Over the long term, electricity use has been closely correlated with the general growth in the economy. Due to the fact that building power stations, transmission lines and siting locations for distribution facilities has a long lead time (sometimes measured in decades), utilities have to plan ahead.

One of the major pillars of electricity demand is industry. Many facilities use large amounts of electricity, such as steel & aluminum, paper and pulp making, and manufacturing plants for autos. Some facilities use so much electricity that they build their own power plants, and / or locate their facilities near cheap power (which is why a lot of the aluminum industry and aircraft manufacturing is in the Northwest, where cheap hydro power was available).

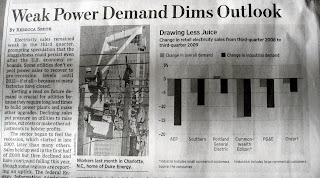

This latest recession has caused industrial usage to plummet to an unprecedented degree. The article above was in the Wall Street Journal titled “Weak Power Demand Dims Outlook“. Per the article:

Electricity sales remained weak in the third quarter, prompting speculation that the sluggishness could persist even after the U.S. economy rebounds. Some utilities don’t expect power sales to recover to pre-recession levels until 2012 — if at all — because so many factories have closed.

Some of the major utilities, such as AEP out of the midwest and Southern Company in the Southeast are seeing demand reductions for industrial use in the 15-20% range. These types of reductions are out of the historical norm for a recession.

Read more