UPDATE: An an article at Belmont Club describes interest in alternative money creation as a way of anticipating inflation. It also goes further into a discussion of general competence.

The idea that Virginia should consider issuing its own money was dismissed as just another quixotic quest by one of the most conservative members of the state legislature when Marshall introduced it three years ago. But it has since gained traction not only in Virginia, but also in states across the country as Americans have grown increasingly suspicious of the institutions entrusted with safeguarding the economy.

What has changed is faith in the federal government, not just in Virginia but in a growing number of places. The lack of faith in the competence of government — and the soundness of the dollar — has been growing leading some states to create contingency plans in case the currency goes bust.

Once again, I apologize for my pessimism but this is what I see. First, there is this article, which quotes a well known financier.

There may be a natural evolution to our fractionally reserved credit system that characterizes modern global finance. Much like the universe, which began with a big bang nearly 14 billion years ago, but is expanding so rapidly that scientists predict it will all end in a “big freeze” trillions of years from now, our current monetary system seems to require perpetual expansion to maintain its existence. And too, the advancing entropy in the physical universe may in fact portend a similar decline of “energy” and “heat” within the credit markets. If so, then the legitimate response of creditors, debtors and investors inextricably intertwined within it, should logically be to ask about the economic and investment implications of its ongoing transition.

Certainly “growth” seems to be fundamental to our economic health. That, of course, presumes a growing population but it also would be affected by a stagnant population with a growing age disparity. The obvious example of the latter is Japan.

The creation of credit in our modern day fractional reserve banking system began with a deposit and the profitable expansion of that deposit via leverage. Banks and other lenders don’t always keep 100% of their deposits in the “vault” at any one time in fact they keep very little thus the term “fractional reserves.” That first deposit then, and the explosion outward of 10x and more of levered lending, is modern day finance’s equivalent of the big bang. When it began is actually harder to determine than the birth of the physical universe but it certainly accelerated with the invention of central banking the U.S. in 1913 and with it the increased confidence that these newly licensed lenders of last resort would provide support to financial and real economies. Banking and central banks were and remain essential elements of a productive global economy.

The effect of asset bubbles on such a system is worrisome as the history of Japan and the recent history of the US have shown. The Panic of 1907 was largely responsible for the creation of the Federal Reserve. That financial crisis is thought, by the authors of a recent book, to have been a consequence of the 1906 earthquake in San Francisco, which destroyed a large amount of real assets and the insurance costs that were associated. The immediate cause was financial speculation but the real losses had added to the fragility of the system.

The panic of 2008, for that’s what it was, may have been a delayed reaction to the 9/11 attack and the loss of assets in the World Trade Center destruction, plus the costs of declining air travel. This followed shortly the collapse of the internet bubble of the 1990s. There is some evidence that Alan Greenspan was responsible for the real estate bubble as he held interest rates far too low and fed the speculation.

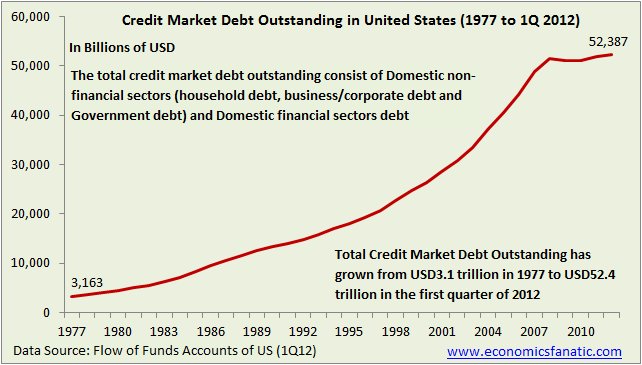

The growth of credit market debt since the 1971 decision to abandon gold as the standard for the dollar.

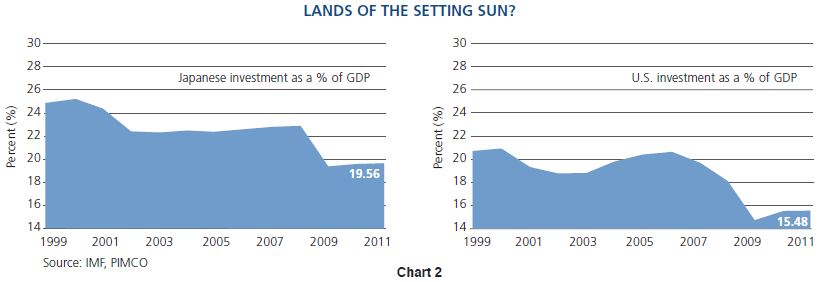

today’s near zero bound interest rates cripple savers and business models previously constructed on the basis of positive real yields and wider margins for loans. Net interest margins at banks compress; liabilities at insurance companies threaten their levered equity; and underfunded pension plans require greater contributions from their corporate funders unless regulatory agencies intervene. What has followed has been a gradual erosion of real growth as layoffs, bank branch closings and business consolidations create less of a need for labor and physical plant expansion. In effect, the initial magic of credit creation turns less magical, in some cases even destructive and begins to consume credit markets at the margin as well as portions of the real economy it has created. For readers demanding a more model-driven, historical example of the negative impact of zero based interest rates, they have only to witness the modern day example of Japan. With interest rates close to zero for the last decade or more, a sharply declining rate of investment in productive plants and equipment

The parallel is uncomfortable. There is, of course, another model, that of Argentina.

