Since Johnathan posted a picture of the Captin’s Market last week, I thought I may as well post a picture of my favorite corner gas-station and mini-mart. The exterior is … deceptive. The inside of it is very different from what you would expect, just driving past.

India

Egypt’s new president.

The Muslim Brotherhood candidate has now been declared the winner of the Egyptian election. Some foolish things are being said, as a consequence.

Morsi’s election is tempered by the army’s recent move to significantly limit the powers of the presidency regarding the national budget, military oversight and declaring war. Following a court ruling this month to dissolve the Islamist-controlled parliament, the military also seized legislative powers and is angling to cement its legal authority over the nation by guiding the drafting of a new constitution.

The military will not be able to control the destiny of the country. The army in Turkey was much stronger with a 60 year history of secularism and a recognized right to displace governments that violated Ataturk’s intent. Since the election of Erdogan, the army has been neutered and half the senior officers are in prison, either with no charges or trumped up charges.

Barry Rubin has a pessimistic view of the future for Egypt.

Let me divide the discussion into two parts: What does this tell about “us” and what does this tell about Egypt and its future?

First, what does it tell about the West? The answer is that there are things that can be learned and understood, leading to some predictive power, but unfortunately the current hegemonic elite and its worldview refuse to learn.

What could be more revealing of that fact than the words off Jacqueline Stevens in the New York Times: “Chimps randomly throwing darts at the possible outcomes would have done almost as well as the experts”? Well, it depends on which experts. Martin Kramer, one of those who was right all along about Egypt, has a choice selection of quotes from a certain kind of Middle East expert who was dead wrong. A near-infinite number of such quotes can be gathered from the pages of America’s most august newspapers.

These people all share the current left-wing ideology; the refusal to understand the menace of revolutionary Islamism; the general belief that President Barack Obama is doing a great job; and the tendency to blame either Israel or America for the region’s problems. So if a big mistake has been made, it is that approach that has proven to be in the chimp category.

Dollar Denominated Debt

Debt is traditionally thought of as a conservative financial instrument. You buy a bond, it pays you interest (tax exempt or taxable), and then you receive your principal back when the bond matures. The interest you receive depends on the duration (time until you get your money back), riskiness of the borrower (traditionally the US government has been the safest lender with the lowest rates, but it may not be that way forever), and the overall level of interest rates in the economy (either the prime rate or LIBOR).

There are many, many variations on bonds, however, and this view of debt is out-dated. Convertible bonds allow the debt to be converted into shares of the company’s stock at certain price points, which allows the company to offer a lower interest rate on debt (because of this “upside”). Distressed debt is often bought by hedge funds and others as a way to take over companies in distress because post-reorganization the equity holders are generally wiped out and the debt-holders receive the new company’s shares.

A risk with debt and all financial instruments is an implied currency risk. In the US we don’t directly “see” the impact of the falling dollar in our day to day activities, but it is immediately evident if you leave the country and go somewhere with a strong currency, as I found out when I traveled to Norway and spent $20 US to buy a drink and lunch for 2 in a decent cafe was over $100. More subtle signs of the dollar’s decline are the hordes of foreign tourists from countries that have a trade surplus with the US buying everything in sight – Dan and I saw an entire upscale mall full of them in San Francisco.

Along with changes in currencies, there is a general hunger for “yield” meaning income that can be earned with relatively low risk (or at least according to models and rating agencies), meaning that borrowers are rushing to market to take advantage by issuing debt at historically low long term rates. Countries that may have had difficulty borrowing in the past or paid high rates like Mexico are now able to issue at interest rate levels that are very low by historical standards – Mexico is now able to borrow with a 10 year maturity at 5.85% (in local currency). These types of rates are at historical lows.

In addition to governments (with decent credit ratings) going out to market for more debt, companies are also issuing debt to take advantage of these historically low rates. Even if the companies have no immediate use for the cash, they are taking advantage of the rates to build funding if the economy turns, for acquisitions, or even to buy back stock and take advantage of leverage to increase EPS. Per this article in the WSJ:

Their timing could hardly be better. Average corporate bond yields finished Monday at 3.28%, just 0.01 percentage point from the all-time low going back to 1973, according to the Barclays U.S. investment-grade index. Industrial bond yields are even lower, at 3.07%.

For private companies in foreign countries, often local banks provided financing. In the US corporations traditionally don’t rely on banks to the same degree and issue bonds to the general public (many of which are bought by pension funds and insurance companies, as well). As banks pull back around the world, foreign companies are now trying to take advantage of 1) historically low interest rates 2) hunger for yield by tapping into this demand for debt by buyers.

Many of the issuers in other countries are now issuing “dollar denominated” bonds. Dollar denominated debt means that they agree to pay at the rate of the US dollar against their local currency, regardless of what happens to the local currency. This insulates the buyer (probably a foreigner from the US) from currency fluctuations in countries like India, Mexico and Chile – but on the other hand it makes the entire transaction much riskier from the seller’s perspective (assuming they don’t hedge this risk). There aren’t just US dollar denominated bonds – there are Euro denominated bonds, Yen denominated bonds, and likely more Chinese currency denominated bonds in the future.

