I have believed for some time that we were entering another Depression. I have previously posted about it.

The Great Depression did not really get going until the Roosevelt Administration got its anti-business agenda enacted after 1932. The 1929 crash was a single event, much like the 2008 panic. It took major errors in economic policy to make matters worse. Some were made by Hoover, who was a “progressive” but they continued under Roosevelt.

I posted that statement earlier and it got a rather vigorous rebuttal. I still believe it, however. I think a depression is coming soon. What is more, I am not the only one. Or even only one of two.

The second article preceded the election of 2012 but is still valid.

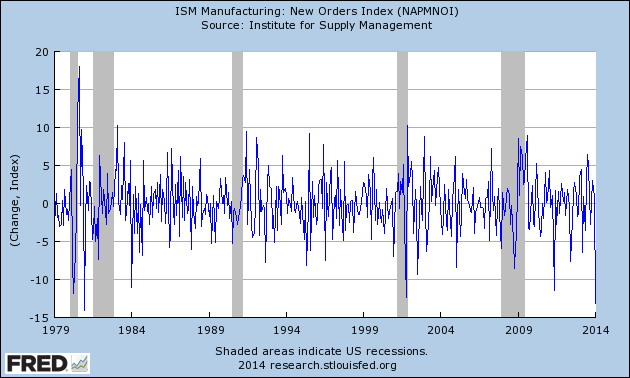

When employment hit an air pocket in December, most analysts brushed off the dreadful jobs number as an anomaly, or a function of the weather. They chose to believe Ben Bernanke rather than their lying eyes. It’s hard to ignore a second signal that the U.S. economy is dead in the water, though: on Monday the Institute for Supply Management reported the steepest drop in manufacturing orders since December 1980:

In January, only 51% of manufacturers reported a rise in new orders, vs. 64% in December. Not only did the U.S. economy stop hiring in December, with just 74,000 workers added to payrolls; it stopped ordering new equipment. The drop in orders is something that only has occurred during recessions (denoted by the shaded blue portions of the chart). The Commerce Department earlier reported a sharp drop in December orders for durable goods. In current dollars, durable goods orders are unchanged from a year ago, which is to say they are lower after inflation.

So, the economy stopped hiring, even at the poor pace the past five years have seen, but business also stopped buying.