For years we’ve been selling China a lot of our bonds. We need the money and they want a safe place to put their money. Some people said that we were at their mercy, but really we had them by the balls. A big borrower always has leverage against his main creditor, because creditors want their money back and are reluctant to do anything that might interfere with the big borrower’s earning ability.

Since our government is increasing its spending substantially, and borrowing to cover much of the new spending, we need China more than we used to. If we can’t sell more bonds we will have to print even more money or raise tax rates even higher than is already planned. Either course of action would eventually be politically costly, perhaps ruinous, for the Obama adminstration. So Treasury Secretary Geithner has been spending a lot of time trying to persuade the Chinese to buy more US bonds.

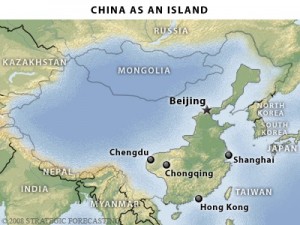

I think it’s reasonable to ask what price our country will pay in exchange for Chinese financial cooperation (we are asking them to take more risk, after all), and whether the Obama administration has a conflict of interest. Obama can do things to benefit the Chinese government — such as by muting actions that we might otherwise take in response to China’s military expansion or its hostile behavior toward our ally Taiwan or its human-rights abuses or its lack of cooperation on North Korea — that will be costly for us but whose costs will not be obvious for years. Obama has a strong political incentive to get his expensive programs passed. Could his personal political interest be allowed to trump the national interest? It might if the rest of us don’t pay attention.

(BTW, we’ve also been selling a lot of our bonds to Gulf oil states. Might there be some worrisome quid pro quos there as well?)