I’ve written previously in my column “President Trump’s ‘Xanatos Gambit’ Government Shutdown” of President Trump’s tendency for building political strategy trees were every possible outcome is to his advantage. (See the “Xanatos Gambit” strategy tree example in the figure below)

This is a decision diagram example of a “Xanatos Gambit.“ Source: https://tvtropes.org/pmwiki/pmwiki.php/Main/XanatosGambit

It very much looks like President Trump has done the same thing with the Democrats and “China lobby” GOP Senators with the post-NAFTA US-Canada-Mexico (USMCA AKA “You Smack-A”) trade agreement and the US economy.

THE US ECONOMY, NAFTA & USMACA

The key thing you need to understand regards NAFTA and American manufacturing is that NAFTA was geared to allow the “China lobby” of multinational corporations to use Canada and Mexico as an “international arbitrage opportunity” for Chinese slave labor wage manufactured goods to be assembled at Canadian and Mexican production facilities and avoid American tariffs.

Multinational corporations exploiting this “international arbitrage opportunity” was “The Great Sucking Sound” that Ross Perot talked about which killed the US domestic refined metals industry and hollowed out middle class manufacturing jobs in the American economy.

President Trump’s USMCA removes that “international arbitrage opportunity” via original 75% North American manufacturing content requirements for metals and intermediate manufacturing goods as well as a Mexican minimum wage rules on the order of $15 an hour for automotive parts assembly.

In response the “China lobby” has been paying large campaign contributions to both House Democrats and “free trade” GOP Senators to try and keep NAFTA, as well running info-war spots everywhere in the corporate media and “movement conservative” publications/media outlets about the benefits of “free trade.” This has resulted in public statements by Speaker Pelosi that the House does not intend to vote for USMCA.

This is where Pres. Trump’s ‘Xanatos Gambit’ strategy tree kicks in via a macroeconomic and trade policy manipulation of the very simple economic equation of gross domestic product:

GDP = US ECONOMIC ACTIVITY + EXPORTS + FOREIGN INVESTMENT – IMPORTS – EXTERNAL INVESTMENT

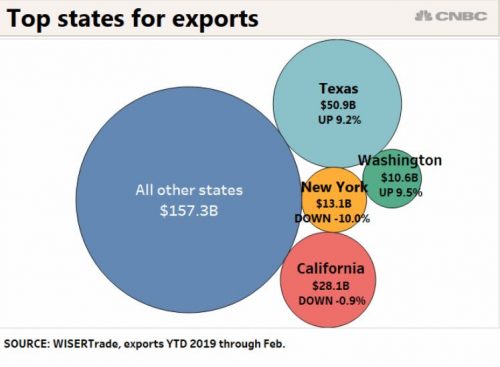

The American economy just grew 3.2% in the 1st quarter of 2019. It would have grown another 0.3% but for the 30-odd day federal government shut down. The “markets” were expecting 2.5% GDP growth. The huge half-percent GDP “miss” boiled down to:

1. The USA exported more.

2. The USA imported less and

3. There was more external foreign investment than expected.

All three were the result of a combination of Trump administration policies on oil/LNG fracking, tax & regulatory cuts and trade/tariffs.

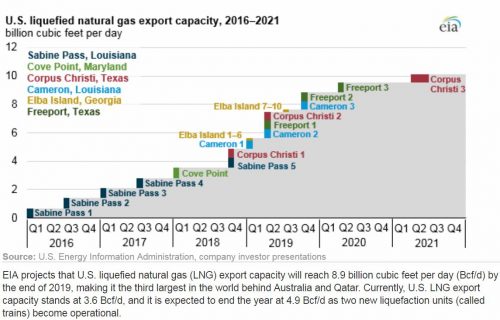

First point, the USA will be a net energy exporter — of oil, natural gas & coal combined — in 2020 if it isn’t one already.

Some rough numbers: In 2012 US oil production was ~8 million barrels a day, all for domestic consumption, and in 2019 it is 12.6 million with some exports. Today’s US oil consumption is 20 million barrels a day. That increase in oil production that has reduced imports of oil by a net of 4.6 million barrels a day has also been accompanied by the displacement of coal and oil in both electrical production and manufacturing by cheaper natural gas, thus freeing both the coal and oil not used to be exported. This combined economic change since 2012 alone is worth a 1% increase in GDP growth a year compared to 2012.

Second, the Trump administration’s systematic and sustained attack on Obama era federal regulatory growth is reducing business compliance costs particularly in the energy sector for new infrastructure projects. These are the “anti-green” actions the Democrats accuse the Trump administration of.

Third, the Trump administration/GOP tax bill, in addition to increasing spending power for the middle class, has had a huge -YUGE- reduction in capital gains taxes and a one-time break in repatriating overseas capital holdings. This has made America a much more attractive place to hold and invest money. Particularly for energy companies like Exxon, which are dropping this foreign capital inflow into the Permian basin for oil and natural gas fracking and energy export infrastructure from the Permian to the Gulf Coast.

Finally, in terms of trade and tariffs, President Trump’s tariffs on Chinese steel and aluminum combined with the business implications of USMCA rules have made further investment in Canadian automotive plants a net loss position. American metal content is now economically competitive for energy sector infrastructure and automobile parts such that US Steel among others are reopening US metal plants.

Taken together every part of the GDP equation has been directly affected by the Trump administration macroeconomic policies to get that 3.2% GDP number.

This is where the Xanatos Gambit for USMCA arrives.

Things will be worse for the China lobby without a vote on USMCA than with one.

Short form:

NAFTA is dead regardless of any action or inaction by the House. All the House and Senate can do is not vote on USMCA. The legislative branch cannot revive a NAFTA trade agreement the federal executive has withdrawn from.

This means without a signed USMCA trade deal Pres.Trump can — and will — lay on even more tariffs on the multinational corporations playing price arbitrage in Mexico and Canada between Chinese and American manufacturing.

While such trade sanctions can reduce the American economy like a tax increase, when we are likely at close to 4% economic growth in late 2019 to early 2020 from the accumulated investment in energy projects bringing defacto energy independence, a 3.5% economic growth rate with tariffs is still pretty good.

And when the House refuses to vote in USMCA, NAFTA still dies.

Pres. Trump can and will lay on new massive new anti-Chinese tariffs on Canadian and Mexican front companies for China without USMCA rules. This will be massively popular in the Midwest in an election year and will hurt the income streams of the multi-nationals supporting the Pelosi Dems and McConnell RINOs.

From Trump’s point of view, What’s not to like about America’s manufacturing base employing the Midwestern white working class growing while the “international arbitrage opportunity” of China’s slave labor economy contracts?