because, its early in the subprime surge. Subprime lending started slowly in the mid-90’s as lenders gradually lowered standards without trouble then it peeked in 2006. You left something out in your quote:

I call buying 44% of Wallstreet’s subprime based securities having a major impact. Clearly the GSE played a key role in accelerating the subprime market. What was happening in a lot of circumstances was that the GSE bought subprime securities and then the issuers of those securities bought the T-bill safe GSE securities back. This was basically a mechanism to foister risk off on the government. Had the GSEs not existed this would not have been done and fewer subprime loans would have been made. This is in addition to the subprime loans the GSE bought directly.

I notice you engage in poor conformational bias. You never answer any of my questions about facts that break your pattern such as the lack of excess in the commercial real estate market. You never explain why we needed the GSE in the first place. You never explain why, if they were such a good idea, they failed. You never explain why institutions that bought GSE debt instruments collapsed.

It’s trivial to find information that confirms a hypothesis. You need to look for the factors that break the hypothesis. I have presented at this point a good dozen all of which you ignore in favor of your confirmation bias.

Well then come out and say it Sean: the government should continue to compel banks to loan to people with poor credit.

Googling “did the cra cause the financial crisis” produces over 14 million hits, but even though there’s plenty of denialism out there, I can’t find a link citing any economist making such a statement. Perhaps you can.

Only seeing the problem now? Try searching the Wall Street Journal editorials for at least the past 8 years. They were all over this early and often. Further, while it is unpopular to ascribe anything positive to the Bush admin, they did try to reform Fannie and Freddie several years ago. The fact is we are not just seeing the problem now, we are only experiencing the consequence of ignoring it.

Critical difference, I’d say.

There is nothing inherently unsound about making loans to borrowers with poor credit histories. The lender merely raises the interest rate to compensate for the additional risk. That’s one of the reasons why there hasn’t been, for example, a credit-card crisis.

However, the CRA and various regulations make it impossible for mortgage lenders to do this, by defining rational lender behavior as illegal “redlining” or “discrimination.” Indeed the entire purpose of the CRA and regulations was to force banks to take on more risk by lending to low-income voters. It was a way for pols with low-income constituencies, mainly Democrats, to buy votes at the banks’ expense. The potential costs of what the pols were doing were easy to overlook as long as housing prices were rising. The risks were always there but only became obvious when real-estate prices declined and high-risk borrowers began defaulting at high-risk rates.

The problem was compounded by the GSEs, which held enormous portfolios of securitized mortgages. The GSEs paid off pols via cash campaign contributions, and by providing lucrative sinecures for Party hacks like Jamie Gorelick and Franklin Raines. The pols in turn averted their regulatory eyes, which allowed the GSEs to overvalue their portfolios (and consequently pay their executives outlandish salaries based on bogus performance). All of the incentives encouraged irresponsible behavior by the GSEs that distorted the entire market. Shannon is correct that the debacle would not have happened but for the existence of the GSEs.

All of this was foreseeable and widely foreseen. The WSJ ran editorials around 2003, pointing out that Fannie Mae management was corruptly underestimating its portfolio risk, and that the organization’s mismanagement posed a significant threat to the nation’s economy. This was around the time when the Bush administration tried unsuccessfully to get Congress to provide real oversight of Fannie Mae operations.

Pursuit beat me to it.

FWIW – Here is a 2006 report, pleading for regulation of the GSE’s that have the growth graphs that you were not able to find related to Fannie and Fredie…

http://www.ofheo.gov/media/pdf/gsereform71906.pdf

Steveend,

Thanks, I’ll check it out.

It’s been a wonder for me, an economic illiterate, to witness this titanic struggle conducted across numerous postings between SeanF and Shannon. Thanks to both of you, and special kudos to Sean for taking hits from most of the commenters here but still coming back in good humour with ostensibly plausible ripostes.

My own judgment on these things can’t be shaped by either economic theory or data – neither of which I have – but merely my own experiences of life, which have led me to the realization that the “planning” side of us humans has a tendency to kill the side that pays the bills and raises the family. In my lawyering world this takes the form of a tendency to draft documents which inevitably outrun any possible ability to execute the details called for in those instruments. The drafting presumes that the creative energies that went into the construction of the document will be applied on a daily basis to execution of the details. This never happens. But since the limited number of parties responsible for the document are the same ones (or related ones) who experience its consequences, they have the nimbleness to bob and weave, adapt or jettison the pie-in-the-sky monstrosity their lawyers dreamed up for them. Things are self-correcting in this small-scale world.

