Powerline today has an analysis of the USA as if it were a firm applying for funds from Kleiner, Perkins. The presentation has a number of slides, some of which I will reproduce here. The link to the full presentation doesn’t work, unfortunately.

[Jonathan adds: Click on the large charts to display them at full size.]

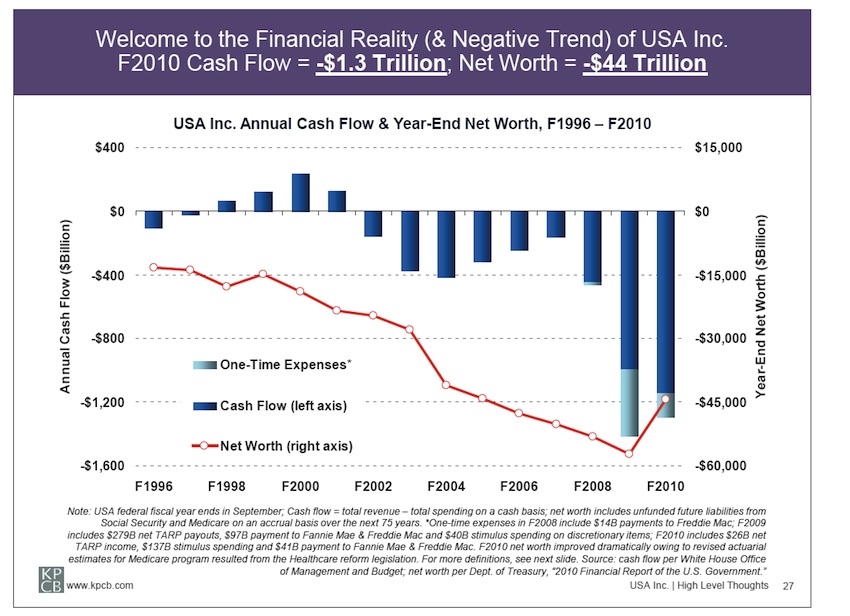

The net worth of the US is on the right side scale. The trend is pretty obvious. The small improvement is probably a sign of some recovery in the past year.

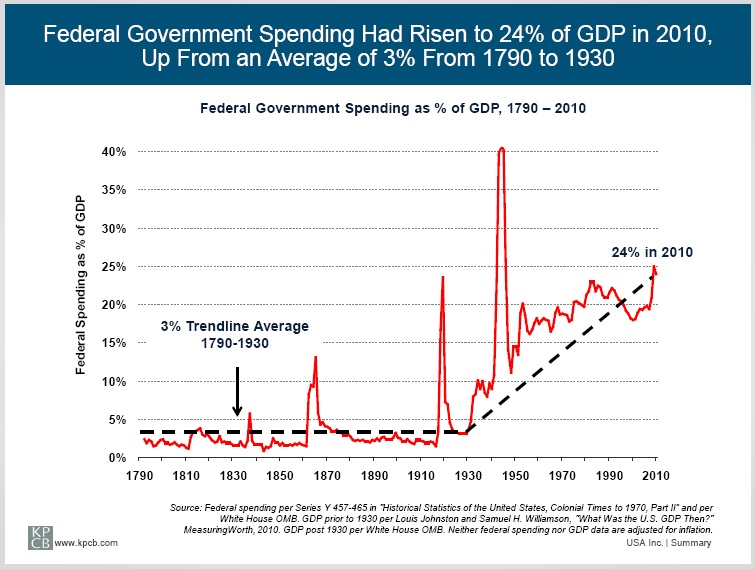

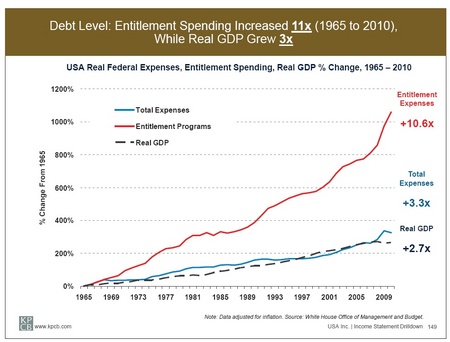

Spending has followed historical events, such as World War II. The trend, however, is not good. After 1930, spending on entitlements began and has grown out of control.

