Most people would not like to travel the way I travel. They want a specific route itinerary and planned places to visit.

For me, it is the spontaneity of the journey that I like. Last November I decided to drive from California to Minneapolis to attend Thanksgiving with my small family. And it was the unplanned stops along the way, a few way off course, that made the trip. I wrote about that trip here.

I have found a travel companion, and because of her background as a cruise director for the Royal Viking Line (and the first female cruise director), she is on board with my travel plans made at the last minute.

Inger once told me that she and her charge of passengers were in the middle of India, and the scheduled plane that was to take them to the Taj Mahal would not come. Now that is a challenge making arrangements “on the fly” for 20 people who are depending on you to get them to their destination in a timely manner. So she is used to travel’s unexpected detours.

A few weeks ago we found ourselves heading west with the general destination of the Bay Area, and Silicon Valley, as the goal. While on the road, the menu of possibilities was to see the Tech Museum at San Jose, or take a Tech Tour of the many technological icons the world knows today, such as Facebook and YouTube.

How’d you like to be the current occupants of the house where Steven Jobs and Steve Wozniak built their first Apple Computer?

As we crossed the Dumbarton Bridge leading us to Menlo Park, we both were amazed at the costs of real estate there. I went to school there in Menlo Park for 2 years in the late 60s, and the contrasts are astounding. The first land you encounter is East Palo Alto, which a local told me was referred as “the marshlands”. I wouldn’t call it a ghetto at the time, but it was rather run down. Inger, who used to be involved in real estate, looked up a house price there now and it was $3.5 million.

While she and her family came from Norway, one of her first homes as a child in the US was in Palo Alto. And her house there sold in 2019 for $9 million. With a $113,000 annual property tax. I told her as long time Californians most of us couldn’t afford to live in the homes we had as children!

Which has had business repercussions throughout the state that I’ll tie in with a subsequent post here.

Those few of you who have read my posts at The Lexicans know that I am fascinated by history and how such profound changes can occur from the smallest of things.

Would World War ll in Europe have ended differently and before Pearl Harbor, if Wallis Simpson not been in his life and Edward VIII remained king?

Would there even be a Microsoft today if Gary Kildall hadn’t been out of the office in Monterey? (For what it’s worth the Forbes recollection is different from what I heard but I will go with the Forbes version for this post). If Gary had been more flexible with IBM and seen the future as Bill Gates saw it (with licensing to non-IBM hardware manufacturers). It was a CP/M world – not MS-DOS – with Intel processors before this meeting.

In 1980 IBM was out looking for an operating system for its coming PC. The legend is that Kildall missed a meeting with IBM because he was out flying one of his planes. He could never live down that legend, but it wasn’t entirely true. He was flying, yes, but he showed up only a little late. Then he talked all day and through the night on a flight with the IBM representatives back to their office in Florida. The sticking point: IBM wanted to pay a flat $200,000 license fee to get a royalty-free license in perpetuity. Kildall wanted more.

Bill Gates came up with a similar operating system. He gave DOS away to IBM for $50,000 and figured, correctly, that he could get rich by licensing the system to other computer manufacturers.

The story I heard was a bit different and Gates didn’t even have what became MS-DOS, but when IBM, desperate for an operating system, then called him and Gates bought what became MS-DOS from Seattle Computer for $50,000 to give to IBM.

In those days, IBM was such a dominant and respected force with the industry saying, “Nobody ever got fired for selecting IBM”. And since Microsoft really became its own dominant force because of IBM’s endorsement, how different would IBM be today if they insisted on having a part of Gate’s (then) fledgling company? I can remember an article in Forbes or Fortune giving the 50 largest computer companies in America.

IBM was of course, number one. Digital Equipment was number 2. It took the revenues of the “bottom 49” companies to equal mighty IBM.

Today, Digital Equipment, who pioneered the mini computer (and whose computer Gates learned programming) , is gone. Along with so many others who couldn’t transition along with the technological wave of the microcomputer.

So anyway, I suggested to Inger that we have lunch where Google was (allegedly) born. Like my version of Gary Kildall (he was out sailing, and his wife was at the office afraid to sign with IBM an NDA) this may or may not be true.

I have heard this story from several sources which doesn’t make it any more or less true.

But the restaurant where Google was allegedly born has given birth to other tech companies.

According to owner Jamis MacNiven, there’s an impressive list of deal-making history at Buck’s.

“Hotmail was founded here,” he says. “Netscape had their early meetings in the back room; Tesla was founded here; PayPal got funded here.”

