I have believed for some time that we were entering another Depression. I have previously posted about it.

The Great Depression did not really get going until the Roosevelt Administration got its anti-business agenda enacted after 1932. The 1929 crash was a single event, much like the 2008 panic. It took major errors in economic policy to make matters worse. Some were made by Hoover, who was a “progressive” but they continued under Roosevelt.

I posted that statement earlier and it got a rather vigorous rebuttal. I still believe it, however. I think a depression is coming soon. What is more, I am not the only one. Or even only one of two.

The second article preceded the election of 2012 but is still valid.

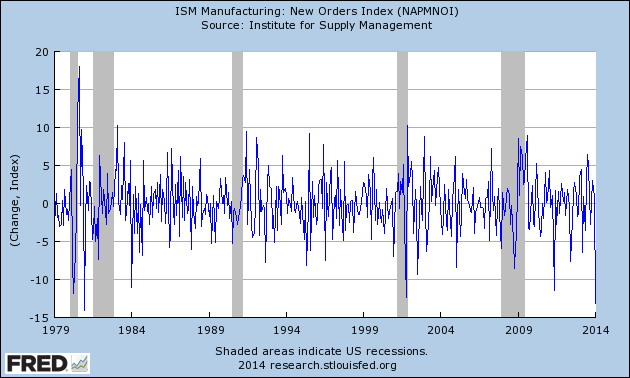

When employment hit an air pocket in December, most analysts brushed off the dreadful jobs number as an anomaly, or a function of the weather. They chose to believe Ben Bernanke rather than their lying eyes. It’s hard to ignore a second signal that the U.S. economy is dead in the water, though: on Monday the Institute for Supply Management reported the steepest drop in manufacturing orders since December 1980:

In January, only 51% of manufacturers reported a rise in new orders, vs. 64% in December. Not only did the U.S. economy stop hiring in December, with just 74,000 workers added to payrolls; it stopped ordering new equipment. The drop in orders is something that only has occurred during recessions (denoted by the shaded blue portions of the chart). The Commerce Department earlier reported a sharp drop in December orders for durable goods. In current dollars, durable goods orders are unchanged from a year ago, which is to say they are lower after inflation.

So, the economy stopped hiring, even at the poor pace the past five years have seen, but business also stopped buying.

This should be no surprise in retrospect given two disastrous underlying trends. One is the decline of real median household income: and The other is the collapse of the labor force participation rate, which is the flip side of the coin: if fewer adults are working, median household income will be lower.

Average hours worked are down 1% from pre-recession levels. That doesn’t seem like a lot, but it’s the equivalent of 1.4 million jobs in a labor force of 140 million. The U.S. has restored 2.5 million jobs since the financial crash, but adjusted for hours worked, it’s the equivalent of just 1.1 million jobs.

This does not take into account the growing population. Also:

Business won’t invest in brick, mortar, equipment and labor. Part of this is due to the Obama administration’s regulatory reign of terror. Part of this is due to Obamacare, which adds to business costs. Part of this is due to secular trendswhat Nobel laureate Edmund Phelps calls a “structural slump.” We no longer have high-tech companies: we have instead aging monopolies run by patent lawyers. Nondefense capital goods orders, adjusted for inflation, are running 20% below the 2000 peak and 10% below the level of 2007.

We’ve had a few deceptive signs of activity, to be sure. With the average age of U.S. cars on the road rising to 11.4 years as of last August, a very large number of vehicles must be replaced. Apart from student loans, the only category of consumer credit that expanded during 2013 was automobile loans. The replacement wave appears to be over and car sales have slumped.

Last year’s 30% runup in the S&P 500 was founded on the firm belief that things would get better in the future as they always had in the past. Can the stock market be so wrong? Twice in my lifetime, the stock market has given ridiculously wrong signals: during the tech bubble of the 1990s and the mortgage bubble of the 2000s. The Fed’s unprecedented provision of liquidity cheered the stock market, but it did not persuade lenders to lend or borrowers to borrow. The growth rate in total bank credit is close to zero, something we have seen before only in recession periods.

The stock market rise, while soothing to Obama supporting financial people, really represents the absence of other investment opportunities with interest rates at near zero. The last time this happened was in 1928-29.

The Fed has insisted throughout that the treatment was working and the patient was getting better. Americans know better: in late January, 74% of respondents to a Fox News poll said the country still was in recession.

What does Spengler advise ?

The problem is NOT government spending, contrary to the well-meaning obsession of the Tea Party. That will BECOME the problem a decade or two from now. The problem now is obstacles to investment: the highest corporate tax rate in the world, onerous regulation, the crazyquilt uncertainty of Obamacare. America needs aggressive tax cuts and regulatory rollback. It also needs to spend more on infrastructure, which is becoming a major obstacle to growth. It needs to spend more on R&D, particularly on cutting-edge military R&D. The way to do this, I’ve argued for years, is to emulate Roosevelt’s alphabet-soup federal agencies and put unemployed Americans to work repairing infrastructure at $20 an hour, rather than paying $50 an hour to the construction unions. That’s heresy from a free-marketeer like me, but it makes economic sense and will drive the Democrats crazy.

I tend to support this idea although it is by no means the only thing needed. The CCC of Roosevelt’s New Deal was one of his few good ideas before the war.

The CCC was designed to provide jobs for young men, to relieve families who had difficulty finding jobs during the Great Depression in the United States while at the same time implementing a general natural resource conservation program in every state and territory. Maximum enrollment at any one time was 300,000; in nine years 3 million young men participated in the CCC, which provided them with shelter, clothing, and food, together with a small wage of $30 a month ($25 of which had to be sent home to their families).

Today, it could provide a healthy alternative to the streets for young black men. The draft in 1941 found that US young men were far healthier than those in 1917 or those in Britain in 1939 when the draft was again instituted in Britain. From 1939:

Contrary to general belief the majority were in work when applying; in 1936 the proportion was 70 per cent. But so obviously unfit were many of these young men that they were rejected on sight by the non-medical staff. 6o,000 men had this experience during the three years 1933-6. In addition, there must be many, some of them no doubt unemployed, who know from their physical condition that it would be useless to apply.

That bit referred to volunteers prior to 1939..

The US experience in 1917 was similar.

“The first adequate physical survey in half a century was made possible when the Selective Service system brought before medical examiners some ten million men. Of the 2,510,000 men between the ages of twenty-one and thirty-one 730,000 (29 percent) were rejected on physical grounds.”

We found it interesting to learn two facts from this article; the first being that the highest number of acceptable draftees were from the countryside and the second involved the malady of flat feet -which effected one out of every five American men at that time.

It won’t solve the economic problem but a CCC equivalent could help with the crime and education problems. The economic problem will require a Republican president and Congress. Maybe we could do something about that, too.

I’ve been thinking that the better analogy is that 2014 is going to resemble 1994.

Probably not going to be a banner year but not armageddon either.

It feels bad because of the new normal. We reset this time at a much lower level and as a result the recovery has been much more anemic.

Keep in mind that those ISM numbers come from a poll of purchasing managers and not based on hard numbers. It’s a good barometer of the overall business climate, but often times is different form what’s going on in the real economy.

“America needs aggressive tax cuts and regulatory rollback.” The first is much easier to accomplish than the second.

“It needs to spend more on R&D, particularly on cutting-edge military R&D.” But whatever’s developed will be in China’s hands as soon as it’s in yours. That just gives China a bigger edge against all its neighbours.

It’s been a hard road but Helicopter Ben kept the fires burning long after the pooch screwing blew up the financial world. Amazing really and an education for me as to financial inertia.

It started years ago, and the Fed’s magic has kept the wheels on the cart, long after they should have fallen off.

Now it begins.

Long ago when the world was new and I was learning macro and micro economics [the rumors that Adam Smith was a visiting professor are only mildly inaccurate] we had definitions for recession and depression. They involved real Gross National Product [now referred to as Gross Domestic Product] which is after the effects of inflation are accounted for. A recession was a decline in Real GNP for two consecutive quarters OR a 1.5% increase in unemployment over 12 months. A Depression was a recession that lasted more than 6 quarters.

These definitions have been changed, largely coincident with Democrat administrations over the last 40 years, to be functionally meaningless. What we have now is considered to be a rousing recovery. Pure Bovine End Product.

Inflation figures have been falsified for years. Products used by real people; food, energy, etc. have been deemphasized in the calculations. But they still have to be purchased by every business, family, and individual. Housing prices [and despite administration cheerleading, the housing market is at best flat] are counted like a new house is a regular purchase.