Evita has returned !

Argentina announced a two-month price freeze on supermarket products Monday in an effort to break spiraling inflation.

The price freeze applies to every product in all of the nation’s largest supermarkets — a group including Walmart, Carrefour, Coto, Jumbo, Disco and other large chains. The companies’ trade group, representing 70 percent of the Argentine market, reached the accord with Commerce Secretary Guillermo Moreno, the government’s news agency Telam reported.

The commerce ministry wants consumers to keep receipts and complain to a hotline about any price hikes they see before April 1.

Polls show Argentines worry most about inflation, which private economists estimate could reach 30 percent this year. The government says it’s trying to hold the next union wage hikes to 20 percent, a figure that suggests how little anyone believes the official index that pegs annual inflation at just 10 percent.

We also risk hyperinflation as the Fed creates money at the present pace.

Credit is now funneled increasingly into market speculation as opposed to productive innovation. Asset price appreciation as opposed to simple yield or “carry” is now critical to maintain the system’s momentum and longevity. Investment banking, which only a decade ago promoted small business development and transition to public markets, now is dominated by leveraged speculation and the Ponzi finance Minsky once warned against.

Note this: There are basically five stages in Minsky’s model of the credit cycle: displacement, boom, euphoria, profit taking, and panic. A displacement occurs when investors get excited about something—an invention, such as the Internet, or a war, or an abrupt change of economic policy. The current cycle began in 2003, with the Fed chief Alan Greenspan’s decision to reduce short-term interest rates to one per cent, and an unexpected influx of foreign money, particularly Chinese money, into U.S. Treasury bonds. With the cost of borrowing—mortgage rates, in particular—at historic lows, a speculative real-estate boom quickly developed that was much bigger, in terms of over-all valuation, than the previous bubble in technology stocks.

That was written in 2008.

So our credit-based financial markets and the economy it supports are levered, fragile and increasingly entropic it is running out of energy and time. When does money run out of time? The countdown begins when investable assets pose too much risk for too little return; when lenders desert credit markets for other alternatives such as cash or real assets.

I don’t know when the music will stop. I hope I don’t see it. I worry about my children but three of the five voted for Obama and will have to accept the consequences.

“I don’t know when the music will stop. I hope I don’t see it. I worry about my children but three of the five voted for Obama and will have to accept the consequences.”

You don’t seriously think Mitt would have been much different I hope, any difference is purely cosmetic.

It’s not like your financial overlords have much choice at this point!

I think Romney was prepared to address the matter of uncontrolled spending and the need for economic growth. He was probably the best prepared candidate for president to do so since Harding. Ryan had serious plans to reform the entitlements that might have been acceptable to the political class, which has been the real source of fiscal insanity since 1974.

I assume you mean that Republicans have been not much better than Democrats in controlling the politicians’ temptation to buy votes with the public’s money. One reason why the American system of an executive has worked since the Civil War is that the president has the mandate to act on behalf of the people as a whole rather than the smaller constituencies of the House members and, since direct election, the members of the Senate.

Your tone sounds like PenGun which means it is unserious but I choose to respond to the question rather than the source,

Zimbabwe has printed too much money – mostly for social welfare programs. Robert Mugabe, Time magazine Man of the Year, Nobel Prize winner, is a world class leader. Today 100 trillion Zimbabwe dollars will buy 1 cup of coffee and the change, 16.7 trillion dollars is the same as the US national debt!

The US National debt will never be a threat to our children. The day will come when they too will be able to pay off today’s national debt with pocket change.

A free market economy is an eco-system where free markets use prices to balance supply and demand for millions of products and services in millions of places at all different times of the year.

Government spending distorts this eco-system. If government spending is small – less than 0.001% of total GDP it has very little impact. But if government spending is greater than 1% of GDP, then it can destroy the eco-system by throwing it out of balance.

Consider the ecosystem of Yellowstone park. In the last 100 years, highly intelligent, well-meaning government spending and management have totally destroyed the ecology of the park.

So also in the US today. The road to ruin is paved with good intentions.

Indeed it was me. Sorry I did not notice I had lost cache here.

