INVESTING BACKGROUND

I run three trust funds for my nephews and nieces that are old enough to understand the concept of saving, investing and stock selections that are documented at the site www.trustfundsforkids.com. I don’t mind directing people over there because there are no ads and it just describes what the funds are about, our selections, and our returns. Here is a post with more background on the topic.

RECENT EVENTS

For anyone who has been following the markets this year, it has been a roller coaster ride. The US stock indices were up for the year with some decent gains but have recently given up almost all of those gains and seem to be in a state of flux right now. High oil prices, the falling dollar, the credit freeze, housing woes, and finally massive write-offs in the financial sector have taken their toll.

Another important element that is coming to light is that profits for US companies are down significantly; per Barron’s the Q3 EPS for companies reporting are down 8.5% from the prior year – this is a big downturn, comparable to the quarters right before prior recessions (1989 and 2000). Without profit improvements, hiring and capital spending tend to fall in a bad spiral.

One term to keep in mind when investing is “negative covariance” – in layman’s terms this means that “bad things tend to occur at the same time”. Thus everything is fine, and then it’s not. For instance, the housing market goes down, liquidity evaporates, banks make huge write-downs, and then the companies that guarantee or eat these debt instruments struggle to understand the damage. These items were all related, and while models may value the probabilities of each individually, they all work together (in a bad way).

The stock markets recently went down about 10% – this is now officially a “correction”. No one knows if this is the start of a long swoon or a “buy on the dips” opportunity.

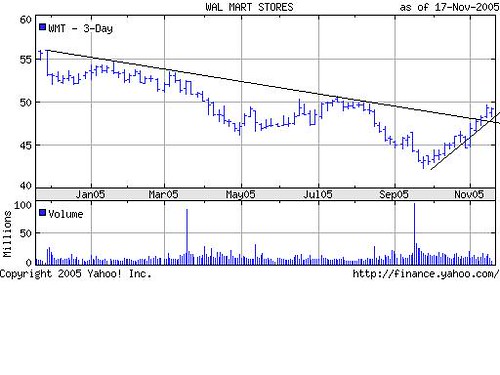

options trade that I have on. I’m holding a large chunk of the March 2006 $47.50 calls, and a smaller amount of March 2006 $50 calls. I picked up the $47.50 calls at an average basis of $3.20 per contract. I picked up the $50 calls for $1.90 this past Friday. Here’s my thinking:

options trade that I have on. I’m holding a large chunk of the March 2006 $47.50 calls, and a smaller amount of March 2006 $50 calls. I picked up the $47.50 calls at an average basis of $3.20 per contract. I picked up the $50 calls for $1.90 this past Friday. Here’s my thinking: