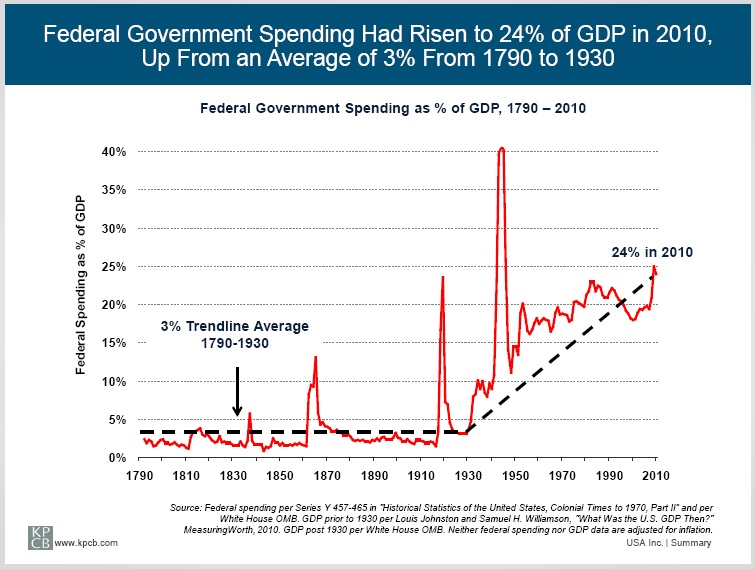

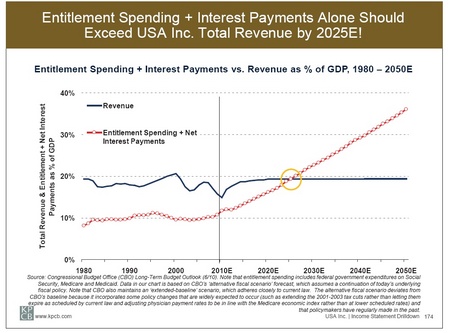

Peonage is a form of involuntary servitude that is undertaken to pay off a debt. Realistically, peonage is what we in the US are facing if we do not get our spending under control.

Today, when politicians propose to continue the spending train with unrealistic, pie-in-the-sky spending cuts that will never happen, they are proposing decades of peonage for us and our posterity. This is worse than wrong policy, it is viscerally offensive to everyone who understands the situation.

The norms of political correctness in the US do not normally permit a white to accuse a black of working to violate the 13th amendment. We do not live in normal times. President Obama is dancing on the edge of a precipice and if he persists in going over the edge, he will be taking the country with him. We must have serious proposals from both parties to step back and restore sustainable government finances. The Republicans have stood and delivered. President Obama and his party have prettied up debt peonage for the nation.