And Yahoo, according to MacNiven, was turned down during a meeting at Buck’s. The restaurant is just miles from Sand Hill Road, site of the nation’s largest aggregation of venture capital firms.

Buck’s isn’t really fancy or pretentious, but a nice restaurant where a lot of venture capitalists come to have lunch. And it’s in my favorite area of California. If I could afford it I would live there. It’s just about 10 miles or so from Redwood City and “up in the pines”. If you traverse the Peninsula east to west, you go up into the mountains with a rustic atmosphere and then to the ocean, all in 30-40 miles. Plus it has some of the best weather in California, temperate the year round.

While this meeting of co-founders Larry Page and Sergey Brin isn’t acknowledged in their official history, the story I heard was when they felt that their new search program was ready for the market, they made pitches to all of the established search engines to sell or license it.

Companies like Alta Vista and Yahoo. I remember using them in the 90s. You literally had to sift through a ton of chaff to get a few grains of wheat. You’d get 50 or 100 results of which 2 or 3 were of any interest. As far as I know, Alta Vista is gone today and Yahoo, which was the dominant force in the 90s, and should have been where Google is today, was sold a few years ago with the buyer realizing that the parts were worth more than the whole. If you read Google’s official history, you know that their search algorithm was radically different, using links from other websites.

Anyway, the story I have heard is that once they were rebuffed by all of the established companies (where are they now?) they decided over a lunch at Buck’s to start their own company.

And something I discovered a few years ago, also not verified.

They don’t go out to the websites that they find for you, but they have copies of all of the websites on the Net. I came to this conclusion when I wrote something for the Lexicans, found it on Google literally minutes later (what summons the programmatic “spiders” that go out to the post so fast?).

I made a change on the post 20 minutes later and then used Google, and the original post was still there. To be updated with my change eventually. Their Google server rooms must be an amazing sight, or at least amazing to an old programmer like me.

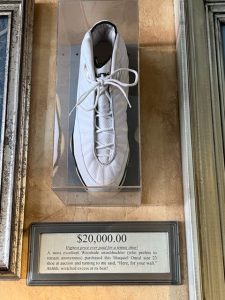

Anyway, if you go to Bucks, their displays along the walls are worth the trip alone.

You must spend at least 30 minutes going around the wall displays, including the shoe of Shaquille O’Neal (size 22!). A frequent patron bought it for $20,000 and gave it to Buck’s owner for his display.

There’s a lot of money in the Bay Area.

After lunch we decided to drive to Google Headquarters in Mountain View 10-20 miles away. I expected it to be in a typical industrial park, where we could walk around. I wasn’t expecting the reality, where it was a complex of buildings over a mile long. They are building 2 new headquarters buildings with what Inger called “whimsical roofs”. If I understood the workman correctly, they will not have conventional heating or air conditioning, but get these needs from below the ground.

Don’t ask me how they will do it, but I am trying to ignore my past questioning of technology’s possibilities as the future has unfolded.

I always think that the beginning of the end for any company is when hey start putting more effort and thought into the architecture of the company headquarters than their products.

re Google, here’s a snippet from a discussion between Peter Thiel and Eric Schmidt, in 2012:

https://www.youtube.com/watch?v=snMWgvMgWr4

The above is an extract from a longer video:

https://www.youtube.com/watch?v=PsXFwy6gG_4&t=51s

As far as travel spontaneity…

I failed spontaneity in high school. One year in English we studied 19th century American literature with one of the works being Ralph Waldo Emerson’s “Nature” and as a practicum our teacher took us to some woods out hack (outside of hunting season) Afterwards I told her about how much I enjoyed it because of all the neat paths I found that I could follow, it took a few years to understand her anguish

Years later we would do Sunday drives through the country following our whims, but to the kids I the back seemed not only aimless but pointless and interminable. I laughed and told them I thought the same when we had to endure my parents subjecting me to the same torture. I have no doubt the kids will do the same to their kids…because you know tradition

Thanks David – I will check it out!

Mike I know this spontaneity gene must be a recessive one and not necessarily beneficial ;-) But I do love to wander, and don’t mind unplanned stops along the way. The only stop I made on my Minnesota drive for which I had some ambivalence was the Spam Museum in Austin MN. But even there I leaned a few things.

The point that Thiel makes; that the hoards of cash that companies like Google have accumulated are a sign that they have run out of ideas is the exact one I’ve made for about as long or longer. By rights, that money doesn’t belong to “management” to piddle away on this or that, it belongs to the stock holders. If management can’t find something productive to do with it, they should pay it out to their investors and let them do so.

My grandfather grew up in downtown Palo Alto across from the Post Office. They sold their house for $8000. Not much tech, but a lot of orchards back then.