Inflation at the level real people deal with is far higher than admitted by the government. I am guessing at least about 6% annually instead of the 1.5% claimed. Unemployment is downgraded by the government by dropping people out of the numbers counted. In theory we have the smallest percentage of our population working since modern figures were kept. Using the old means of calculations, we have an unemployment rate of about 11-14%; which is 2-3 times what is claimed. The only thing holding things together is a totally unsustainable level government transfer payments based on borrowed or fictional money.

We are in, and have been in, a depression for years. I rather suspect that this year is going to be the Year of Consequences when the buzzards come home to roost. Keep thine codpieces buttoned, as the ride is going to be bumpy.

Subotai Bahadur

I have absolutely NO idea why my post appeared all in italics. There was only one word in italics about a quarter of the way down, and I checked and the tag WAS closed. The real time preview only appears after my first post of the day. It is up now and is showing all italics; so the problem is on y’all’s end.

Subotai Bahadur

Maybe it’s Word Press. I find that to have lines between italicized segments, I must add an before the line. Even if there was also an at the end of the precedent line.

My comment is also italicized and the code disappeared

[Should be fixed now. Jonathan]

Present-day attempts to create a CCC, or a TVA, would run into serious roadblocks in the form of endless environmental litigation, as well as lawsuits by unions who claimed interference with jobs that should be rightfully theirs.

Even if major projects were thoroughly dunked in Green holy water…say, they involved construction of massive solar-thermal farms in the Southwest, on land belonging to Indian tribes who strongly favored the projects…probably nothing could over be done over the next 3 years other than planning, environmental studies, and response to litigation and regulatory maneuvering. I doubt Obama could turn this golem off even if he wanted to.

John Williams of Shadowstats.com calculates inflation using the methodology the government has employed in the past.

Using Carter-era figuring we’re running at about 8% right now.

With that in mind it seems to me that 1) either Carter got a bum wrap, and the economy was doing swimmingly while he was president 2) or the economy is much worse now than the government is claiming.

My money is on 2).

“Using Carter-era figuring we’re running at about 8% right now.”

For some reason gold price collapsed so that metric is unavailable. There used to be a conspiracy theory that governments sold gold to crash that market. I’m not current in conspiracy theory these days so I don’t know about that. I just look at a few indicators and the currency debasement seems to have been pretty severe during the last 50 years. Getting old is better than the alternative but it does give one a depressing view of inflation. Gasoline at $3.55 is said to be cheaper in real terms than when it was $0.26 when I was in college.

Personally I think Shadowstats is rubbish. If you estimate the cumulative error based on the charts they provide,prices would have to be something like 6x 1985 levels – which is when I started working. There is simply no way this is possible, for a start it implies my current pay is actually less than my starting salary, which is just wrong. 4 or 5% a year biases compound into very large numbers over 15 or 20 years. Official figures put cumulative inflation over my career at a little over double. Checking prices like my first apartment’s rent, first car price, gas prices and other items I bought regularly are generally 2 or 3 x now. Hell, even tuition, which has clearly been running way ahead of everything else is only 4x.

The government certainly has incentives to downplay inflation, and maybe a better measure would be a little higher. But 5% annually compounds to a doubling ever 14 years, or looked at another way, the halving of living standards. Things haven’t been great, but they haven’t been THAT bad.

I bought my first house in 1969 for $35,000. My first new car, a 1968 Mustang convertible was $3050. In 1972, I bought my house in Orange County for $67,000. In 1973, I sold the house in South Pasadena for $42,000. By 1985 it was for sale for $595,000. My Mission Viejo house is now worth about $850,000. The Mission Viejo house I bought in 1991 for $259,000, I sold in 2010 for $600,000.

I won’t even mention the beach house I bought in 1979 for $320,000. It is now worth more than a million. It was for sale a few years ago for 1.5 million.

I think the multiplier is a bit more than you estimate, Forty five years at 5% is”Future Value $246,399.60 “for the South Pasadena house which was $595,000 by 1985. Of course, California may not be the best example.

The other lesson is don’t get divorced. Two of those houses went that way.

Here’s a good place to compare prices from different years

http://www.measuringworth.com/uscompare/

Depending on how you measure those prices may be about right.

The wide variation in different types of measures is the big dilemma with arguments like Shadowstats.

I don’t see how we can have a depression when we never had a recovery from the last recession. I think that we may well go through a series of dips, but nothing terribly dramatic. Sort of a low grade fever and anemia, not a real acute attack.

