Interest rates will eventually rise without an even more devastating policy of financial repression. When they do, rising interest costs will produce a vicious cycle of ever more borrowing. We are already approaching the “event horizon” of spinning into this black hole of an inflationary spiral and economic collapse from which few countries historically have escaped. A substantially higher rate of growth is the only way to break free.

National economic growth is typically measured by the growth of GDP, and citizen well being by the growth of per-capita GDP. The long run trend of GDP growth reflects labor force participation, hours worked and productivity as well as the rate of national saving and the productivity of investments, all of which have been trending down.

The population grows at about 1% annually and actual GDP growth averaged 2% overall for 2010-2016 (using the new World Bank and IMF forecast of US GDP at 1.6% for 2016), hence per capita GDP grew at only 1%. Moreover the income from that 1% growth went primarily to the top one percent while 99% stagnated and minorities fell backwards.

Why we are approaching the Event Horizon

The Obama Administration annually predicted a more historically typical 2.6% per capita growth rate, consistent with the historical growth in non-farm labor productivity. How could their forecasts be so far off?

The Obama Administration pursued the most massive Keynesian fiscal and monetary stimulus ever undertaken. Such a policy generally at least gives the appearance of a rise in well being in the near term, as the government GDP statistic (repetitive, as the word “statistic derives from the Greek word for “state” ) reflects final expenditures, thereby imputing equal value to what governments “spend” as to the discretionary spending of private households and businesses in competitive markets. But labor productivity gains stagnated at only about 1%, most likely reflecting the cost and uncertainty of anti-business regulatory and legislative policies that dampened investment, something the Administration denied, trumping even a short term boost to GDP.

As a result the national debt approximately doubled from $10 trillion to $20 trillion, with contingent liabilities variously estimated from $100 to $200 trillion, putting the economy ever closer to the event horizon. Breaking free will require reversing the highly negative trends by reversing the policies that caused them.

Technology alone isn’t sufficient

Obama Administration apologists argued that stagnation is “the new normal” citing leading productivity experts such as Robert Gordon who dismissed the potential of new technologies. Many disagree, but Gordon’s findings imply even greater reliance on conventional reform.

Fiscal policy won’t be sufficient

Raising taxes may reduce short term deficits but slows growth. Cutting wasteful spending works better but is more difficult.

The list of needed public infrastructure investments has grown since the last one trillion dollar “stimulus” of politically allocated and mostly wasteful pork that contributed to the stagnation of the last eight years. Debt financed public infrastructure investment contributes to growth only if highly productive investments are chosen over political white elephants like California’s bullet train, always problematic.

Major cuts in defense spending are wishful thinking as most geopolitical experts view the world today as a riskier place than at any prior time of the past century, with many parallels to the inter-war period 1919-1939.

The major entitlement programs Social Security and Medicare for the elderly need reform. But for those in or near retirement the potential for savings is slight. Is Medicare really going to be withheld by death squads? Are benefits for those dependent on social security going to be cut significantly, forcing the elderly back into the labor force? Cutting Medicare or SS benefits for those with significant wealth the equivalent of a wealth tax won’t affect their consumption, hence offsetting the fall in government deficits with an equal and offsetting liquidation of private wealth. Prospective changes for those 55 years of age or younger should stimulate savings and defer retirement, improving finances only in the long run.

The remaining bureaucracies are in need of major pruning and in numerous cases elimination but they evaded even budget scold David Stockman’s ax during the Reagan Administration.

Americans will have to work more and consume less

That is the typical progressive economic legacy of excessive borrowing from the future.

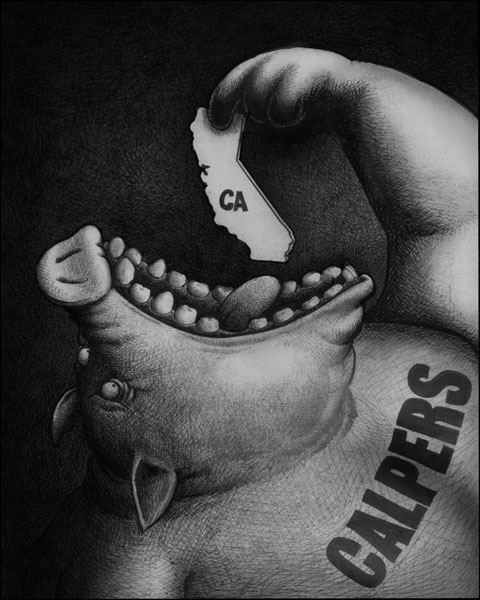

The first Clinton Administration created the crony capitalist coalition of the political elite and the politically favored, e.g., public sector employees and retirees, subsidy recipients and low income home loan borrowers. The recent Clinton campaign promised to broaden this coalition, which would have accelerated the trip over the event horizon.

Reform that taxes consumption in favor of savings and a return to historical real interest rates could reverse the dramatic decline of the savings rate. Regulations redirecting savings to politically popular housing or environmental causes need to be curtailed in favor of market allocation to productive business investment.

Repeal and replace of Obama Care could reverse the trend to part time employment. Unwinding the approximate doubling of SS Disability payments and temporary unemployment benefits could reverse the decline in labor force participation.

Service sector labor productivity has been falling since 1987, the more politically favored the faster the decline. Legal services are at the bottom, partly reflecting political power of rent-seeking trial lawyers, followed by unionized health and then educational services. Union favoritism through, e.g., Davis Bacon wage requirements and “card check” increases rent seeking, particularly rampant in the unionized public sector.

Competition, of which free but reciprocal trade has historically been a major component, has traditionally provided the largest boost to well being by realizing the benefits of foreign productivity in a lower cost of goods while channeling American labor into employment where their relative productivity is highest. The transition is often painful, but paying people not to work long term is counterproductive. Immigration of both highly skilled and low cost labor (but not dependent family) generally contributes to per capita labor productivity in the same way as free trade.

None of this will be easy. The alternative is Greece without the Mediterranean climate or a sufficiently rich benefactor.

—-

Kevin Villani, chief economist at Freddie Mac from 1982 to 1985, is a principal of University Financial Associates. He has held senior government positions, been affiliated with nine universities, and served as CFO and director of several companies. He recently published Occupy Pennsylvania Avenue on the political origins of the sub-prime lending bubble and aftermath.