Barack Obama is fond of describing government this way.

As President Obama said the other day, those who start businesses succeed because of their individual initiative their drive, hard work, and creativity. But there are critical actions we must take to support businesses and encourage new ones that means we need the best infrastructure, a good education system, and affordable, domestic sources of clean energy. Those are investments we make not as individuals, but as Americans, and our nation benefits from them.

That was a reaction to Romney’s criticism of his silly comment.

I prefer the quote attributed to Washington.

“Government is not reason, it is not eloquence,—it is force! Like fire, it is a dangerous servant, and a fearful master; never for a moment should it be left to irresponsible action.”

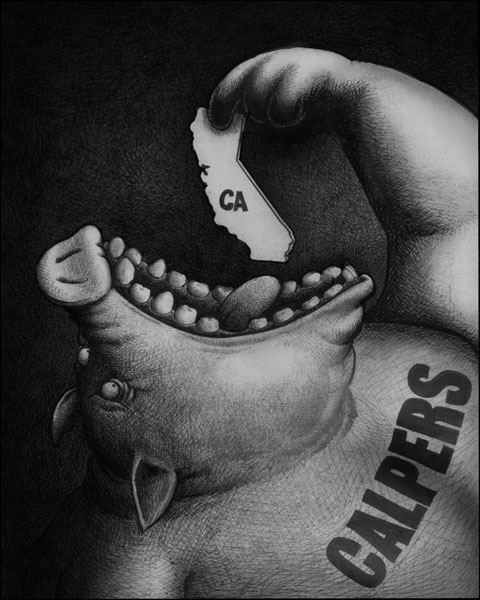

Now, we see a new imposition.

The Department of Labor says its so-called fiduciary rule will make financial advisers act in the best interests of clients. What Labor doesn’t say is that the rule carries such enormous potential legal liability and demands such a high standard of care that many advisers will shun non-affluent accounts. Middle-income investors may be forced to look elsewhere for financial advice even as Team Obama is enabling a raft of new government-run competitors for retirement savings. This is no coincidence.

Labor’s new rule will start biting in January as the President is leaving office. Under the rule, financial firms advising workers moving money out of company 401(k) plans into Individual Retirement Accounts will have to follow the new higher standards. But Labor has already proposed waivers from the federal Erisa law so new state-run retirement plans don’t have the same regulatory burden as private employers do.