I am not sure that inflation is a huge current problem either. Again sort of low grade annoyance. I know that the government can fiddle its numbers, but the Billion Price Project [http://bpp.mit.edu/usa/], and the markets for TIPS do not point to a huge current amount of inflation.

To be sure there are a couple of things that could go dramatically wrong, and they are related. One big one is that the Fed needs to climb down from its bond buying binge of the last five years and return its balance sheet to something approaching normal or it will be unable to do anything if it is really needed. That process could go dramatically off the tracks and lead to a hyperinflation or a credit catastrophe.

The related difficulty is that interest rates need to return to normal levels (~6% for the 10 year), before savers choke to death and starve the economy of capital. However, if that happens, the Federal budget will go completely pear shaped.

May you live in interesting times.

What you’re seeing is the second dip of the ‘Double Dip’ recession that our “knowledgable” friends assured us couldn’t happen. (e.g. Krugman) There wasn’t any actual recovery from the previous recession, just money pumping to simulate economic movement, and now the inflation catches up (inflation always lags). It’s sorta like crossing a muddy spot in a vehicle; when you lose inertia, you sit and spin, and dig yourself in further. (sorry for going all country on you there…)

This “Double dip” economic slow down was guaranteed the moment Obamacare was passed because it was going to draw a lot of resources from the economy in just the same way Social Security did in creating the “Double Dip” in the Great Depression for FDR.

The difference between Social Security and Obamacare is that Obamacare is effing up something that worked for most, that a lot of people used and most people did want messed with in the first place.

Losing the Senate will be the least of the Democrats worries.

Shadowstats may or may not be right about inflation but they do have it right on unemployment.

A person either has a full time job or not. Period.

Since the long term unemployment extension expired in December, even fewer people are now counted.

If the trend holds up we should reach close to measured “full employment” this year.

I should have qualified the Shadowstats remark to limit it to inflation numbers. I lack personal experience on other numbers. Do note that the 5% is 5% in excess of official inflation, not absolute inflation. The changes shadowstats is talking about occurred during the 1980s, so prior inflation (much of it quite high by US standards) doesn’t bear on this particular point.

Mostly I just wanted to point out that saying something like “inflation is more like 8%” is saying that the government is masking an historic drop in living standards. Long-term growth rates during the industrial era have run around 2-3% – roughly doubling every generation. Accepting the Shadowstats data means not that growth has stalled, but that the past 25 years have wiped out the growth of the prior generation (1960-85) and much of the generation before that. It’s not a matter of thinking that your children won’t have a better life than you. It’s saying that they won’t have a better life than your grandparents. And there is simply no way you can convince me that is true.

Shadowstats has a good point.

The BLS started changing the basket of goods so there’s no longer a pure apples to apples comparison.

In addition they apply a discount for technological innovations and other improvements. However, the consumer still has to pay the higher price, and it’s not a stretch to imagine the BLS adjusting their stats for political purposes.

On the other hand, products do fall out of fashion and are replaced by newer ones. Quality improvements do make our lives better and often have a multiplier effect on spending power for other things.

If the BLS is arbitrary or political with their adjustments, who’s to say that Shadowstats isn’t with their retorts. They’re not recalculating a constant basket, but just adding to the official BLS number in ways, like you say, that defy reason.

There’s no where to hide from the unemployment though. Labor force participation is the lowest it’s been since the late 50s. Most is due to women dropping out which you just don’t hear about and probably some sort of cultural shift.

“There used to be a conspiracy theory that governments sold gold to crash that market”

There still is- or perhaps I should say are, as there seems to be plenty of conspiracy theories about gold.

Some even seem credible.

VDH has a good column on the plight of the middle class which will take the brunt of the coming crisis.

Conspiracy theories may be proved not to be just theories soon. Consider the case of the German gold deposited in the US at the beginning of the Cold War.

1) In 2012, the German government realized that it had missed required physical audits of its oversea gold holdings here, and asked to count their gold.

2) The US government refused.

3) They made faces at each other for a while, and then Germany said they wanted it all back, now.

4) We said no.

5) Ended up that they get a fraction back over a period of 7 years, for “logistical reasons”. Note that gold moves in bulk around the world daily. It ain’t that hard, and GSG-9 can provide a whole bunch of security for no marginal cost.

6) They were supposed to get 300 tonnes back last year, and got back 5 [five]. That 5 did not come from the US, but from US owned gold that was in Paris. There seems to be some problem with producing the original bars with serial numbers and bank stamps.