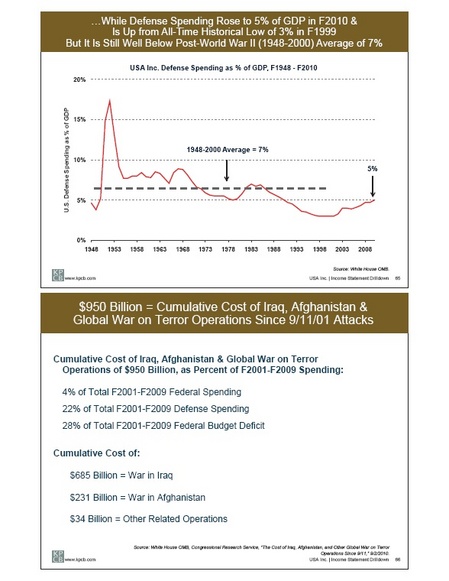

Defense spending is blamed by leftists but there has not been a lot of defense spending since Vietnam.

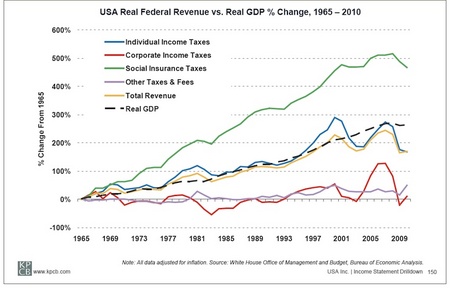

Taxes have followed a steady trend line until Obama was elected. The sharp rise has not helped as costs far outstrip revenue.

What, then, is the problem ?

Entitlements.

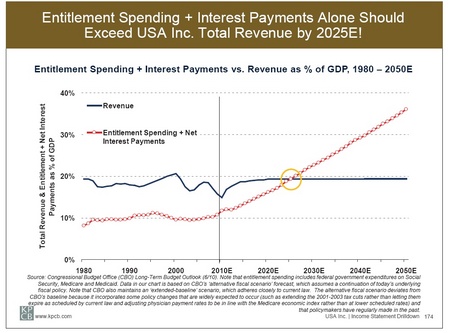

Entitlements plus interest alone will exceed revenue by 2027. That’s 16 years from now.

The left wants to raise taxes.

How high must tax brackets go ?

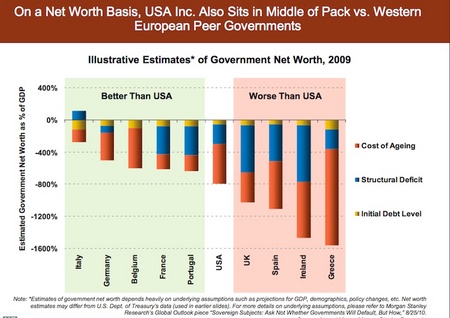

How do we compare to other countries ?

Better than some and not so good as others.

Can the left stop denying reality and start to discuss it?

No.

Here is the response I got:

I am certain that not everyone here is as stupid as I am.

I try very hard to keep factual information from you. To wit, here is some bad analysis of our fiscal situation.

Of course, I could be wrong and I’m not this dumb. But probably not.

[fixed it for you. If you’re not even going to acknowledge our good faith attempts to allow you to comment while simply requiring that you not insinuate everyone’s stupidity then we can only assume you don’t mind the same treatment in return – mod.

Posted by: Mike K

They constantly use fake versions of my signature, which of course the moderators could stop. It fits their pattern. Modifying my comments is also standard and they actually think this is clever.

No, I am not optimistic.

Michael: I am not sure I understand what your back and forth was with Washington Monthly.

I doubt that it is a good use of your time to try to enlighten the left. It will take a much harder blow to the head than you can administer over the internet to get them to wake up. After all anybody who thinks that EJ Dionne is a source of wisdom is too far into the weeds for you to tow out.

