From an excellent column by J.W. Verret:

The government policy of promoting long-term profits is bad economics, and even worse, it is engineered to favor incumbent firms and stifle innovation. When the government gets to decide the proper term of your investments, it constitutes the same form of cronyism as when campaign donors are directly given sacks of cash by the government officials they donated to when they were candidates.

A guiding principle in our economy is Joseph Schumpeter’s theory of “creative destruction.” Just as some forests need to burn in order to clear away brush and make way for more robust growth, economic innovation also requires that old and outdated companies be broken up for new replacements to take root. Recently, Americans have received an education in this principle by watching Uber’s challenge to the taxi cab incumbents.

The American capitalist economic system is at its best when guided by the principle that no firm is too big or special to fail. While corporate executives may feel such a jungle atmosphere is harsh and unforgiving, don’t forget that customers who buy products and investors of capital are at the top of the food chain in this jungle. Wall Street banks and corporate executives are the prey! Protecting failing companies and subsidizing politically powerful incumbent firms, under the false guise of promoting long-term value, is simply un-American.

A couple of other points:

-Short-term trading adds market liquidity, which reduces bid/offer spreads. Because of short-term trading, long-term investors pay less to buy and receive more when they sell.

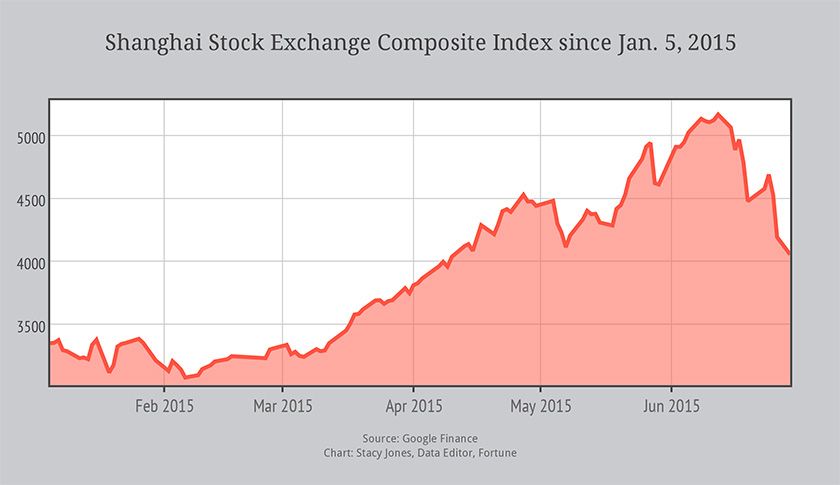

-Liquidity buffers volatility. Wild market swings happen when liquidity dries up. Any trading restriction that reduces market liquidity will increase market volatility.

This stuff is basic. It’s a shame that many people never learn it and are credulous about fairy tales involving evil speculators and high-speed traders in dark alleys. When someone in a position of authority tells you that a particular type of free exchange is bad, it’s usually safe to assume that he has a stake in some crony enterprise that benefits by restricting your choices.

(Via Instapundit.)