In-Cog-Nito

In-Cog-Nito

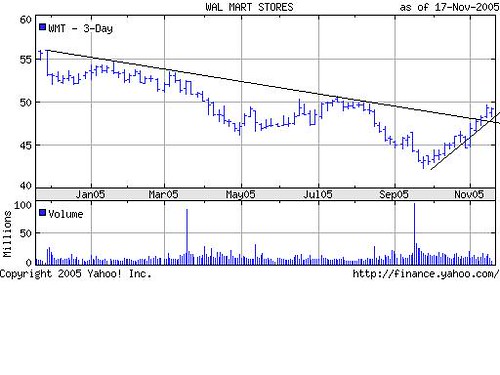

Walmart

options trade that I have on. I’m holding a large chunk of the March 2006 $47.50 calls, and a smaller amount of March 2006 $50 calls. I picked up the $47.50 calls at an average basis of $3.20 per contract. I picked up the $50 calls for $1.90 this past Friday. Here’s my thinking:

options trade that I have on. I’m holding a large chunk of the March 2006 $47.50 calls, and a smaller amount of March 2006 $50 calls. I picked up the $47.50 calls at an average basis of $3.20 per contract. I picked up the $50 calls for $1.90 this past Friday. Here’s my thinking:

Walmart stock’s volatility is extremely low. Being a Dow component helps. As a result, the option price is pretty cheap compared to even large cap tech stocks. The $47.50 calls cost me $3.20. It’s in the money by $2. So what I’m really paying for is $1.20 for the right to WMT’s upside from now until March 17, 2006. To put it in other words, if WMT is at $50.70 on or before March 17, 2006, I break even. Anything on top of that, and I’m making money.

Why do I like the $47.50’s? The $50 calls are not in the money. So I’m really paying $1.90 for the privilege to WMT’s upside from now until March. But the initial outlay is lower per contract. With the $45 calls, I would be paying 90 cents for that privilege, but the intial outlay is much higher since it’s further in the money.

For me, it’s like buying a $3 tech stock with the upside potential of Nasdaq, backed by the steadiness of a Dow component.

Buyer beware: options are extremely risky. Do not construe any of the above as investment advice.

Update: It seems Warren Buffet thinks Walmart is a value here as well.

WASHINGTON (Reuters) – Berkshire Hathaway Inc. (NYSE:BRK-A – News; NYSE:BRK-B – News), a company run by billionaire investor Warren Buffett, on Monday revealed previously undisclosed holdings of shares in Anheuser-Busch Cos. (NYSE:BUD – News) and Wal-Mart Stores Inc. (NYSE:WMT – News).

According to amended U.S. regulatory documents, Berkshire Hathaway disclosed that it held 44.7 million shares of Anheuser-Busch stock valued at about $1.9 billion and 19.9 million shares of Wal-Mart stock valued at about $874 million as of September 30.

It’s nice to have validation from the most influential value investor. Even better is that he has a legion of investors who follow his lead.

Update 2: Wal-Mart’s Black Friday numbers are better than expected, and they forecast November same-store sales growth to be 4.3%. This number is without new stores and former Wal-Marts converted to Wal-Mart Supercenters. It’s looking like a merry Christmas indeed.

Trading Diary Notes – LWSN

I bought Lawson Software (LWSN) and Silicon Motion (SIMO) on Friday to get long. Both had stellar earnings beats, along with good charts.

One interesting thing I saw over the weekend on LWSN is that they have $248m of cash/mkt securities on their balance sheet with negligible debt. Current market cap according to Yahoo Finance is $856m. But since it’s profitable and cash flow positive, under M&A analysis, LWSN’s market cap is really closer to $608m since whoever buys them would pocket the cash and get the earnings stream. Assuming analyst estimates of 36 cents a share for FY06 earnings, and 105m diluted shares outstanding, LWSN should earn in the ballpark of $38 million. This makes its forward P/E closer to 16, rather than the current forward P/E of 22.5. Funny thing, Yahoo Finance’s market cap calc looks like 113m shares outstanding, but LWSN’s financials say 105m fully diluted. I’m guessing LWSN is more accurate, which would make LWSN’s true market cap closer to 793m. Call it a market inefficiency of info, ie more people look at Yahoo than SEC filings. Backing out cash, 793m-248m = 545m, brings forward P/E closer to 14. Downright cheap.

I’m hoping LWSN is a buy and hold. I won’t hesitate to sell if the market plunges, but this gives me comfort in holding the stock.

Some good news, the portfolio’s first full month performance (since inception/start of law school) as of this weekend is 15.5%. It was higher, but I’ll take that any day. So cheers, here’s to the return of Greed. Hopefully I won’t have to experience the return of Fear (and loathing).

Ding ding ding…

Update: I should have waited until the true “end of the month” to calculate 1 month returns like mutual funds do. It would have been 21% vs 15.5%. I love mark up day – good enough for a 5.5% improvement on returns today. But I bet my original calculation is a “cleaner” return than the potentially artificial end of month numbers. I should also write another post called “day trading for fun and profit”… I took advantage of the run up for some intraday gains. Not recommended, but it’s a way to play the gun up game, without the overnight risk.

Smokin’ Hot

I’ve highlighted what can go wrong with an investment. Here’s an example of what can go right: Novavax (NVAX), top gainer and most active for trading on Nasdaq today, up 33% on 51 million shares.

Novavax is an avian flu play. They have a potentially proprietary way of mass producing flu vaccines. I didn’t quite believe it, but vaccines are still made the same way as a century ago: “where the product must be incubated over months at a time using century-old chicken egg-based technology.” Novavax’s Virus-Like Particle (VLP)technology can cut that time down significantly.

If you’re into watching the market, the trading in NVAX is a sight to see. NVAX has 43.5 million shares outstanding. So today’s 51 million shares volume says a lot. What caused the jump? You name it: the avian flu scare in Europe, short squeeze, momentum traders, CNBC focus, shortage of flu vaccines last season from production problems, to name a few.

I smell a frenzy. Smokin’ hot.

Note: NVAX is a highly volatile small cap stock. Be careful. Do not construe any of the above as investment advice.

Dana and Automakers Update

This is what I’ve been waiting for with Dana (DCN). Too bad I had to take a hit with the pop on Monday.

Dana Says Restatements to Reduce Profit by Up to $45 Million; Company Cuts Dividend

TOLEDO, Ohio (AP) — Dana Corp. said Tuesday that its planned financial restatements will reduce profit by as much as $45 million going back through 2004 and the auto parts maker slashed its quarterly dividend to one penny.

Dana shares fell 89 cents, or 12.8 percent, in after-hours trading. They fell 22 cents, or 3.1 percent, to $6.97 in the regular session on the New York Stock Exchange.