@Jaime – when I went to school at Menlo – 1968-1970, one day I got a ride in the traffic spotter plane of KCBS. And flying over San Jose you could still see orchards, but you could see houses encroaching on them.

@MCS How does “hoarding cash” associate with running out of ideas”? More likely they have made the big search algorythims (and perhaps equally important) the linking of advertising to those search requests, and the future from now on is incremental improvement?

Jay Leno said something that resonated with me.

He was profiling his ’63 Corvette split window coupe. And here is a car, that debuted in late 1962, that is still very coveted today. Still stunning looks, performance that while not cuttings edge today, still great.

And 50 years ago from 1962 cars were just starting – leaving the horseless carriage stage.

Fast forward 50 years from 1963, and has auto progress been as dramatic in 2013?

Improvements have been incremental, and in small increments. Perhaps the biggest improvement was in 1996, with the implementation of OBD II. That’s when ignition distributers were abandoned, and individual coils for each cylinder were adopted, with a computer controlling precise timing, and knock sensors to back off that timing in the event of a pre-detonation. Every ounce of potential energy is used from each drop of fuel.

@Jaime – BTW Inger’s family was not rich – but that house – if we could leave pictures in the comments – we went back to see it. It is now on the historic register – 7,000 sf – and the owner has the interior completely gutted. He won’t move back in for 2 years. Paid over $9 million for it in 2019. I think in the 1960s (early) her father paid $30,000 for it.

There’s a lot of money in the Bay Area. When I went to Menlo, real estate prices were comparable to homes in the Central Valley. In the 1970s, they started to really climb. And I thought them, “it will level off”.

Shows you what I know.

My father received his MD in 1944 from UCSF and was promptly drafted as a Lieutenant into the army. Spent 2 years tending the Pacific Theater casualties in a 2,000 bed military hospital in Livermore, CA.- discharged in 1946 as a Captain. After a year each in post-docs in Michigan, Vancouver and Salt Lake City (post-docs I think because of a BS, MD and Ph.D in Physiology from UC Berkeley, 1932-1940), our family (my Mom, an RN, my elder sister born in 1945 in Michigan, my brother in Vancouver in 1947 and my younger sister in SLC in 1949) settled in San Jose in 1950, he working at O’Connor and San Jose General. In 1956 or so, our folks bought a buildable parcel in Palo Alto. A couple of years later, they bought a 1 2/3 acre parcel in Saratoga, I’m guessing because it would be a shorter commute Paid $15,000. Paid an architect to design a 4,000 SF split level adobe/Spanish tile roof with 3-car carport home. The adobe (dyed concrete) blocks were 12″ thick, massive construction. The construction cost was $59,000. Think about that, a quality home built for less than $15/SF. Thank you, deficit spending and unlimited borrowing. Why do we allow these morons in Wash., DC any power at all?

Bill,

I do perform so!e wandering, usually stemming from a curiosity of where a road that of often passed may go or what that mysterious house on that far off hill may portend

A while back I was in Budapest and I would do an early morning walk across through the river through the Buda castle district. After a few days I grew curious about the neighborhoods s on the surrounding hills, nothing remarkable about them but it gave me a vibe similar to the hills around LA, so I rescheduled the morning appoint!iPad and went wandering. The highlight of my wander was finding what amounted to the Budapest Kwik-e-Mart with gas pumps, a slushee machines, and school kids buying candy and cigarettes. I felt, as Iwas.buying some strange slushee flavor whose flavor was.desscribed in that indecipherable Hungarian I felt a door had opened and my world expanded

A couple of years ago we were on a river cruise that docked at Bratislava, not really a tourist trap and we on that Friday night before the boat.left.we just wandered the town. Slot of families, we joined what seemed to be a protest by bicyclist s who were good natured and I would like to think that.being joined by some random American tourists would give them a good story to tell. We had a much better time than Vienna which struck me as a hollowed out imperial city but we spent a beautiful early autumn Sunday not going on another scheduled tour of some palace or cathedral but going to Prater and just sitting on benches and people watch and trying to crash a kid’s birthday party

Not really a world traveler but it does amaze me when people don’t even explore where they live, how many times they pass abroad and have no idea where it goes or see a strange building on their morning commute on don’t know what it is. It’s the small things of discovery, like a strange road or a weird flavor of Hungarian slushee, that keeps our mind open to the universe

@Raymondshaw – While our spending habits in DC have brought us a lot of problems, I think as far as the Bay Area (and LA/San Diego) are concerned, its simple supply and demand. They have run out of land to build, although you could probably add zoning restrictions in – and the CA coastal commission.

