Now the Republic’s enemies must be asking themselves: where is the bottom to these people’s incompetence? Can they do anything at all? How safe is it to rush ahead? Why don’t we try?

And if they do, what tools will President Obama have left? Diplomacy? Economic incentives or sanctions? Moral authority? Maybe the military. Yes that’s it. But his competence at war is predicted by his incompetence in peace. One would hope he’d have the sense to stay away from truly dangerous tools and that probably means he doesn’t know better.

Predictions

A Hipbone Approach IV: Polar bears and polar opposites

[ cross-posted from Zenpundit ]

Norwegian photographer Arne Nævra took second prize in the "Our world" category of the Shell Wildlife Photographer of the Year 2007 competition with this photo

Bruce Sterling‘s State of the World 2010 conversation with my online friend Jon Lebkowsky on the Well’s “Inkwell” forum this year was rich in concept and language as one might expect. This in particular caught my eye:

It’s like looking at your SUV and seeing drowning polar bears. Just a minority viewpoint.

Two concepts, two dots to connect: SUVs and polar bears. Sterling chose those two concepts, no doubt, because the connection between them is non-obvious in the sense that a dictionary definition of SUV won’t contain a reference to polar bears, heck, even an encyclopedia article is unlikely to, and the reverse is also true — and obvious, in the sense that the “minority” in question can easily connect these two otherwise quite distinct and separate dots, the connection being “climate change” aka “global warming” or more specifically an entire complex dynamic systems analysis incorporating the process by which an aggregate of comparatively large and frequently used gasoline-powered internal combustion engines adds incrementally to a trend in the global weather…

Not that any of this should surprise us: Sterling’s readers presumably know that SUVs are a convenient stand-in for “gas guzzlers” and thus for the whole panoply of cars and trucks, and more abstractly for our planetary tendency to technologize our environment into greater convenience and less sustainability — and polar bears, while Sterling may like the look of them in photos, documentaries, zoos or on the occasional visit to the Arctic, serve here as a marker for the entire notion of environmental degradation, a massive die-out of species and such other non-Arctic phenomena as the loss of mountain tops in Appalachia and of rain forests in the Amazon and elsewhere.

So Sterling has played two “concepts” on the board of “connect the dots” and asserted that for some people the connection will be obvious, while for others it will be invisible — which in term of connecting the dots means it might as well not exist.

*

Indeed, some will argue that while both dots — SUVs and polar bears — exist, the connection implied between them does not.

But that’s not the topic of my consideration here.

*

Bruce Sterling’s interview gives me the pair of dots I intend to focus on today SUVs and polar bears but there’s another pair of dots that Sterling’s remarks forms part of, a pair in which Sterling stands at one pole (science, fiction) of the debate on climate change, with Rep. John Shimkus, R- IL, at the other (scripture, fact).

Addressing the House Subcommittee on Energy and Environment’s hearing on Preparing for Climate Change on March 15, 2009, Rep. Shimkus made the following now-celebrated remarks:

The right of free speech is a great right that we have in this country. Very few times we use it to espouse our theological religious beliefs, but we do have members of the clergy here as members of the panel. So I want to start with Genesis 8, verses 21 and 22. “Never again will I curse the ground because of man even though every inclination of his heart is evil from childhood, and never again will I destroy all living creatures as I have done. As long as the earth endures, seed time and harvest, cold and heat, summer and winter, day and night will never cease.” I believe that is the infallible word of God, and that is the way it is going to be for his creation.

The second verse comes from Matthew 24. “And he will send his angels with a loud trumpet call, and they will gather his elect from the four winds, from one end of the heavens to the other.” The earth will end only when God declares it is time to be over. Man will not destroy this earth. This earth will not be destroyed by a flood.

And I appreciate having panelists here who are men of faith, and we can get into the theological discourse of that position. But I do believe God’s word is infallible, unchanging, perfect.

I have characterized Sterling’s stance as “science, fiction” and Rep. Shimkus as “scripture, fact” but the connection between these two dots is far from clear, and it is at leasdt arguable whether the designations shouldn’t instead be “science, fact” for Sterling, and “scripture, fiction” for Rep. Shimkus.

*

There’s a certain elegance to that in fact it begs to be made into one of those diagrams that Jung and Levi-Strauss were fond of…

Of course, fact and fiction may not be exclusive, opposed categories, and the same is true of scripture and science. Consider, for example, Kathleen Raine’s comment:

myth, when a real event may be the enactment of a myth, is the truth of the fact and not the other way around”

or the similar idea that CS Lewis once wrote to her

What flows into you from the myth is not truth but reality (truth is always about something but reality is about which truth is) and therefore every myth becomes the father of innumerable truths…

*

To return to Sterling… The game of connect the dots that Sterling plays here could be made into a simple systems diagram of the sort that Peter Senge used to illustrate his book, The Fifth Discipline, or the more elaborate form of systems dynamic model that Jay Forrester pioneered at MIT and Donella Meadows so eloquently preached in her essay, Places to Intervene in a System — complete with feedback loops in which shifts in global weather patterns and the exquisitely-patterned trails of SUVs dance the dance of complexity and emergence…

Sterling’s version of the game is verbal, minimalist, and suggestive: two phrases, not often found next to each other, quietly juxtaposed, in such a way that the mind can supply the connection that makes the leap between them. In short: the man can write.