The interesting part for me is the long term “evolution” of debt from a relatively straight-forward low risk instrument (except for default risk, which supposedly could be “rated”) to a very complex instruments with myriad risks. One OBVIOUS risk on these dollar denominated bonds is – what happens when the country’s currency falls vs. the US dollar and these bonds have to be paid back in US dollars? What do you think happens?

According to this article “Weak Rupee Hits India Bondholders“:

The Indian rupee’s sharp depreciation has added to the woes of Indian companies scrambling to repay foreign currency bonds – and it is increasing the likelihood that foreign investors will be hurt… in 2005-2007… the rupee was strengthening, trading at a record of around 40 rupees to a dollar. The bonds were sold only to foreign investors, and companies used the money to fund their growth plans… Indian companies have to repay nearly $3.4 billion in foreign-currency bonds before the end of 2012.

But now, many of these bonds are coming due when the rupee has lost nearly 40% from its high and is trading around all-time low levels.

The article goes on to mention several companies who are having trouble making payments and asking for reprieves from lenders, which typically involves extending terms and / or changing the interest rates. And since these were sold to foreigners, good luck trying to take action within the Indian legal system unlike the US where debt can lead to an implied stake in the post-bankruptcy entity (this wasn’t mentioned in the article and I am not an expert on this so it is only my opinion).

I don’t know how any investor looking for yield and wanting to avoid currency risk just assumed that these risks didn’t exist because they were being borne by the issuer and not them when they received their payment in US dollars. Now these chickens are coming home to roost, and it is pretty obvious in retrospect that these issues were very risky on the currency side and were much closer to a high risk investment than a vanilla boring interest bearing security. The hunger for yield and the fact that these were issued in US dollars made them appear to be much less risky than they apparently turned out to be.

Cross posted at Trust Funds for Kids and LITGM

Random Letter From Treasure Trove

As I mentioned in this post, I have inherited hundreds of letters that were written from my wife’s grandfather to her grandmother while they were courting. Most of the letters were written during the time while my wife’s grandfather was drafted into service during WW2. Many are from basic training and many are from his time served in India. I have not yet begun the formal process of scanning, dating and sorting the letters. This letter was floating around on top with no envelope – there is no date listed on it besides “1945”. All spelling, punctuation and grammatical errors have been left intact.

Treasure Trove

My wife took a recent visit to her grandmother and grandfather. They aren’t doing so well. We have had to have “the talk” with them about getting them out of their house and into some sort of assisted living facility. It isn’t pleasant, of course – it never is when dealing with situations such as this.

While there, my wife was asked to go through some things and distribute them among the living family members. Most of these things hold only sentimental value. I ended up with a couple of guns, a sweet antique Marlin .22 and a beautiful bolt action Mossberg 12 gauge shotgun. I haven’t had time to research them as of yet.

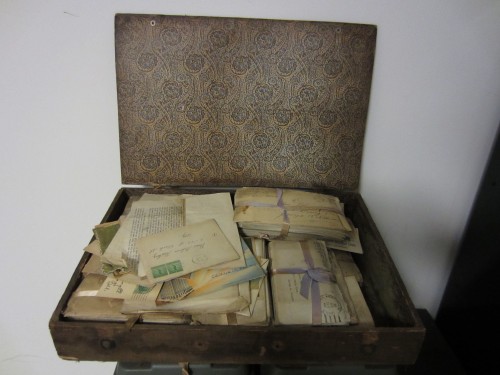

As we were cleaning up the van and getting some of the items ready for a garage sale to raise cash for them, my wife informed me she also got a box of letters. What’s that, I said? Well, here it is.

I was told that these were letters from my wife’s grandfather to her grandmother. And they are. Hundreds and hundreds of them, neatly bundled and put away for nearly 70 years before my eyes gazed upon them. From an early look, the vast majority of them seem to be from when my wife’s grandfather was drafted to be in the big war – ww2, that is. They have that musty/old book smell.

He was stationed in India and from what I can glean upon reading a letter or two is that he was a supply clerk of some sort. There are also a lot of letters that he wrote to her from basic training. Most of the addresses use grandma’s maiden name. They were still courting.

Oh yea – I haven’t told my wife this yet – there are letters from other guys to grandma too. Well then.

I plan on sharing some of these letters with our readers here. They are an invaluable source of information to a historian such as myself to get a feel what it was like back then – not only from a military history standpoint, but they will be a look into the social lives of folks back then as well.

I shall change the names as these folks are still alive, but I will leave all of the language intact. I hope you enjoy these letters that I will publish as I find time to transcribe them. The first thing I need to do is figure out everything chronologically.

I am absolutely giddy with anticipation.