A more succinct version comes from from Eric Raymond:

* * *

Sorry, I left out the link to Raymond:

http://esr.ibiblio.org/?p=3035

I have to agree. It is sad as there are educated people there and I got used to debate when Kevin Drum was running that blog. Kevin investigated the Bush TANG rumors 6 months before CBS and Dan Rather made fools of themselves. Kevin concluded there was nothing there. He is now at Mother Jones but they have deleted my comments, as well.

If we cannot have a dialog with people who disagree, what chance is there to solve our problems? I hate to give up but I guess it is a waste of time. If I try to post arguments at Washington Monthly, they either respond with obscenities and personal invective or they change the comments, as you see, and try to ridicule those who disagree.

The problem is that, as with the Japanese reactors, these are real problems and will not be wished away. Fortunately for me, I am old enough that it will not affect me directly. Still, it is hard to see people head into a storm ignoring all precautions. I have sailed across oceans and survived because I took the sea seriously. What will happen to those people who think it is all a joke, or an irrational conspiracy? I see a sentence that reads, “Sen. Al Franken (D-Minn.) pointed out in a little-noticed but powerful speech on the economy in December, “during the past 20 years, 56 percent of all income growth went to the top 1 percent of households. Even more unbelievably, a third of all income growth went to just the top one-tenth of 1 percent.” Some people are definitely not broke, yet we can’t even think about raising their taxes.”

Does anyone think that makes any sense ?

That was me. The comments function seems to be seriously awry.

Gack! Those are some graphs.

Not reassuring.

– Madhu

Yes, the comments function is awry. Not complaining!

It reminds me of Abu Muqawama’s comments section where your comment shows up maybe right away, maybe ten minutes later, or sometimes a full hour later, if that….

? Spam filters

– Madhu

Altering someone’s comments without saying you did so is probably the most dishonest thing you can do in a blog style dialog. Just plain deleting them is much more polite. I have a hard time deleting comments unless they are obviously trolling/thread hijacking or blatantly disrespectful.

I haven’t yet read the Kleiner, Perkins piece in detail, but note that its lead author, Mary Meeker, was well-known in the aftermath of the dot-com bubble/collapse for having been just a bit…uh…optimistic in her valuation of many companies. It is possible that she is making the same error in the opposite direction this time around.

Some of the recommendations do seem to show a serious lack of cluefulness, for example the calls for more “investment in education.”

Sorry about comments filter. It has a mind of its own. We may have to start using spam-sniffing dogs or trained bees.

David –

“cluefulness” That’s a good one. Thanks for that very useful addition to my vocabulary.

Washington Monthly was once a pretty interesting magazine, generally Left in orientation but frequently thoughtful and sometimes creative. About 10 years ago, they seemed to begin sliding into doctrinaire thinking and increasingly outright nuttiness.

On the subject of political argument: Political speech is largely about marketing, and marketing is almost always improved by market segmentation. Which in this context suggests not worrying about converting the core lunatics but focusing on those who have good instincts but have been subjected the mis-information and dis-information, usually due to their social & professional circles and their information source being the dinosaur media.

We got into a fairly useful debate about Obamacare in 2009 there but then I was banned. A number of commenters got angry at me with the theme being, more or less, “You are in favor of single payor so why aren’t you supporting Obama ?”

I had done a lengthy analysis of the French system on my blog in 2008. It began here:

http://abriefhistory.org/?p=400

and went on for quite a few posts. I think the French model is a useful one for us to use in thinking about reform. First, it is not single payor. It is funded by payroll deductions. There are government subsidies but some of that is because pension is mixed in with it. Also, France has a problem with immigrants joining the system, especially British ex-pats who won’t go home for care in the NHS. They join the French program for indigents. In fact, I got interested in the whole issues from reading ex-pat bulletin boards. The British middle class is largely moving to rural France; there are towns in eastern France that are entirely English speaking.

The French system is aggressively fee-for-service and the patient pays the doctor FIRST, then gets reimbursed from a national fee schedule. The doctor is free to charge what she chooses but must inform the patient first and there are incentives for doctors to accept the fee schedule.