The point I am laboring to make here has to do with communication: with getting an insight across to other people.

Writers do this by dropping verbal markers (“SUVs” and “polar bears”) into sentences. Mostly, they write many such sentences in sequence (a blog post, an article, a book), so the reader skims or skips lightly from one marker to the next, like a stone skipping across a pond in the childhood game. Individual leaps and single connections between pairs of dots are not important here, the reader’s mind half-notes them as it passes to the next dots and the next, and such things as “conclusions” and “actionable items” or in some cases “character” and “plot” far outweigh the largely subliminal links and connections triggered along the way.

From an analytic point of view, however, it is the connections that make the difference — whether those connections are causal, as in the steps of an argument; dynamic, as in the workings of a homeostatic system with feedback loops; emergent, as in the discernment of pattern at the edge of chaos; or associative, as with creative insight, metaphor and analogy.

And in each of these cases, some form of language, diagram or model can spell out the connection, some form of software can embody that language, diagram or model, and some form of human insight can assimilate its meaning and apply it to further tasks of observation, orientation, decision and action…

*

We may connect the dots for pleasure, as in one of those games that chains of restaurants print up to keep children busy while their parents talk over pancakes and bacon, or for benefit: and here the issue is not only to connect “past” dots correctly so as to understand what has already happened and can be viewed with twenty-twenty hindsight, but to make the great conceptual leap from past and present and propose connections with dots that will arise in the “future” (that zone of uncertainty): we write scenarios, we plan, we attempt to intuit an enemy’s next move, to make our own OODA loop tighter and meaner than his.

And while in the short term we may succeed, in the mid and long term we may fail.

At which point, as a depth psychologist might say, our projections tell us more about ourselves than about the reality we are attempting to grasp.

I’d include here those moments when we “see” connections that don’t exist, as well as those in which we miss connections that do: hallucinatory links, and blind spots, both.

*

Bruce Sterling, in the same forward-looking piece that contains that quick verbal aside about polar bears and SUVs, asks himself how anyone can give “a coherent picture of where your future is heading”. Without some such picture, indeed, we are at the mercy of vicious feedback loops and unintended consequences.

Here’s how he thinks about what we might call medium term scenarios:

Let’s imagine you’re three years old again. You want to give your Dad, back in 1974, a coherent picture of what 2010 looks like. You know, something very actionable, lucid and practical, where he can just slap the cash on the counter and everything works out great for the family. Okay: given what you know now about the present, tell me what you oughta tell him about 2010, back in 1974.

Forrester-style modeling won’t carry us forward thirty five years: there are simply too many shades of grey and black swans between “now” and “soon”.

And so task number one is an “ornithological” task — to peer into our own blind-spots, to see the invisible, to have what is called “vision”.

And I don’t mean a gosh-darn brand-new marketing strategy. I mean a sense of the great tides that underlie epochal changes — the kind of vision that William Blake had, which allowed him to rail on about the “satanic mills” long before the word “ecology” was a dim spark in the mind of the fellow who coined the word. The sort that Leonardo da Vinci had.

The sort, in fact, that contemplatives (all those Zen and Tibetan and Benedictine monks) and shamans (Lakota and Huichol and !Kung and all the rest) and artists (in words, in images, in sound, in film, in concept) all know about.

*

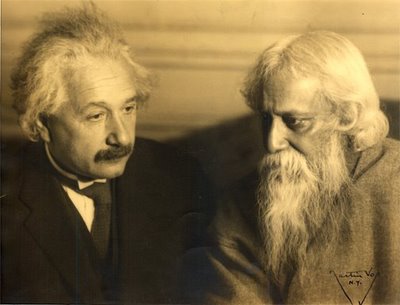

Which is to say, the sort Einstein knew about — so that when the mathematician Jacques Hadamard asked him about his thought process, he answered:

The words or the language, as they are written or spoken, do not seem to play any role in my mechanism of thought. The psychical entities which seem to serve as elements in thought are certain signs and more or less clear images which can be “voluntarily” reproduced and combined.

There is, of course, a certain connection between those elements and relevant logical concepts. It is also clear that the desire to arrive finally at logically connected concepts is the emotional basis of this rather vague play with the above mentioned elements. But taken from a psychological viewpoint, this combinatory play seems to be the essential feature in productive thought – before there is any connection with logical construction in words or other kinds of sign, which can be communicated to others.

The above mentioned elements are, in my case, of visual and some of muscular type. Conventional words or other signs have to be sought for laboriously only in a secondary stage, when the mentioned associative play is sufficiently established and can be reproduced at will.

That’s quite a mouthful, so I’d like to pick out a few points that maybe of relevance here.