Given that, the actions of governments in relation to physical gold are legitimately subject to doubt. Also, if you own gold, have it under your own control.

Subotai Bahadur

We might need a new type of graph as governments continue to “adjust” their numbers. We do have a model similar to ours from Japan. They tried our current system of economic stimulus and failed – though they keep trying. Maybe you should put up a graph of Argentina’s economic growth. That is where we are heading.

Phwest,

Good points, as I don’t believe living standards have collapsed in the last fifteen years either. But I also believe John Williams and his numbers are roughly accurate.

Thus I have a conundrum.

More later, as I’ve run out of time for the moment.

I used to tell the kids that the dollar was worth about a dime from the one I knew as a young working student many years ago. (That was so they would understand my reluctance to purchase $100 jeans or sneakers.) Now my estimate is about 6 cents in purchasing power compared to a 1965 dollar.

We are seeing the 3rd generation in a “shirtsleeves to shirtsleeves in 3 generations” story. It will require a major rebuilding of our moral and intellectual environments in order to remodel and rebuild the political and economic relationships in our society.

We have allowed too many fools to influence our societal course for far too long.

They are easy to spot: they constantly jump up shouting about how smart and important they are.

The ones we need to listen to, and cede some measure of authority to, are the ones who quietly go about their lives actually accomplishing some form of productive work.

Enough credentialism…let’s try some competence for a change.

I’m baaack.

In fairness to John Williams my casual reading of his inflation chart produced via Carter-era methodology doesn’t look to indicate 8% inflation over the whole time since. It looks to be quite a bit less- 6%-ish, or even less.

Anyway, since I’ve expressed my support of shadowstats and also noted that Phwest has good points- how do I explain my conundrum?

Hmmm. Just what would it look like if the wealthiest nation in the history of mankind went bankrupt? And thus faced a collapsing standard of living?

I think a variety of things would occur. Including:

1) Phonied-up economic statistics, of course including the official inflation rate.

2) People borrowing to maintain living standards, in myriad ways.

3) An enormous increase in the number of people surviving thanks to government transfer payments.

4) Lack of investment in infrastructure, as spending is diverted to keep up appearances. So to speak.

5) Lack of investment in defense spending, same reason.

6) A political establishment which- having been in place before the country went tango uniform- will seek to pretend that reality hasn’t happened, and hence will attempt to convince everyone that good times will be here again real soon now.

If it seems like I’m simply listing an assortment of recent developments in American life- yep. If it seems like I’m ignoring Phwest’s comments- I beg pardon.

It just seems to me that the phonied-up inflation rate is only a small segment of the story of the de facto collapse of the American economy.

Living standards are a lagging indicator- but they’ll catch up, sooner or later.

Alas.

This is MANUFACTURING.

Manufacturing is OLD ECONOMY.

That’s not unimportant, but America does not make money by making stuff, it makes money by DESIGNING the stuff.

By creating IP which is central to the process of making stuff.

The key question is — what is happening in the IP market? What is happening in the service markets?

That’s where the future of America lies.

I do believe that the anti-business aspects of our current admin have, and will continue to have, a deleterious effect on that developing economy, but I would argue that downturns in historical manufacturing numbers are far less significant than at any time in Industrial-Age history.

What is happening in the employment of IP & Services people? Is the laxity of the employment numbers the direct result of fewer manufacturing workers than ever before, but a not-quite counterbalancing development in IP&S workers? That WAS a significant factor in the Great Depression, mind you — the final serious transition from 90% of populace farm employment in 1880 to 5% in 1960, and 80% industrial employment.

What should be happening NOW is the final transition from industrial to IP&S… with a hard shift from people working in making things, as factory workers, to working in offices and white collar jobs. That may be a painful transition, and yeah, Teh One is just stupid enough to make it much more painful, as people whose factory-only skills get pushed into the McJobs that is all they are qualified for but don’t want to do need complete retraining.

What should be happening, if the government actually wanted to get people working, is to zero tax any monies spent on training up new workers. And encourage full training support — i.e., if a company pays for someone to go to school to learn skills needed to work for them, then they get some form of tax write-off for that.

That makes sure that the companies get employees trained in the skills they want and need, and the people who need the training are under less pressure to get stuck in McJob type labor positions.

Apprenticeships should be a high priority but not in an administration that depends on labor unions to get out the vote.