It avoids much of the moral hazard problem of US insurance. A huge reform in Medicare would simply be to allow “balance billing.” That is, the doctor could charge more than Medicare pays. That would solve the access problem. It would require advance notice to the patient but the internet makes that easy. Many doctors’ offices provide the medical history forms for patients to download before the first visit. The same could be done for the fee schedule.

Anyway, there is a role for debate with people who disagree with you but it is being squeezed out of public discourse.

When we go back to the post-WWII defense spending levels, can we get them to kick in 15% of public school spending like the Defense Department did then?

You might be on to something: The old National Defense Education Act, and “in-lieu taxes” provided millions to help public schools. That spending aid has dropped dramatically, and local school budgets hurt as a result.

That’s Grover Norquist’s choice. He hoped to bring down regulation by overspending all the money government could spend, and tapping out the taxpayers. He said it would be heaven, then.

If he was wrong about running out of money being heaven, he might have been wrong about other things, too, don’t you think? Maybe Keynes was right: Surpluses should be saved for rainy days, and not used as wealth redistribution plans to the benefit of Second and First Estates.

Here is more from Hugh Hewitt and Congressman John Campbell, formerly my Congressman.

http://www.hughhewitt.com/blog/g/2697c4d3-9150-49b8-a3f3-319ae5343e7b

The highlights:

“Treasury Bonds: I learned something last week. I learned that fully 40% of the over $9 trillion in Treasury debt currently outstanding to the public has a maturity of 3 years or less. Put another way, it means that we are rapidly approaching $4 trillion in U.S. debt that matures by 2014 or sooner. As I write this, the yield (interest rate paid) on a 2-year Treasury note is 0.645% or about 2/3 of one percent. The yield, at the same time, on a 10 year Treasury note is 3.4%, and on a 30 year is 4.55%. In bond parlance, this is called a “steep yield curve” where interest rates get much higher as you go farther out in time.

It’s pretty clear why the Treasury is doing this. By issuing mostly short-term notes, the Treasury is paying less interest, thereby keeping interest costs and, consequently, the deficit down. In addition, the Federal Reserve is in the middle of its “quantitative easing #2” (QE2) under which it is buying $600 billion of our own Treasury debt over about a 6 month period. The Fed is not buying the short-term notes, but is buying 10 year maturities and longer in order to hold those rates down. And, since the Fed is earning the interest thereon (paid by the U.S. Treasury), it is improving its yield. We are currently running a deficit of about $130 billion per month, so the Fed is basically buying all of the new bond issuance from the deficit for almost 5 months.

What does this all mean? I understand that the Fed and the Treasury are trying to keep interest rates low and improve the economy and the deficit. But, when coupled with the huge deficits, these moves look a bit like a Ponzi scheme that will soon unravel. “

More here:

http://www.lesjones.com/2011/03/14/normal-interest-rates-would-be-a-disaster-for-u-s-debt/

As Sen. Tom Coburn (R., Okla.), who served on the deficit commission and supported its recommendations, pointed out at a press conference this week, the United States has, historically, paid an average of 6 percent interest on its debt. It currently pays about 2 percent. If rates were to return simply to that historical average, it would involve an increase to our overall interest bill of $640 billion ”” to be paid immediately. “An impossible situation,” in Coburn’s words.

And that’s why the Federal Reserve is buying U.S. Treasuries. If they didn’t, the U.S. would have to pay higher interest rates on its debt, and we can’t afford to.

That’s Grover Norquist’s choice.

Then the President should fire Mr. Norquist from the important position he holds in government.

What position is that, exactly?

By the way, since the second sentence you quoted was, “And not just in the U.S., either; the same problems of political overcommitment and structural insolvency are playing out in advanced nations all over the planet”, aren’t you attributing to Norquist the kind of vast behind-the-scenes influence that is really wielded only by Karl Rove and his weather control devices?

It’s easy to imagine scenarios where there’s a big sell off in the govt bond mkt, borrowing costs increase substantially and the USA has a Greek-style financial crisis. The main question is when, not whether, it will happen. Many elected officials want to bet that it won’t happen on their watch. The tea parties are a distributed attempt by voters to force the pols to deal with this issue.