Let’s clear the word “muscular” out of the way first. Some of the ideational germs of Einstein’s most brilliant work, he tells us, are “muscular”. Many of us know that visual thinking is an important component of understanding: Einstein adds thinking “of muscular type” into the mix. His body is part of his mind, and he knows it. That’s important: Einstein is, in fact, connecting dots for us here linking mind and body. But he doesn’t just link dots in his response to Hadamard — he actually talks quite a bit about making connections.

*

Einstein links to Tagore

Let me rephrase his response to Hadamard the way I see the process he describes unfolding.

He has a strong emotional desire to understand, in the way that “physics” understands — which is to say, “to arrive finally at logically connected concepts” of the nature of nature. He then turns away from logic and concepts, and — still under the sway of that desire — attends to the sensations of his body and to his internal field of vision. In response to that desire and from regions of the body and mind unspecified, certain “psychic elements” of a visual and some of muscular sort arise. These he says can be “combined” — he says also that he can “play” with them — but the play is, at least at first “vague”. Indeed it is precisely this “combinatory play” which appears to Einstein to be “the essential feature in productive thought”. It is only when these elements have been voluntarily played with and satisfactorily combined that Einstein begins, internally, to verbalize and “translate” the combinations he has perceived into some form of “logical construction in words or other kinds of sign, which can be communicated to others”.

So we have three sorts of connection going on here: (i) an associative connectivity between imagistic and muscular “psychic elements” in the mode of play (ii) their “connection with logical construction in words or other kinds of sign” and (iii) the connections he can then present to others in the language of “logically connected concepts” — ie mathematical physics.

*

In all of this, I would like to highlight (i) the (perhaps unexpected) importance of the body’s connection with the mind in human thinking, (ii) the significance of a deep desire for understanding as the attractor for the largely unconscious motions of body and mind, (iii) the role of play as the mode of thinking in which creative linking occurs, (iv) the ubiquity of connectivity as the ruling imperative in all phases from the initiation of play to the communication of theoretical physics.

All four — body-mind, desire, play and connection — are key components in anything worthy of the name of vision.

Bubbles

Government employee salaries + benefits + pensions = bubble.

Government schools K-12 = bubble.

Higher education = bubble.

MSM monopoly = bubble.

The foundations of the opposition are crumbling before our eyes.

We are on the verge of a table-clearing, systemic regime collapse.

Once in a century change is coming.

Be happy.

Timely Topic

Sept. 30, 2010: IASB proposes Severe Hyperinflation amendment to IFRS 1. “The amendment proposes guidance on how an entity should resume presenting financial statements in accordance with International Financial Reporting Standards (IFRSs) after a period when the entity was unable to comply with IFRSs because its functional currency was subject to severe hyperinflation.” This is good information, and I expect to study it closely.

I’m exaggerating to make a point here. Hyperinflation is unlikely in the US and EU. Inflation, long term, is nearly certain. Why? Because government debt is denominated in inflatable currency. The debtor has the means to determine the real value of the debt. Inflation would also permit the return of “bracket creep.” This prospect is delightful to the political class, as it passively increases taxes through wage inflation, while permitting nominal “tax cuts” through rate/bracket adjustments that can be artfully timed to coincide with the electoral cycle.

If you’re looking for the Bernanke Helicopter as a sign of coming inflation, you may already be too late. The Bernanke Submarine has already delivered its cargo and returned safely to base. The Federal Reserve’s politically invisible policy of paying interest on excess bank reserves has already created a monetary overhang of $1 trillion. So far, the expanded money supply has amounted to a subsidy for banks, as they can get the equivalent of the overnight Fed funds rate on all their reserves, not just the statutory requirement. The government has essentially printed new money, then borrowed it back in order to buy government and agency debt (quantitative easing).

This strategy, which has worked in the past in Japan as a countermeasure to deflation, creates its own risks. First, it has a tendency to reduce whatever stimulating effect other measures might have by soaking up money and taking it out of circulation. Why should banks lend money to businesses and consumers when they can safely lend to the Fed? Second, it can be difficult to exit. At 0.25%, the Fed is up against the limit of zero interest rates, so the effectiveness of quantitative easing as an anti-deflation device is near its limit. But even if it stops being effective for the purpose, the Fed has a wolf by the ears, and can neither hang on indefinitely nor let go safely. To unwind the position, it would have to sell government and agency debt in the open market. Done abruptly, it would effectively raise interest rates by depressing the price of government debt, immediately inflating the currency. It would have the same effect as an overt currency devaluation, and carries a risk of hyperinflation. Done gradually, it has the risk of continuing to lock up money in the banking reserves and restricting growth. Done clumsily, welcome back stagflation.

The only good exit from this bind is a growing economy. A small amount of inflation is always a by-product of vigorous GDP growth. To the extent that other government policies discourage GDP growth, the Fed’s strategy could make matters worse.

Quote of the Day

Any system susceptible to a Black Swan will eventually blow up.

–Nassim Taleb [Link is a pdf.]