I am hardly an advocate for big intrusive govt but a few months ago I was driving up CA 1 – between San Simeon and Carmel – arguably one of the prettiest stretches of road in the world.

And it struck me that this stretch – with the baron hills and road carved out of them looking down at the sea – hadn’t changed since my younger days in the 60s.

And I imagined them full of homes and condos with that beautiful view.

I can find a lot of fault with the Coastal Commission as being too rigid and restrictive – I know of a family who inherited 1,000 acres of coastal land right below Bodega Bay – and the CC won’t let them do anything with it but graze cows. They even had a temporary mobile home park there – where people could enjoy the smell and sight of the ocean – no pavement – just septic tanks and a dirt road – and they made them remove it.

But on the big things it has been beneficial IMO.

@Mike – as you say, it is the little unexpected things and interacting with the locals that make a trip so memorable. I can remember, while stationed in Germany 50 years ago, taking one of my many day trips along the Rhine on a Koln-Dusseldorfer boat. They were, and as far as I know – still are – like a Rhine Taxi. Buy a ticket for a short 30 minute ride or all day – they stop at every town.

And for some reason, 50 years later, I still remember getting off at the Lorelei Bend (made famous in song and poems for the danger it held to mariners) – walking up the rock and meeting a woman selling bratwurst in a little stand at the summit.

What always amazed me were these GIs who never took any advantage of their station to sightsee a bit. Knew a man who as an armorer sailed on the Nimitz 8 times around the world and all he knows are bars around the world. I took every bit of leave I could and traveled around Europe and to this day, 50 years later, it is the only time, other than a 1992 trip back to Germany – I have done that.

“@MCS How does “hoarding cash” associate with running out of ideas”? More likely they have made the big search algorythims (and perhaps equally important) the linking of advertising to those search requests, and the future from now on is incremental improvement? ”

My point was that that money doesn’t belong to management, it belongs to the shareholders. I management has some way to invest that money for a return, otherwise, pay it out to the shareholders and let them seek a return elsewhere. They don’t need $100’s of billions just to tweak the algorithm. Instead, they piddle around with things like self driving cars that are, first: nothing they seem to have any particular ideas beyond throwing ever more money down the same hole and nothing that will show a return in the foreseeable future. What’s left, they invest in nothing that their shareholders couldn’t as well if they desired.

If they had to run the business without that enormous slush fund, they might do things a little differently. For instance, why does Google need an air force larger than most small countries? Explain how fat, dumb and slap happy isn’t an accurate description of Google management.

Bill, speaking of real estate prices, here is the house I bought for $35,000 in 1969 when I was a surgery resident at LA County. It is not for sale but the Zillow value is almost $2 million. It is on a 50 by 100 foot lot. When I had it it was 3 bedrooms and one bath. They have since added a bath but I don’t know where. Built in the 1920s.

@MCS saw the YouTube video David recommended and was astounded that they have horded $50 billion in cash that they “don’t know what to do with”.

I agree; a lot should be returned to the stock holders.

Mike – we just went to San Jose today to see the Tech Museum only to discover they closed at 3PM. Back Thu

But Inger likes to key in sample homes we see along the way and how about this 900 sf gem:

https://www.redfin.com/CA/San-Jose/390-S-10th-St-95112/home/17293408

Notice how much the estimated value rose from 2011 to today.

Years ago (15) we had a car club member who lived in Reno NV and commuted to work in San Jose. He would rent this little bedroom in an old house for over $1000 (15 years ago) leave Reno Sunday and return Friday. He was a systems programmer for one of the disk driver manufacturers.

He joked about this website that tracked U-Haul rentals and far more were leaving the area than returning.

He eventually got divorced unsurprisingly.

I wanted to see Facebook Headquarters – was surprised. It is in Menlo Park right at the end of the Dumbarton Bridge – address 1 Hacker Way (:-D)

Picture a Soviet style apt building that is a mile long and 1/2 mile deep with a little color splashed on the walls – why do they need it so big? But I read 3 billion people are on it of which half use it every day. Still…the size of that place and completely uninspiring architecture unlike Google.

If you’re a company with investible assets…and the question is what to do with them…there will often be fields you can enter that are market-adjacent or technology-adjacent. For example, GE has long had a strong position in power turbines. Their expertise in turbine technology allowed them to innovate with practical turbochargers for aircraft engines and later, in the late 1940s, to become a major supplier of jet engines.

OTOH, it is often possible to convince oneself that you have more adjacent-field strengths than you actually do. And moving into adjacent markets can sometimes require organizational changes which will not go down well with incumbent players in the company.

