This is the second of a series of posts on recent events in the world electricity & energy market. Here is Spain.

Britain’s Energy Policy

Britain has a mostly de-regulated electricity market for generation. One item that must be considered with electricity is plain old geography; Britain is an island and must generate all their electricity locally. Thus they can have costs either significantly higher or lower than those found on mainland Europe, because it is difficult to use arbitrage (in the form of transmission) to resolve price imbalances. Correction – Britain imports 5% of her electricity from France in a cross-channel cable. Thanks to commenter Jim Miller for pointing this out.

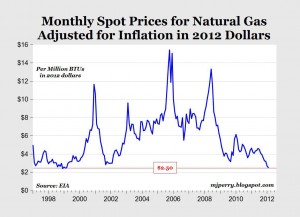

Like most of Europe, Britain is in the thrall of the greens, and their favorite tool is to mandate a certain percentage of energy to come from “renewables” (wind and solar, for semi-practical purposes), while hounding coal on environmental grounds and nuclear on whatever grounds they tend to come up with at the time. Natural gas represents almost 50% of current energy today. This article from the Economist provides a good summary of the British market.

While Britain traditionally has gotten much of its natural gas from local drilling, LNG imports from overseas provide a higher percentage today. According to this article, LNG imports represent 25% of British usage, while locally drilled gas has fallen by 10% from the prior year. Britain traditionally has relied on the North Sea for its natural gas and oil production, but these fields are in long term decline.

In 2011, the UK initiated a surprise tax increase on North Sea oil and gas producers. The percentage of tax on profits increased from 68% to 80%, an increase of 12%, per this article. This sharp rise in taxation was a surprise under the supposedly Tory administration, because it is typical of more of a labor “carve up the pie” view of the world than one I would typically expect under the Tories that “incentives drive behavior”.

This article discusses the impact of ever changing tax policies in the UK on investment in oil and gas rigs.

The hike prompted furious reaction from the industry. Mark Hanafin, director of Centrica Energy, told the Telegraph: “the North Sea is the second-largest oil-producing region in the world after Saudi Arabia. It’s a national treasure for the UK. The government is utterly destroying that. I wish people would step up and say you just can’t do this. Capital is leaving the country and going elsewhere”.

Who could have predicted what would happen next? Oil and gas produced since the tax hike has dropped by the most since records have been kept, per this article:

UK natural gas production in the third quarter of 2011 slumped to the lowest level since records began in 1996, at 103TWh (terawatt hours), Department of Energy and Climate Change (DECC) data show. This also represented the largest year-on-year quarterly decrease ever seen, down 29.4pc on the same period last year.

Now that the British government has dis-incented investment and damaged their oil and gas industry through erratic and socialistic behavior, what’s next? A central-planning, top down new “plan” for the electricity sector, of course.

As summarized in the Economist article (which failed to mention the negative impact of tax incentives on natural gas’ decline, a serious oversight):

Renewable technologies account for a mere 7% of current supplies… government pledges to cut planet-heating (ed – their words) emissions and get 15% of energy from renewable sources by 2020… the industry regulator reckons that around $315 billion USD needs to be spent by 2020. Investment currently amounts to $6-9B USD / year. But the move to greener power in Britain must be achieved without infuriating voters already upset at high bills.

The government expects the private sector to finance the renewables (wind, solar and new nuclear) that they plan to have in place to meet the 15% target, while shutting down older nuclear plants and coal plants, as well. It is very difficult to entice the private sector to make these sorts of investments, however, unless they know in advance that they can recover the high and otherwise un-economical costs for these renewable power through the life of the facility (30 years or more). These costs, obviously, must in the end be borne by either residents or corporations (the business sector).

I would love to be a “fly on the wall” if you tried to convince any rational financial institution to invest in these sorts of projects, knowing that Spain just abandoned all their subsidies midway through (decimating their industry) and that the UK has a history of changing tax regimes with gas and oil extraction (see above).

Even the economist, which unfortunately is a cheerleader in this sort of central planning, sums it up dimly:

It is doubtful that the draft bill has enough detail to break the current hiatus in energy investments. It is still unclear how prices will be determined, how often they will be reviewed, and how contracts will be implemented. Uncertainty about the form of the contracts compounds existing investor fears about the durability of government price guarantees on energy.

While these government fantasies about supposedly rational private sector investors ploughing funds into un-economical renewables continues, a backup plan of sorts is occurring because they are extending the life of existing, older nuclear plants that they were planning to close. Keeping these plants alive defers the enormous (and likely significantly under-estimated) costs of building new nuclear plants, which are summarized here at wikipedia. From my perspective I would be willing to bet that none or perhaps 1-2 at best nuclear plants would ever be built going forward in the UK post the disaster in Japan; the greens are too strong and they will protest and drag the process out for an eternity. Other than one plant that came on line in the mid 1990’s, all the plants are from the 1980’s and 1970’s and dreams of a nuclear renaissance in the UK ring just as hollow as they do in the US. Here is an article about re-licensing British reactors. Britain’s ageing nuclear reactors, which were due to close in the next decade, are set to be kept open under a plan approved by the industry’s regulator.

In a move that could have far-reaching implications for the government’s energy policy, the Office for Nuclear Regulation has told the Guardian it is working with the country’s dominant nuclear operator, the French-owned company EDF, to extend the life of its eight nuclear power stations in the UK, and that it is “content for the plants to continue to operate”, as long as they pass regular safety tests.

Well there you go. Before the ink on the plans are dry, they’ve already backed down on one of the key tenets of their mad plan. I guess that is progress. But there is no way that their math can work as far as bringing new investment into the system since utilities and power generators won’t ‘add’ to their investment in this climate at the level needed to mothball such critical elements of their power generating infrastructure.

It is quite sad to see that the UK, which had once been a leader in electricity de-regulation, with lower prices to show for it than most of their European counterparts, to propose to effectively nationalize or central plan out an entire industry. All this under a Tory government, too. It seems that cooler heads have prevailed by keeping the nuclear stations open longer, and the collapse of the renewables market in Europe will likewise be a precedent that the UK will not want to follow.

Cross posted at LITGM