Basic education is in the hands of teachers unions that have wrecked it.

The black underclass has no work ethic which is a problem in the white middle class, as well. The illegals seem to have the best of it here.

The police are getting far too militarized for my taste. What the hell do they need armored cars for anyway ?

Every social service seems to be developing into a racket.

Interesting piece on Valerie Jarrett in Chicago Magazine. No too complimentary. Is the bloom off the rose ?

}}} It’s not a matter of thinking that your children won’t have a better life than you. It’s saying that they won’t have a better life than your grandparents. And there is simply no way you can convince me that is true.

Then you’re buying into a load of absolute rubbish and digging deeper.

I’m sure the government is lying about a lot of things, including many of these numbers, but your sources are looking at apples-and-oranges numbers and not even acking the apples and oranges involved.

I will agree that Dr. Mark Perry is a definite optimist. But his numbers, and point of view on those numbers — even ADJUSTED for the variances that Shadowstats claims — show that the current generation is likely to be defacto the wealthiest in history, short of total economic collapse.

The numbers that Shadowstats is keeping — and hence comparing to modern numbers, are not valid. Household income, for example, adjusted for inflation, is not the same thing when the typical households are three people vs six people. That has to be taken into account when dealing with such numbers, and most of the Chicken Little types do no such thing — they don’t even THINK to address that far from insignificant difference. And if I’m an unmarried single “head of household” with no kids (MUCH more common than 50 years ago) and I’m making $40k a year, vs. an inflation adjusted (either number) father of five making $55k a year 50 years back, then WAKE UP I’M BETTER OFF THAN HE IS in purely financial terms. His expenses are far, far higher than mine, AND his capacity to adjust to economic vagaries — to “tighten his belt” — is far, far lower. To say nothing of my capacity to pick up and go where the jobs are.

Perry also notes that apples-to-oranges, yet again: that much of what you can buy now was NOT EVEN CLOSE to what you can buy today. In almost every way, the average quality level of many products is far higher. As anyone who ever had a TV dinner in 1975 can easily tell you while eating a frozen dinner from Healthy Choice, Marie Callendar, or Boston Market can tell you. There’s no comparison. The quality of a TV, a sound system, and most household appliances are much higher — and the cost of them in the most CLEARLY relevant terms of “how many hours to I have to work to buy that?” — makes the modern time literally incomparably better than the 60s. Yes, cars cost more, but are FAR safer — and last FAR LONGER — than they did in the 1960s — in the 1960s, cars required far more maintenance work, and generally, once it hit 100k miles, it was on its last legs. Nowadays, cars can hit 175k, even 200k, on a common basis with limited repair work prior to that point beyond a certain amount of maintenance expenses (New brakes, new fuel pump, that kind of thing). Tires, too, are VASTLY improved from the 1960s and before. Nowadays, you can go on a 2000 mile trip not with a spare but with one of those stupid little “half spares” with nary a thought. In the 60s, you not only took a spare, but probably took FOUR spares, just because you could not be sure of getting the size you needed in Podunkville, nor could you rely on even ALL four not to need replacing in that time frame.

In short, you cannot simply compare costs and say “life is worse”. It’s not, EVEN if someone grants you “increased costs” — because PPP, based on average income, is VASTLY above what it was 50 years ago — and that is a “shadowstat” not subject to government manipulation. The number of hours you have to WORK at a typical job to get basic necessities — food, electric, clothing — is well below what it was at any time in history. The only thing that has not kept pace is housing, and even THAT could have kept pace if we had actually improved the way things get built as much as we should have in the last 50 years.

Adjusted for Household Size, Real Income Reached An All-Time High in 2007, +66% Higher Than 1967

(Adjust THAT for shadowstats rather than “official government figures”. It’s still going to put paid to the presumption of an ever-worsening middle class)

Microwave: 63.2 Hours in 1981 vs. 6.5 Hours Today

And a larger, wider net than the above example:

The Miracle of the Market

…With some help from the Student Entrepreneur Society at the University of Michigan-Flint (especially Jennifer Moore), and an old 1950 Sears catalog purchased from Ebay, we were able to compare the costs of 16 typical household items in 1950 to the costs of those same items today, measured in the cost of our time to purchase those household items….