David F: “… there will often be fields you can enter …”

Definitely true. The question is not whether the stockholders’ executive employees could use the stockholders’ money to buy up some adjacent asset — the question is whether they should.

Lots of research over the years showing that most acquisitions destroy shareholders’ value. It is the “Winner’s Curse” of having to pay more than the acquisition was worth. Synergies and cost savings usually turn out to be mirages. But somehow the executive employees seem to do ok — the principal/agent problem.

The alternative for the stockholders’ executive employees would be to give the money back to its real owners and let those stockholders decide whether they want to invest their money in the potential acquisition.

Bear in mind that that video is five years old, the cash hoard is bigger and they’re no closer to a self driving car. They had one good idea twenty-odd years ago, they had to genuinely develop the tech to build and operate huge server farms. Amazon had to do the same thing, yet Amazon has been much more successful commercializing that tech.

Gavin…entering an adjacent market doesn’t always require an acquisition, though. I don’t think GE acquired anything in order to enter the jet engine market. Nor did IBM acquire anything in order to segue from punched card systems into the computer field.

I think MCS hit on 2 key points relating to palatial HQs and huge cash hoards as problems with corporate management. I’ll take it a step further and call it a problem with corporate governance

Cash on hand not only leads to extravagant spending but provides poor return. Corporations are not the same as your county treasurer who parks evens out their cash flow by parking property tax receipts in short term paper. Cash for a corporation is poor ROI and therefore indicative of poor management which is why I think we need to look at corporate governance.

Corporations go through various cycles, conception through growth and then a mature stasis, and each of those cycles takes a different form of management There has been a lot of ink spilled about how the entrepreneurs who founded a company weren’t the right guys to run it once it got to a certain size. It seems to be the existence of a large cash hoard is ipso facto an indictment of the competence of management as it shows a suboptimal use of capital.

So what to do?

Move into other areas adjacent to the business as mentioned above? Possible though I keep having recurring PTSD from the conglomerate phase of corporate acquisitions so any such move would have to be highly focused. Return the money to shareholders? That is the safest and most ethical thing to do but by what means? I am leery of stock buybacks based on how they were abused in the past by management using leverage in order to indirectly boost their options. That leaves dividends

Tall of this back to corporate governance in order to avoid the usual principal-agent problem you see in corporations. Just as you will see a board willing to step in and replace the founding entrepreneurs with professional management once the company reaches a certain size, you need the board to step in and replace corporate management once the company has exhausted the growth potential of its immediate business and need to diversify. This is not such much a criticism of current management as just a recognition that new perspectives are needed for the next life cycle. I am not suggesting a hard and fast rule about this otherwise you get a measure-becomes -the-target issue where if management knows they will be measured by the size of the cash hoard they will ensure no such hoard will exist even if it means suboptimal investments.

I am also not against stock buybacks to give money back to investors but that would take greater oversight to prevent management from abusing it to juice their options.

Stock buybacks used to be justified on the basis that they were “tax efficient” compared to increasing dividends. Note that the only investors who benefit from stock buybacks are those who decide to bail out — take the money and run away from that company. Buybacks are dangerous because they reduce a company’s capital base, but they do wonders for the stockholders’ executive employees’ options! Not so long ago, stock buybacks were mostly illegal — and that is the way it should be.

Fully agree with Mike’s point about the weakness of corporate governance. That is due to the usual situation that the Directors have little real stake in the company, sometimes no shares at all. A reasonable solution would be to require all Directors to invest something like 20% of their total Net Worth in the company’s common stock, held in a trust that could not be liquidated until 3 years after the Director resigned from the Board. Of course, that won’t happen in a world where politicians depend on contributions controlled by stockholders’ executive employees.

1. Bill Brandt: “I wanted to see Facebook Headquarters – was surprised. It is in Menlo Park right at the end of the Dumbarton Bridge – address 1 Hacker Way (:-D) Picture a Soviet style apt building that is a mile long and 1/2 mile deep with a little color splashed on the walls – why do they need it so big? ….”

Facebook took over Sun Microsystems’ former HQ building. Don’t know about now, but at one time they had simply turned around the old sign: Facebook’s was on the (now) front-facing side of the sign, but Sun’s logo remained on the back side.

2. The tax codes and corporate governance regulations should be restructured to favor dividends and restrict buybacks. Dividends are hard proof of earnings; being direct payouts to shareholders, they help ground a company in its proper mission, and work against attempts by management to game the stock price for their own private windfall at shareholders’ expense.