Really your corporate masters, I am getting tired of the term but it is so descriptive, run the show. Both parties dance to their tune as they hold the checkbook.

PenGun is our Eric Hoffer and his experience as a garbage truck driver has imbued him with the wisdom to explain our situation and all our limitations as a society.

I bow to the greater wisdom.

First. Some links:

The financier you quoted above is Bill Gross, founder of PIMCO, one of the largest and most successful investment managers. Here is the link to his original article “Credit Supernova”:

http://www.pimco.com/EN/Insights/Pages/Credit-Supernova.aspx

Here is a recap of the situation from a demented but truth constrained leftist:

http://www.zerohedge.com/news/2013-02-06/guest-post-all-well

All human institutions come to an end. The current regime in the USA, the one I call the Peoples Democratic Republic of the USA, was founded by FDR in 1933, and it to will end some day. Bill Gross is only tracing fever chart. Whether somebody will be able to wrestle the monster to the ground and get it under control is yet to be seen. The current administration cannot, or more likely does not want to, see the problem. But, the American people chose them. God help us all.

If something cannot go on forever, it will stop. Things that cannot go on forever can keep going longer than you thought possible, and fall apart faster than you imagined. The end result will be more bizarre than anything anyone projected.

thanks for the link. I see Chavez devalued his currency by 32%. Some of this can be blamed by US central bank policy. Our 0% interest rate environment has economic costs.

Of course, Chavez is no capitalist. So, most of it is his fault.

Well 66.5 million American people chose the current administration. 65 million did not. However democracy at this point – isn’t. And hasn’t been since the New Deal.

I’ve been reading Gross’s [Grosses?] public columns for a year at least…these are laments the party’s over…he can’t figure out how to make money anymore. Hence the resort to physics metaphor, etc…

Mind you he has such valuable insights. That it took $4 credit = $1 GDP in the 80s and $20 credit = $1 GDP now, I did not know.

Also either he or Schiff calculated actual inflation 2002-2012 at 44%. BLS had it at 27%.

The current government lives in bubbles sealed from the consequences. As far as elections our actual government has been working very hard since 1933 to immunize itself from them.

We do not have democracy. And that is not a problem. It is a God sent opportunity.

The people – a rising power – are awakening to the Great Swindle of our government, which insanely has decided to stop pretending. Insane because if the basis of governing is “manipulating procedural outcomes”..that is to say deceit…you DO NOT tear back the curtain. It’s all very well in the Wizard of Oz, but in reality he doesn’t live happily ever after being exposed. He’s torn to shreds.

The rising power of the people also cannot be blamed for the abuses of the last 8 decades. For although in theory they might have wrought these things in fact THEY DIDN’T.

This places the government in the position of frauds. It places those who would restore the Constitution as not Revolution but Restoration.

It always helps too when you’re in the Right, and the other in the wrong…

The real architect of our present fix is Alan Greenspan who made the decision to substitute a real estate bubble for the collapsed internet bubble after 2000. The politicians have been irresponsible since 1965. Roosevelt prolonged the Depression but he had the excuse that nobody knew any better. We don’t have that excuse. Before 1965, the total volume of federal expenditures was a small enough share of the national economy that we could tolerate their irresponsibility. Nobody seems to remember that World War II was fought, not by borrowing from others, as we do now, but by deferring consumption of consumer goods to fund the war. We borrowed from ourselves with war bonds. What a quaint custom !

I guess the interesting part is that you think it’s Alan Greenspan who is at fault. I think he just did what he was told to.

You were experiencing a slowdown and the real estate market was really all you had to create some more boom for the greedheads so you pushed the concept that everyone should own a home and made mortgages very cheap.

The result was not surprising and here in Canada we are about to follow you through the same stupid process.

Romney never tried to win the election. He could have won by demanding to see Obama’s Birth Certificate (Romney has already released his own Birth Certificate). Obama would never have been elected because he has no birth certificate.

This means that Joe Biden has been President since 2008 and all the laws signed by Obama were actually vetoed because a President never signed them. Only Romney can demand to see Obama’s birth certificate in court because only Romney has Standing in a Federal court (he was personally injured by Obama’s victory). No one else can sue.

Absent a Romney suit, Obama will continue to destroy the economy, the constitution and the republic.

Grey Eagle, I think the birth certificate issue is overblown. The source of the controversy is early Obama books that claim his birthplace as Kenya because he was using a foreign student rationale for preferences. That is why his college records are sealed. I have no doubt that he was born in Hawaii.

Romney conducted a good campaign but the media and the weak GOTV program of the GOP doomed hi efforts. The 1952 electorate would have elected him in a landslide but that electorate would not have supported Obama in 2008.

@Michael Kennedy,

You say “The 1952 electorate would have elected [Romney] in a landslide but that electorate would not have supported Obama in 2008.”