And another exercise like the above:

Young Americans: Luckiest Generation in History

It’s Never Been Better for Americans: Lower Monthly Payments and Bigger Homes Than Ever

Overwhelming Evidence III: Good Old Days Are Now

Over 100 Years, Food Prices Have FALLEN By 82%

Manufacturing Productivity Has Improved Our Lives

Young Americans: The Good Old Days Are Now

Despite Current Economic Slowdown, Consumers Have Never Had It So Good. Ever. Anywhere

…A comparison of the price of a typical household appliance in 1949 (178.4 hours of work to purchase a refrigerator) to the price today (only 18.9 hours of work) is just one of hundreds of examples that demonstrate the significant increase in the average American’s standard of living over time….

More Choice, Better Selection, Much Lower Prices

The Magic and Miracle of the Marketplace: Christmas 1964 vs. 2011 – There’s No Comparison

The Significant Increases in Energy Efficiency of Home Appliances Over Time

Christmas Shopping, Stereo System: 1958 v. 2009

Christmas Shopping for a TV: 1958 vs. 2009

Stuff that can be made in factories has gotten cheaper and generally higher in quality. Stuff that can be made in factories and packed with many units in a shipping container has gotten especially cheaper.

But for stuff outside these categories, the track record is spottier. For a high % of people, the cost of sending your kids to a school where they will (a) actually learn some stuff, and (b) not be in serious physical danger has gotten higher–either in the direct form of private school tuition, or the indirect form of moving to a more expensive neighborhood where the public schools suck less–is considerably higher than it was. Ditto the cost of college.

Also, calculation of how much X a person can buy per hour worked needs to be done on an after-tax basis, which of course means it varies greatly by income level and locality.

Much of the benefit of a more-productive economy is being absorbed by social dysfunction, government inefficiency, and rent-seeking.

The Following chart has been linked around today. It certainly is interesting.

That at least is the conclusion reached by a frightening chart that has been making the rounds on Wall Street. The chart superimposes the market’s recent performance on top of a plot of its gyrations in 1928 and 1929.

The picture isn’t pretty. And it’s not as easy as you might think to wriggle out from underneath the bearish significance of this chart.

Oh Oh

Yet the market over the last two months has continued to more or less closely follow the 1928-29 pattern outlined in that two-months-ago chart. If this correlation continues, the market faces a particularly rough period later this month and in early March. (See chart, courtesy of Tom McClellan of the McClellan Market Report; he in turn gives credit to Tom DeMark, a noted technical analyst who is the founder and CEO of DeMark Analytics.)

That chart is scary, but even they admit the scale is off

At the same scale, the slopes would not compare very well.

Even if we are only looking at form alone, a comparable “crash” would only take us back to last summer’s level.

“However, what is important, McClellan said, is that the time scales of the two data series need to be the same. And, he stresses, there has been no stretching of the time dimension to make them fit.”

It’s no secret that there are seasonal patterns in the stock market. Prices from one year often match another.

Spring rallies, “Sell in May and go away”, Santa Clause rallies, etc. happen year in and year out.

Nothing they’re saying suggests we’re seeing something earth-shattering.

“Manufacturing is OLD ECONOMY.”

Yeah, sure. Thing is, I live in the US and I think your various links are nonsense. B*llsh*t, actually.

All of them, I bet. I’ve grown increasingly tired of the endless cheerleading about how everything in America gets better and betterer, each and every year, because America f*ck yeah!!!

Or alternately, because of the sacred market forces that somehow never seem to reach the politically connected.

I ain’t buying it, sorry. I used to work at a unionized steel mill- yes, I know I’m supposed to simply complain about how unions made everything inefficient, etc. True, but what’s really stuck with me about my employment there are various personal anecdotes, not related to me in any sort of attempt to make any political point.

For example, I recall that I was told that getting a job at that company was once no big deal, whereas when I was hired it required extensive all-day testing. Context, I came from grocery store, which was regarded as the same as working at the mill, twenty years prior. And I was told that employees in the 1970s could take home after taxes about $2k a week, at least in certain areas of the mill. At that time in the 70s a new car was only a few weeks’ work- which amazed me.

Yeah, all the praise the sacred market forces, hallowed be their name. Unless they harm the politically connected.

A-gain. I live in the United States. I have for a long time. I see things, and read. When I done get told that everything is just peachy, warm and fuzzy, cuddly bunnies, etc- because we aren’t all starving in the streets, struggling to save up enough to buy a fridge- hmmm.

Yeah, I just ain’t buying the shinola.