The regulatory world suffers from all the same planning-motivated maladies of fertile brains that we see in the private sector (enhanced by a dangerous tendency to utopian dreaming) without the capacity of the affected parties to mitigate unworkable consequences. The problem is not only in the largeness of government but the disconnect between the stuff it’s given to do by the dreamers who created the regs and the effects of those regs in practice. Really smart people like Sean really do believe that the regulations they dream up to save our world can actually be executed with precision by ordinary untalented people who work 9 to 5 and don’t much care about results or have any reason or ability to correct bad effects.

The mind of a dreamer is a dangerous thing when it leaps from poetry to practice. Shakespeare dreamed. Immanuel Kant dreamed. Their words ended up in the proper spheres – poetry and philosophy. The crafters of regulations for the modern state aren’t exactly dreamers in that class, but they do dream – and their dream is the dangerous one of a society tailored to their specifications. Plato had a go at that once. It didn’t work out for him. I don’t reckon it will work out any better for our latter-day utopians, honourable and smart as they may be. As I often say to my socialist friends, “Ah, if only you were the one administering the world you dream of.”

Sean,

You used quotes from the Washington Post article to counter Shannon’s argument yet the last paragraph you quoted only serves to confirm it.

mishu,

Actually, no. If you read Shannon’s post and my reply above, we both agree that that GSE’s contributed to the crisis when they caved and started buying the bad loans from the lenders. That’s clearly documented fact. The GSE buying between 2003-2005 made things worse.

Our entire argument was about whether GSE’s *caused* the mispricing and the market failure.

KJ: thank you for your kind words. I appreciate your point. My perspective is that utopias are dangerous – specifically, the unregulated free-market utopia favored by libertarian dogma. It’s never been successfully implemented in any human society. Whenever it’s been tried, it’s lead to problems.

The defenders of this free-market utopia claim that the problems have arisen because the attempts were not conservative or free-market *enough*. That reminds me of Koestler’s Darkness at Noon attack on communism.

Yes, it might be perfect in theory – at least if you’re communist – but if the elimination of a market economy in favor of communism leads to problems whenever human beings try to practice it, that may be a sign that communism may not be a good idea.

Regulations always have costs. Too much might be a terrible idea. But history has always shown that some regulation is preferable over anarchy. If human beings were always honest and never responded to bad incentives (e.g. hiding information to make a profit), unregulated free-markets might work. But in the real world, human nature always wins out.

seanF,

If you read Shannon’s post and my reply above, we both agree that that GSE’s contributed to the crisis when they caved and started buying the bad loans from the lenders

(1) That’s what they intended to do. They wouldn’t have served to increase lending if they didn’t allow lenders to off load the risk of lending onto them. Even if they restricted themselves to creaming off the best loans (which they did not) reducing the risk of some loans reduces the risk of all loans. If you remove the risk for a lender in making the 50% most secure loans, then that reduces the risk for the lender of making more loans in the bottom 50%. Again, that was their design. They gradually accustomed lenders to making more and more risky loans. This primed the pump for the subprime loans.

(2) They had no reason to “cave” to mortgage brokers other than profit motive. The GSE were designed to make money using only the governments sponsorship without using any government money. This created a classic failure of private profit, public risk. The GSE had every incentive to get by subprime mortgages and no incentive not to. They weren’t bullied, they simply took the opportunity offered. Had they actually been focused on their supposed mission and had any concern for taxpayers who guaranteed them, they would have told Countywide et al to take a hike. Instead they bought 44% of the subprime offerings thus jump starting the entire sub-industry into overdrive.

(3) They just didn’t buy loans to include in their own MBS offerings, they bought the MBS of subprime lenders. The subprime lenders then bought GSE MBS to use as their legal collateral. The GSE therefore laundered subprime mortages turning them from high risk loans into t-bill safe securities.

All these effects happened because the GSE operated not only shielded from market forces but also shielded from normal government regulation. They were privileged in the original sense of the word i.e. private law. None of this would have happened had we never created the GSE in the first place and never tried to cheat the market on the cheap.

Too much might be a terrible idea. But history has always shown that some regulation is preferable over anarchy.

Scratch a leftist find a worshipper of the leviathan. For myself, I endeavor to create a world in which people can make their choices without terror. But that’s just me. I know a lot of people get a kick out of dominating others.

My perspective is that utopias are dangerous – specifically, the unregulated free-market utopia favored by libertarian dogma.

You’re projecting. No free-market advocate believes that utopians or anything close is possible. Indeed, free-market philosophy is grounded in the belief that people are inherently selfish i.e. evil and that therefore power should be diffused as far as possible. The free-market is about accepting the limitation and pain of voluntary associations instead of using force to accomplish some utopian goal. Adam Smith didn’t paint a utopia, Marx did.