You could say the same thing about the 1992 electorate.

By 1992, the electorate as it existed in 1952 was already changing. Bush probably lost because of raising taxes but Clinton, while more experienced than Obama, was still an iffy proposition on ethics. Actually, I was a Perot voter until he imploded in conspiracy theories. I didn’t mean to imply that 1952 voters were all white; just that they were far more inclined to be conservative in outlook and better educated. If you watched that Ben Carson lecture, you must have noted his reference to 19th century school books.

When I was in 8th grade, I found a cousin’s high school world history textbook. I read it cover to cover. A couple of times. It read like a novel and began with the Punic Wars. It was used in 1936. I wish I still had it. Read a grammar from 1890. We have a functionally illiterate voting population. It has nothing to do with race as blacks I knew in 1950 were more educated than college freshmen today.

An example (pdf). I remember hours diagramming sentences for the nuns at that stage of my education.

My find for the day on point:

In Chapter 6 of The Economic Consequences of the Peace, Keynes* (1919 [1971],

p. 143) … :

“Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not

only at security, but at confidence in the existing distribution of wealth.

“Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become ‘profiteers’, who are the object of the hatred of the bourgeoisie, whom the inflation has impoverished, not less than of the proletariat. As the inflation proceeds and the value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

“Lenin was certainly right. There is no subtler, no surer means of over-turning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and it does it in a manner which not one man in a million is able to diagnose.”

*John Maynard, yes that one. A far more subtle observer and commenter than his political hack disciples.

The quotation is not important because Lenin said it. It is important because Keynes said it.

Sorry: I left out the link:

http://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.23.2.213

@Michael Kennedy

Obviously, I did not mean that the 1992 electorate was identical to the 1952 electorate. Nor was I primarily referring to the racial mix, although the electorate had become course considerably less white over those 40 years. I meant that nobody as far left as Obama, with his kind of radical background (do you think this guy could have gotten a security clearance before he was elected to the Senate?), could be taken seriously as a presidential candidate in 1992 (just a year after the Cold War finally ended). People like Jesse Jackson ran for the nomination, but all understood that they would be toast in the general election.

I think that the Democratic politicians and their voters had been inching leftward (slowly catching up with organized leftwing advocacy groups) ever since the mid-60s. But under the Clinton administration, the process accelerated as Republicans ceased to be competetive in many parts of the country, as the left consolidated bureaucratic and judicial power under Clinton, and as a reaction to the GOP control of Congress and, in particular, the attempt to impeach Clinton. Now, there is very little gap left between official policy of the Democratic administration and Congress, on the one hand, and the agenda of the organized Left, on the other. Of course, the Democrats, their activist supporters and the media vastly exaggerate whatever small differences remain as part of the cynical effort to shift the political spectrum leftward to make Obama/Reid/Pelosi appear merely “moderate” and “centrist” to moronic swing voters. Seems to be working.

“Obviously, I did not mean that the 1992 electorate was identical to the 1952 electorate. Nor was I primarily referring to the racial mix, although the electorate had become course considerably less white over those 40 years.”

It occurred to me that I might have accidentally implied as much. An electorate made up of Clarence Thomas’s grandfather, Charles Payne’s mother and Ben Carson’s mother would be entirely trustworthy although they probably did not have 20 years total education among them.

The GOP Congress missed a huge opportunity in the 1990s to get the country on a safer course and, not coincidentally, re-establish the GOP brand. What we have now is a ruling class that is useless and might even be worse than the French Ancien Regime of 1790. The latter was seduced by the theories of Rousseau. The present ruling class has seen where that leads and thus has no excuse.

“What we have now is a ruling class that is useless and might even be worse than the French Ancien Regime of 1790.”

The pre-revolutionary Russian intelligentsia also comes to mind.

In my more morbid moments, I speculate that we are on the road to a truly grim upheavel, comparable to the French and Russian revolutions, 20 to 40 years from now, when a swollen lumpen proletariat demands the expropriation of the remaining affluent, most of whom would be the descendants of the current crony capitalist class and their retainers. It would serve them right. Hope I’m wrong.

The remaining affluent will be living in Singapore. The low information voters don’t understand that the real rich are immune. The working people who have built a successful business are much more susceptible to the sort of blackmail the low information voter plans. Many of the latter will not accept this willingly. The French aristocracy were enthusiastic supporters of the revolution until Robespierre. Few have read enough French history to understand that the nobility supported the revolution until it became a bloody mess.

Alternative money seems more prevalent for cash short communities, not inflations. It’s a way to make payments when official currency in unavailable. In inflations, money is available but loosing value. People then pass on the offial money quickly while holding foreign currency or physical assets.

May I suggest we save morbidity for the government. For it’s them that’s dying not America.

Mind you it’s death will not be pretty.