The same dichotomy exist in this conversation. Oh, you say, if only the leviathan had possessed more power it would have in its wisdom and benevolence given us lots of home ownership and a stable financial. No, I say, you can’t cheat nature. Risk is risk, you can’t avoid it. We have to bite the bullet and accept a trade off between the levels of home ownership and financial stability. Which view is utopian? Your view that says we can get everything we want without compromise or my view that says we have to accept a painful tradeoff?

Had we not had the GSE directly manipulating half the residential mortgages in the U.S., we wouldn’t have a utopia, we would merely have a country in which fewer people owned homes and/or a country of more modest homes. We would have more numerous but significantly smaller financial crises. We would have subprime loans and credit default swaps but on a much smaller scale. Financial institutions would have actual assets as collateral instead of GSE debt instruments. Best of all, stupid, greedy people would pay for their own mistakes.

Government intervention amplifies financial disasters just like overly aggressive forest management amplifies forest fires. Just as putting out every little forest fire eventual builds up a vast store of tender that creates a cataclysmic forest fire, removing the risk from more and more investments builds up a vast store of risk that eventually creates a cataclysmic financial collapse. At every point we see the GSE offloading risk from the free-market onto the government and thereon to the people. Through their purchase of loans, to their laundering the MBSs of others, to the legal standards that made their debt instrument legal collateral, they destroyed risk signals throughout the financial system. A huge amount of risk built up within them until they collapsed and the risk burned wildly throughout the financial system. First, credit default swaps, based or hedged on their securities collapsed, then the institutions that held their debt as collateral became insolvent, and finally those we invested in their stock, debt and securities got burned.

You like to imagine that there is a group of people who are always right and if only they always held the reigns of the leviathan then nothing would happen. Oh, you say, if only the always-right Democrats had held total power over the last eight years none of this would have happened. It doesn’t work that way. If it did, the GSE would be the only sound institutions remaining instead of laying smoldering in the epicenter of the fire.

It’s a clever move, Sean, to try to turn the tables on us libertarians by making us out to be closet utopians. But you forget that we aren’t for state coersion – that’s the game of your side. If the concept of utopia is not to be drained of all meaning it denotes a reign of virtue enforced by the instruments of state power. It means Plato’s Republic or Robespierre’s rule of justice. The word was invented by St. Thomas More, of course, who had a sort of humanistic theocracy in mind. Our side doesn’t draw inspiration from any of those sources. The Federalist Papers are closer to our heart. The writers presumed a fallen world in which humans were naturally inclined to selfishness, greed and turbulence. The founders saw government as a very likely instrument of oppression in the hands of these corrupted human beings – that is, unless tamed by inner constraints, checks and balances, neutralizing the inherent tendency of both human beings and states to tyranny. They hoped to craft a polity capable of steering between the Scylla and Charibdis of governmental oppression and anarchy. Yes, you can say mockingly that this has never been perfectly realized and never will be, but you can’t really say that those who advocate it don’t have a wised-up understanding of the way the world works. We see man as flawed and those flaws as not mendable by government action. That’s not, as Shannon rightly says, a utopian vision. It’s simple realism to anyone with an eye to see and a brain to understand.

>>>Scratch a leftist find a worshipper of the leviathan. For myself, I endeavor to create a world in which people can make their choices without terror. But that’s just me. I know a lot of people get a kick out of dominating others.

C’mon Shannon, you’re a better man than that.

And KJ: yes, utopias originally started out describing perfect societies on imaginary islands. but to me, the operative word is imaginary. because perfection is imaginary. crooked timber etcetera.

libertarians may see man as flawed. well, yes. but you see the market as perfect. now *that* is the flaw. and when, as today, we have a market failure following extensive deregulation and lack of regulation based on a dogmatic belief in the power of markets to self-regulate, the explanation is…what?

that actually, no, the real problem was these GSE’s and so really, after some questionable analysis, that no one other than libertarians are convinced by (and no respectable libertarian economist has even dared sign his name to), libertarians conclude that really, the real problem was too much government. because, as all good libertarians know, there is never an economic problem that can ever be caused by deregulation. the market, after all, is perfect.

the god that failed, causing untold human suffering, taught everyone on the left many lessons, one of which was scepticism. it’s ironic that we have to teach it the conservatives of today.

Oh, and I’m going to stop posting, at least for a long while. I think I really have said everything I have to say.

so sayonara folks, it’s been fun. shannon, it’s been a pleasure to debate you.

Is that a promise? You don’t trust people to make voluntary agreements amongst themseleves but you trust them to coerce each other.Really neat,that.

SeanF, R.I.P. Slain by Shannon.